Last night at the Nasdaq Marketsite, Mark Hulbert and I served on a panel discussion entitled Defend Yourself: Top threats to investors in 2015. The event was organized by MarketWatch and we spoke to a standing-room only crowd of over a hundred individual investors, Dow Jones journalists and other financial industry folks.

Moderator and MarketWatch columnist Bob Powell led us through a discussion about all of the usual concerns that investors have – Greece, China, cyber security, oil prices, stock valuations, the Fed raising rates, etc. I dutifully weighed in on each of these topics, as did Mark, and then I was given a chance to leave the audience with a closing thought.

My message was a simple one, but to me it was the most important thing I was able to get across: The biggest threat to your portfolio is you.

China is not threatening your portfolio, nor is the price of oil or the level of the Fed Funds rate. What’s threatening your portfolio is the way in which you may react to any of these items, plain and simple. Your emotions and the actions you take during times of increased volatility or drawdown will ultimately have more impact on your long-term returns than any exogenous thing that may come along.

Our reactions to market stress and volatility, in the aggregate, usually involve some combination of the following:

* Fleeing into the arms of a charlatan who purports to having predicted it

* Buying into Black Swan funds and protective products that cap all future upside and cost a fortune

* Obsessing over hedges after the fact

* Selling out with big (permanent) losses and sitting in cash

* Freezing 401(k) contributions or having retirement cash allocated to money market funds

* Excessive trading

* Planting a flag and being unwilling to publicly change our minds in the face of new evidence

* Throwing money at bizarre alternatives like coins, bars, bricks and bullion which have no proven ability to fund a retirement

* Conflating political views with investment expectations

Note that every one of these things is extremely detrimental to our financial health. In some cases, the damage could be irreversible. Nothing kills the long-term returns of a portfolio like throwing away the playbook in the heat of a market crisis.

Hulbert had made the point that no one will see the thing coming that derails the economy or the market next time around. It certainly won’t be something that’s on the front page of the newspaper each day like Greece or interest rates. I would add in that we still cannot pinpoint the events that have marked previous market tops even in hindsight.

Consider:

What happened on the day in March of 2000 when the Nasdaq stopped going up? Nothing, it just did.

What was the proximate trigger for the crash of ’87? There wasn’t one.

Why did the stock market ignore the real estate bust for 18 months until one uneventful day at the end of 2007 when all of a sudden it stopped climbing and reversed? We don’t know to this day.

What happened during the week after Labor Day in September 1929 that put the top in on the stock market? Nothing of note besides a bearish speech by Roger Babson a thousand miles away that may or may not have been noticed by traders on the floor.

If we cannot even identify the reason for why a market tops or crashes on a given day with the benefit of looking back, what makes any of us think we can do so in real-time or in advance?

More importantly, doesn’t it make more sense to recognize the durability of the capital markets in the face of all these threats rather than try to play hopscotch with our retirement assets each time a new one arises?

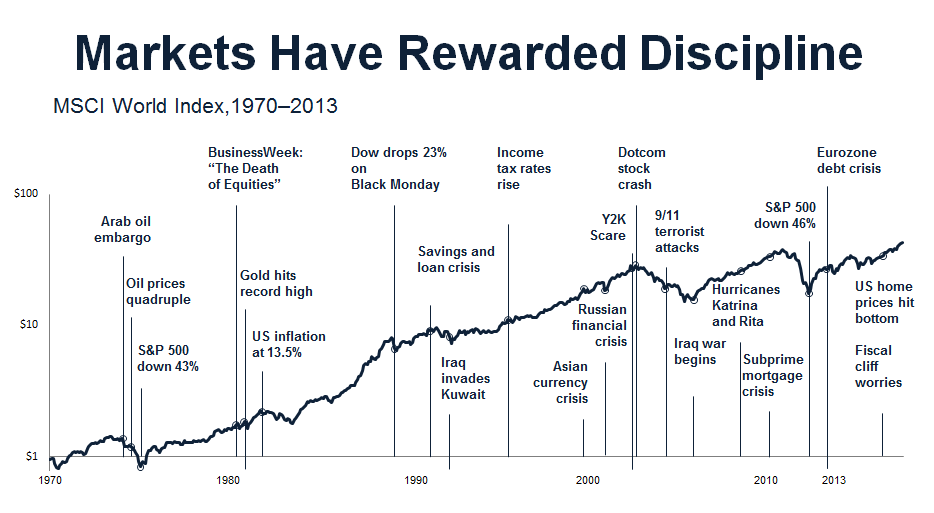

The below chart, courtesy of Dimensional Fund Advisors, does a really good job at illustrating this resilience. Note that each item along this timeline was accompanied by thousands of articles and TV segments discussing at length how bad things were going to get…

And so the key takeaway I hope I left people with was that they themselves constitute the number one threat to their own portfolio. It’s a sad but true fact – but it’s also very hopeful. Once you buy into this idea, you begin to take control of your future, even if you cannot control the future events that will shape our world.

Having a plan in place that’s been crafted in advance – and not just any plan but a damn good one – is superior to any kind of insurance one can buy after the fact. Plans should be agreed upon and adopted during times of clarity and sanity, never under duress. And most importantly, they should be revisited often so as to imprint their importance deep within our psyche.

And if we can commit to that, we’ve got a great shot at surviving whatever comes next.

***

At my firm, on-staff Certified Financial Planners work directly with investors to build custom-tailored plans and portfolios every day. If you think we can help you, please get in touch.

The Biggest Threat To Your Portfolio by @ReformedBroker http://t.co/ITQHmt2QNs

RT @DeThomasFinance: The Biggest Threat To Your #Portfolio is YOU http://t.co/ZmpXEKEJnN #investing #markets #advice #finance

RT @InvestSensibly: We can’t even work out why markets topped or crashed in the past. What makes us think we can do so in advance? http://t…

The biggest threat to your portfolio

http://t.co/xJsb5nvI8a

RT @InvestSensibly: We can’t even work out why markets topped or crashed in the past. What makes us think we can do so in advance? http://t…

RT @MStarInvSvcs: Via @reformedbroker, The Biggest Threat to Your Portfolio ^JO http://t.co/GVFEYJT6Fb

RT @InvestSensibly: We can’t even work out why markets topped or crashed in the past. What makes us think we can do so in advance? http://t…

RT @MStarInvSvcs: Via @reformedbroker, The Biggest Threat to Your Portfolio ^JO http://t.co/GVFEYJT6Fb

RT @InvestSensibly: We can’t even work out why markets topped or crashed in the past. What makes us think we can do so in advance? http://t…

RT @InvestSensibly: Markets reward discipline. So stop playing hopscotch with your retirement savings #Dimensional #DFA http://t.co/Rg1ViV7…

RT @DominicFrisby: The Biggest Threat To Your Portfolio by @ReformedBroker http://t.co/muS2y528XJ

RT @InvestSensibly: Markets reward discipline. So stop playing hopscotch with your retirement savings #Dimensional #DFA http://t.co/Rg1ViV7…

The Biggest Threat To Your Portfolio

http://t.co/W7lciGXcnA

The Biggest Threat To Your Portfolio by @ReformedBroker http://t.co/jzQmqpREy1 #finance #investing #behavioraleconomics

RT @IronMG: The Biggest Threat To Your Portfolio http://t.co/rYKwQh1e1d via @ReformedBroker http://t.co/eAAtvbKmQH