The fiduciary debate is about whether or not a broker or financial advisor should have to sell you the best possible financial product or just a product that’s good enough but that may carry alternate incentives for the salesperson.

Today’s story at DealBook illustrates why this is so important. They took a look at the in-house mutual funds being offered by banking institutions like Wells Fargo and JPMorgan Chase. These are the funds that you are highly likely to be shown if you’re investing through the bank itself, for obvious reasons. As my friend Wes Gray points out, there are several layers of profit involved for all different departments within these banks when advisors sell the house product.

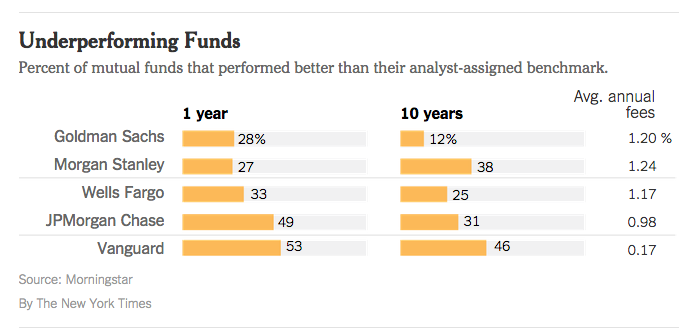

Unfortunately, the house product isn’t always the best option for customers:

The banks have suggested in marketing materials that their investing prowess differentiates their offerings from the pack. But the relatively high fees that banks charge for their mutual funds subtract from the ultimate returns and make it harder to compete against their most successful competitor in recent years, the giant fund manager Vanguard, a company that prides itself on offering low-cost funds.

Vanguard’s funds are not winning so consistently against Morgan Stanley and Goldman Sachs because Morgan Stanley and Goldman Sachs are bad at investing. This has nothing to do with the quality of research or “investing prowess” and it has everything to do with cost. Russ Kinnell, a Morningstar analyst, found that cost was the only statistically robust determinant of future performance among the tens of thousands of mutual funds they studied five years ago. This is true even if you’re invested in funds from the top investment banks on The Street.

Now if you’re a client of JPMorgan Private Wealth Management or a Morgan Stanley Private Banker or whatever their brokers call themselves these days, chances are your guy or gal at the bank understands this concept. But their job involves selling the company’s products, for better or for worse. Because their loyalties are divided between their clients and their company’s shareholders. It doesn’t mean they’re bad advisors or bad people, it’s just the nature of the thing. Everyone has conflicts – even fiduciary advisors – this particular conflict just happens to be a glaring one.

Source:

Wall Street Banks’ Mutual Funds Can Lag on Returns (DealBook)

Understanding How Broker Incentives Shape Financial Advice (Alpha Architect)

Should you buy mutual funds from your bank?… (http://t.co/PyPdOsvTsr)

RT @ReformedBroker: Should you buy mutual funds from your bank? http://t.co/X23ne89PCs

[…] Joshua M Brown The fiduciary debate is about whether or not a broker or financial should have to sell you the best […]

RT @ReformedBroker: Should you buy mutual funds from your bank? http://t.co/X23ne89PCs

Should you buy mutual funds from your bank? http://t.co/w9BQvJXq52

RT @Notiflux: Should you buy mutual funds from your bank? http://t.co/w9BQvJXq52

Should you buy mutual funds from your bank? by @ReformedBroker http://t.co/8HtXZqUTlv

RT @alphaarchitect: Should you buy mutual funds from your bank? by @ReformedBroker http://t.co/8HtXZqUTlv

RT @alphaarchitect: Should you buy mutual funds from your bank? by @ReformedBroker http://t.co/8HtXZqUTlv

Should you buy mutual funds from your bank? by @ReformedBroker http://t.co/19J6Yry9Dv

RT @InvestSensibly: Beware the glaring conflict of interest when considering buying a mutual fund from your bank @ReformedBroker http://t.c…

RT @InvestSensibly: Beware the glaring conflict of interest when considering buying a mutual fund from your bank @ReformedBroker http://t.c…

[…] Should you buy mutual funds from your bank? Downtown Josh Brown looks at the history of underperforming bank mutual funds. […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2015/04/13/should-you-buy-mutual-funds-from-your-bank/ […]

… [Trackback]

[…] Here you can find 9286 more Info on that Topic: thereformedbroker.com/2015/04/13/should-you-buy-mutual-funds-from-your-bank/ […]