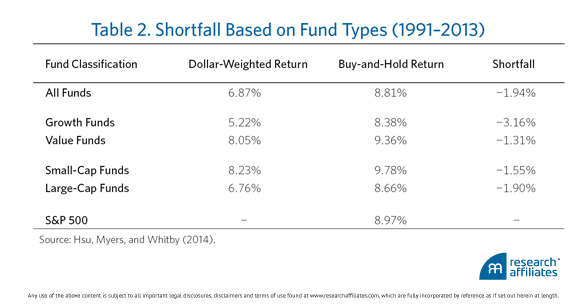

What if I told you that:

a) investors in value funds are actually earning a “negative premium” thanks to their awful market-timing and the mean-reverting nature of the premium itself

b) investors in growth funds are even worse in terms of behavior, so their dollar-weighted performance is even more abysmal compared to the funds themselves

In the table above, “dollar-weighted” returns are reflective of the actual returns investors receive based on when money is added or taken out of the funds being studied. The “buy-and-hold” returns are what would have been earned had investors all stayed put.

That might make you think about some of your own behavioral investing traits a bit differently. It may also make you wonder where (or to whom) that premium is going, if investors in the aggregate continue to pay it.

Good question.

Jason Hsu and Vivek Viswanathan (Research Affiliates) write:

Research Affiliates is a value shop in the tradition of Ben Graham’s investment philosophy. As investors, we sell the popular securities that have become overpriced and we bargain-hunt for assets that have fallen out of favor. Today, however, we must acknowledge an inconvenient truth. The excess return earned by the average value mutual fund investor has been meaningfully negative.

What’s going on? How does this recent experience jibe with decades of research on the value premium? Does the negative excess return earned by value investors arise from an unrepresentative measurement period? Perhaps fees for the average value mutual fund are so high that they more than offset the value premium. The answer will not only surprise you but suggest tremendous opportunities for truly contrarian value investors.

Keep reading:

Woe Betide the Value Investor (Research Affiliates)

… [Trackback]

[…] There you can find 66129 additional Information on that Topic: thereformedbroker.com/2015/03/28/what-happened-to-the-value-premium/ […]