There’s a really interesting piece of research out from Credit Suisse in which Ravi Mehrotra & Co lay out an “It’s different this time” thesis that seeks to explain why the huge rally in biotech stocks is justified and possibly not over yet.

They note that there are indeed bubble-like optics at play here (The cumulative market cap of the 5 largest cap biotech stocks is $513B currently up from $128B at the beginning of 2011, the BTK index is up 204% since 1/1/2011 versus 64% for the S&P500, etc). But the CS argument is that business models have radically shifted, and now biotech companies can self-fund and give away much less of their profits to the big pharmas they used to be desperate to partner with. Therefore, investors may be appropriately bidding up the biggest and best companies in a re-rating of sorts.

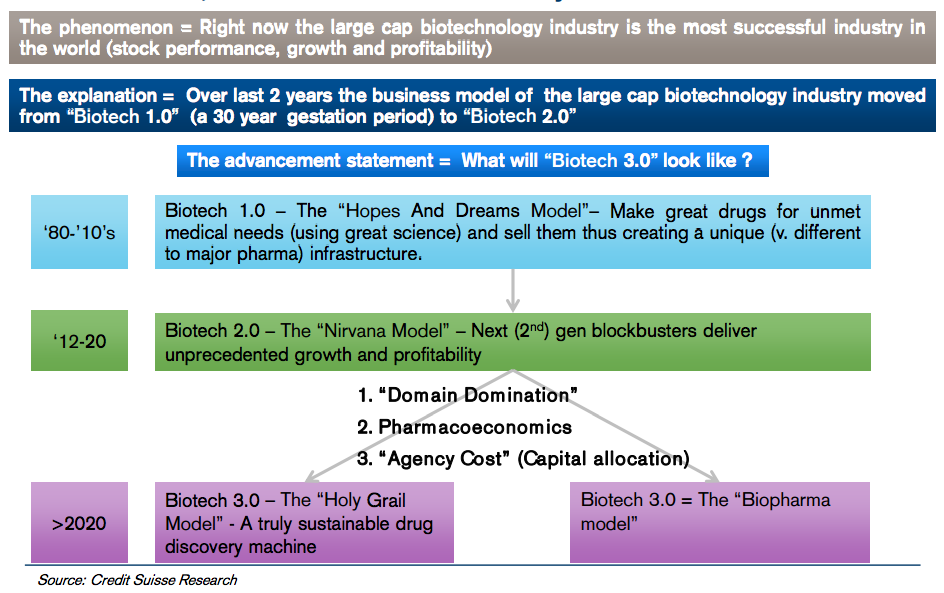

Here’s an illustration of what this looks like now, and could develop into in a new “Holy Grail” phase…

Our Hypothesis – Large Cap Biotech Is So Successful Due to Unique “2.0” Business Model, Evolution to “3.0” Model Key For Continued Success

Source:

Are We In A Biotech Bubble? Domain Domination Is The Answer!

Credit Suisse Equity Research – March 27th 2015

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] There you will find 89386 more Information to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/03/27/credit-suisse-on-biotechs-nirvana-phase/ […]