Credit Suisse notes that the mountain of earnings being accumulated and hoarded overseas by US corporations is now over $2 trillion. Further, they get into a discussion about how a lot of S&P 500 companies to decline to provide a tax liability estimate for these overseas earnings when reporting to the SEC each quarter. They make the case that these earnings are indefinitely intended for overseas reinvestment and that it is “impractical” to make such a tax liability disclosure given the complexity of their foreign operations.

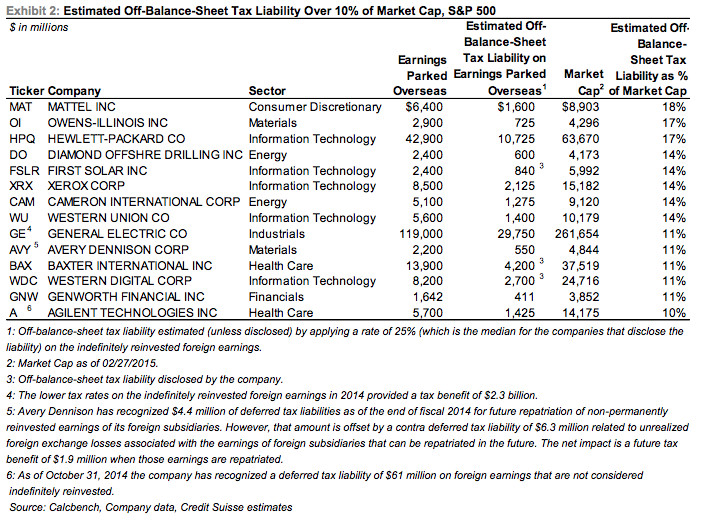

CS took a look at the S&P 500 companies whose off-balance sheet tax liabilities represent the largest portion of their respective market caps to get a sense of where the risk might be should companies need to repatriate more of their overseas cash to fund operations or buyback/dividend plans. The analysts conclude that many balance sheets are nowhere near as flexible as some may currently believe when this is factored in.

…only 69 companies out of the 310 in the S&P 500 (excluding REITs and companies domiciled outside the U.S.) that disclose how much in earnings they have parked overseas provide an estimate of the potential U.S. tax liability, which totaled $150 billion.

For the remaining 241 companies we assumed the residual taxes due in the U.S. would be 25% of the earnings parked overseas and estimate the total unrecognized/undisclosed deferred tax liability is $384 billion. Add that all up ($150 billion + $384 billion) and we estimate there’s a $533 billion (after rounding) off-balance-sheet U.S. tax liability tied to the $2.1 trillion in earnings parked overseas for the S&P 500 companies.

To get a sense for the magnitude of these off-balance-sheet U.S. tax liabilities, we compare them to the market cap for each company. We found 68 companies, where that potential tax liability was more than 5% of the market cap including the 14 companies in Exhibit 2, where it is more than 10%. Balance sheets might not be as healthy as they appear after factoring in this off-balance-sheet tax liability. Have you priced it in? If you’re expecting that the earnings really are reinvested overseas indefinitely then you might not have to, but if the company wants to put the funds to work in the U.S. or return cash to you the shareholder (or creditor) then you should.

One additional risk here is the possibility that Obama’s proposed mandatory tax holiday goes through. The Cliff’s Note’s version of this proposal is that the US government would force repatriation at a rate of 14% – far below the normal corporate tax rate of around 35%, but mandatory nonetheless. CS does not believe this budget proposal will pass this year, but it’s still out there…

Source:

Parking A-Lot Overseas

Credit Suisse – March 17th 2015

[…] Joshua M Brown Credit Suisse notes that the mountain of earnings being accumulated and hoarded overseas by US […]

The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

That we know about……

RT:@ReformedBroker S&P 500 names with the largest off-balance sheet tax liabilities http://t.co/3sqgtoQ1Ya

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

RT @ReformedBroker: S&P 500 names with the largest off-balance sheet tax liabilities http://t.co/2NiJulJVC9

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

RT @ReformedBroker: The US stock market’s $533 billion off-balance-sheet U.S. tax liability

http://t.co/fHP63h59iQ

S&P 500 names with the largest off-balance sheet (overseas) tax liabilities, the real sexy stuff.

http://t.co/OdKyFUeEtS

S&P 500 names with the largest off-balance sheet tax liabilities http://t.co/Z2mwfc40Sk http://t.co/e6n4mp8HvG

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/03/17/sp-500-names-with-the-largest-off-balance-sheet-tax-liabilities/ […]

… [Trackback]

[…] There you will find 52506 additional Info to that Topic: thereformedbroker.com/2015/03/17/sp-500-names-with-the-largest-off-balance-sheet-tax-liabilities/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/03/17/sp-500-names-with-the-largest-off-balance-sheet-tax-liabilities/ […]