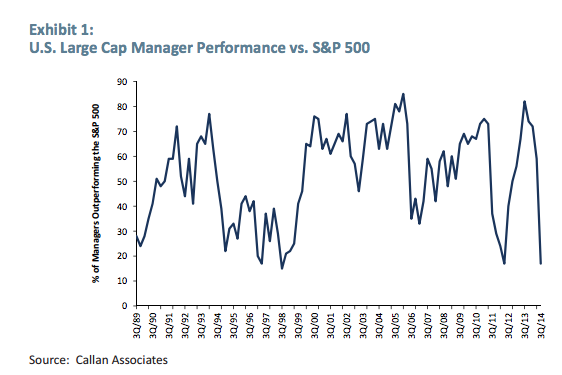

As you are likely well aware by now, 2014 was the worst year for actively managed mutual fund performance in three decades. Less than 20% of stock-picking managers were able to exceed the returns of their benchmarks last year and, in some categories, the number was closer to 10%. How on earth could things have gotten so bad?

More importantly, is it secular or cyclical? Permanent or fixable? There is some evidence that last year was an anomaly and some evidence that the decline of active management is inexorable. Below, I will solve the mystery behind how this happened and I’ll let you decide whether or not things will change.

I’ve just finished reading the excellent new book by Larry Swedroe, The Incredible Shrinking Alpha, in which he lays out the evidence for why active management isn’t working for investors and some reasons for why it will only get harder, not easier, going forward. One of the more interesting ideas he has is that the exodus into passive strategies – which is usually cited as a reason for active outperformance going forward – is actually a major negative. This is because, with all the unskilled investors departing, pros will be left to square off against only other pros. The lack of retail punters and their harvestable mistakes cuts off one of the most reliable historical sources of alpha for sharp-eyed managers.

This is the “Paradox of Skill” theory that Michael Mauboussin has written at length about – wherein it is only relative skill, not absolute skill, that matters. Ted Williams was one of only seven Major League Baseball players ever to bat over .400 for a full season – and he did it back in 1941, more than 70 years ago. No one’s been able to do it since because all of the players have gotten so much better. In the stock selection game, luck plays an increasing role because, relatively speaking, there is so much more talented competition and everyone is highly skilled. Larry explains that in the stock market, as in baseball, “as average skill skill increases, it becomes more difficult to outperform by large margins – the standard deviations of outcomes narrows.”

But the increase in average skill has been happening for awhile now. Surely there must be other reasons for the cliff that active managers fell off last year – the drop being so sharp and sudden from even the existing trend of diminishing outperformance. A new white paper from GMO’s Neil Constable and Matt Kadnar makes the point that there are three reliable sources of outperformance – preconditions, if you will – that need to be present in order for there to be a lot of US equity managers beating their benchmarks.

According to the paper, large cap US stock managers can outperform in decent numbers if at least one of the following shows up as a benefit:

1. Smaller cap stocks within the large cap universe do better than their mega-cap brethren.

2. Cash isn’t a major drag on returns.

3. International stocks perform well or better than US stocks.

In most years, at least one or two of these conditions will manifest itself, thus enabling skilled managers to differentiate themselves from the benchmarks in a positive way. Last year was a Perfect Storm in that a) the small cap or “size” premium was actually negative and b) cash was a huge drag on performance and finally c) international stocks were uniformly terrible versus US stocks. Because none of those things served as a tailwind, US large cap managers were left to the mercy of the index itself (and the index was absolutely merciless).

Based on their research, absent the benefit of smaller stocks working, cash working or international stocks working, historically it’s been tough for large cap managers in the aggregate to put up competitive numbers.

Here’s GMO (emphasis mine):

It is not uncommon for managers to have several percentage points of their portfolio allocated to each of these asset classes, and therefore underperformance from any of these will act as a drag on the performance of the overall portfolio…

…in the 12 months ending September 30, 2014 the S&P 500 beat both international and U.S. small cap stocks by around 10% while outperforming cash by 20%. If a manager were to have had 5% of his portfolio in non-U.S. stocks, 5% in small/mid cap U.S. stocks, and carried 1% in cash, then he will have effectively started with a deficit of 120 bps versus the benchmark. That is a lot of ground to make up from stock picking within the S&P 500 alone.

Constable and Kadnar posit that it is unlikely that all three of these drivers of alpha will fail to show up concurrently in future years, thus their conclusion that there is some hope for active management going forward. This may be true.

My take is that one doesn’t need a large cap US manager to dip into cash, small caps or international stocks. In the portfolios my firm constructs for clients, for example, we can tap into these sources of alpha in their beta forms and reap whatever benefits they offer systematically, without paying a high expense ratio for the privilege of having these exposures taken on by a guesser.

But the issue Larry Swedroe highlights – about the retail migration away from “playing the game” – is probably the more important secular problem for active managers. Minus the exploitable accidents of large numbers of mom and pop investors, there’s simply less alpha to go around. The low hanging fruit has left and gone to Valley Forge, PA. In the absence of so many unskilled players, the field has become much more brutal, much more difficult to best.

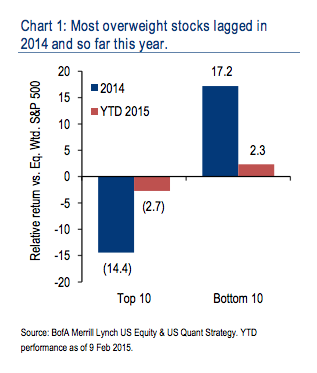

There is one last facet of the disappearing alpha story that is also worth considering. Because of the pressure of outflows on actively managed funds, it turns out that the most popular stocks among professional stockpickers are performing very poorly versus the least popular. The logic goes that as funds are forced to sell to meet the redemptions of fleeing investors, the stocks they are most heavily weighted towards are the ones with the most selling pressure. If a stock is largely owned by active funds, and active funds are seeing mass outflows, then that stock is more likely to be held down even amidst a broad market advance.

Savita Subramanian, who heads up Bank of America Merrill Lynch’s Equity and Quant Strategy group, revealed that the ten most widely held stocks among active large cap fund managers underperformed the least popular stocks by a wide margin (emphasis mine)…

Of all the attributes we track, ownership may have been most important over the last year. Of the ~50 quantitative factors we follow, ownership consistently ranked among the best explanatory factors for stock returns in 2014. With signs of a continued rotation out of active into passive strategies – flows into passive last year were 15x flows into active – stocks most held in active portfolios may have been under some pressure. We found that the 10 most underweight stocks in the S&P 500 by large cap active managers outperformed the 10 most overweight stocks by managers by 32ppt in 2014.

That’s not a typo – and 32 percentage points is a huge difference. Unfortunately for active funds, this trend has continued into 2015. Here’s what it looks like:

Subramanian says that the answer for fund managers is to avoid crowded trades, because the ten most under-owned stocks are already beating the ten most widely-held by 5.1% in the first five weeks of this year. In other words, the ongoing flight from active funds into index products carries with it a self-reinforcing trend that exacerbates the underperformance of managers rather than cures it.

Whether or not this trend continues or abates is still a matter for debate. But the reasons laid out by Swedroe, GMO and BAML should be the starting point of any discussion of the topic. These truths should the basis for your opinion about how things will (or won’t) improve in the future.

Sources:

The Incredible Shrinking Alpha (Amazon)

What’s hot, what’s not (Bank of America Merrill Lynch – February 11th 2015)

RT @BrattleStCap: “Why Active Management Fell Off a Cliff – Perhaps Permanently” great read http://t.co/GjMw7cSRRO

RT @johnauthers: This is a great piece: @reformedbroker http://t.co/EClf9xmM12

RT @johnauthers: This is a great piece: @reformedbroker http://t.co/EClf9xmM12

RT @2MyPathway: Active management (aka stock picking and timing the market) are dead. Long live Indexing and Smart Beta! http://t.co/K2dWR…

cc @carlquintanilla MT @mims: Why stock picking is permanently broken&no one should do it anymore, by @reformedbroker http://t.co/DxpxzE1F2F

RT @johnauthers: This is a great piece: @reformedbroker http://t.co/EClf9xmM12

Great @ReformedBroker article on active v. passive investing. Highlights a new favorite author of mine @mjmauboussin http://t.co/LcfxUgxzoO

The lack of retail punters and their harvestable mistakes is the reason for poor fund performance. http://t.co/PvbwSNHw4B

Why Active Management Fell Off a Cliff – Perhaps Permanently http://t.co/60svDm5jDN

Why active fund management fell off a cliff @ReformedBroker http://t.co/joAUAENdQh

Why Active Management Fell Off a Cliff – Perhaps Permanently http://t.co/FXFwvr9ppr

Why Active Management Fell Off a Cliff – Perhaps Permanently by @ReformedBroker http://t.co/mI6nV9V2ST

Several good theories on why active management is struggling from @ReformedBroker http://t.co/fReeXsA3lw

RT @BlairHduQuesnay: Several good theories on why active management is struggling from @ReformedBroker http://t.co/fReeXsA3lw

RT @BlairHduQuesnay: Several good theories on why active management is struggling from @ReformedBroker http://t.co/fReeXsA3lw