In this week’s Barron’s, we get the second part of the semi-annual Roundtable and global macro investing legend Felix Zulauf kicks things off with a fairly dire outlook. He’s been dire for a while now (as all macro people must be), so that’s not the news. What I did find interesting was his outlook for the US dollar, and his explanation about how nobody truly understands why it’s been rallying…

Zulauf: Mainstream economists are telling us that the dollar is strong because of growth differentials among countries, and an impending interest-rate hike in the U.S. They don’t understand the true reasons for the strong dollar.

Enlighten them, and us, please.

Zulauf: The Federal Reserve, under [former chairmen] Alan Greenspan and Ben Bernanke, pursued a monetary policy that kept interest rates too low. It weakened the U.S. currency, which became a funding currency around the world. Corporations issued dollar-denominated debt. According to the Bank of International Settlements, there is $9 trillion of dollar-denominated debt outstanding in the private sector around the world. That is the short position. Whatever the reasons for the recent firming of the dollar, the true firming eventually will occur when all issuers of dollar-denominated debt see their liabilities rise. They will have to hedge their positions and buy dollars, creating demand for the dollar.

At the same time, the current account deficit of the U.S., which is the way the U.S. supplies dollars to the rest of the world, has been shrinking in recent years. Therefore, there is a diminishing supply of new dollars. At some point this year, the market will realize that interest-rate hikes in the U.S. are off the table. When that happens, the dollar will have a correction. I expect that correction to start in the first quarter and end before midyear. Then, the dollar will strengthen again, probably into late 2016. I don’t want to buy U.S. dollars at today’s level, but an investor who wants to establish a dollar position should do so in phases as the dollar corrects.

Source:

22 Smart Investment Ideas (Barron’s)

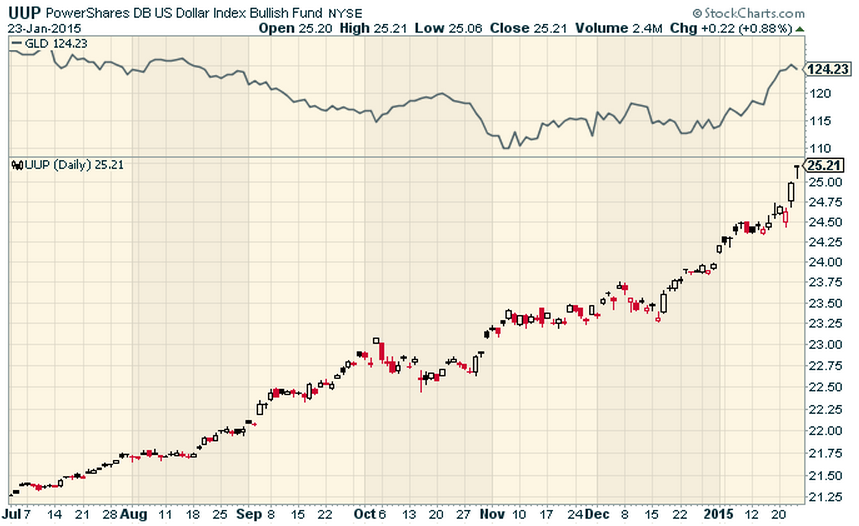

Josh here – one other observation I’ve made, which may or may not be connected to this but is interesting nonetheless: Since the beginning of this year, gold has broken its inverse correlation with US dollar strength and has begun rallying with the greenback. My interpretation is that this is not an “economic” phenomenon. Rather, I believe it represents pure fear, or the reintroduction of pure fear, anyway.

My chart below:

“@ReformedBroker: Felix Zulauf: There is a Dollar Shortage http://t.co/QjuQJ7r9iY”

I got a 1880 silver dollar & it’s worth 2 bucks!!!

RT @ReformedBroker: Felix Zulauf: There is a Dollar Shortage http://t.co/4lB0pw8ubh

“@ReformedBroker: Felix Zulauf says the dollar rally will crack – but then you BUY

http://t.co/vOX6JPlK3X $UUP $TLT”

They Otta all SPLIT!

Felix Zulauf: There is a Dollar Shortage by @ReformedBroker http://t.co/3YfdGT1S0P

RT @ReformedBroker: Felix Zulauf says the dollar rally will crack – but then you BUY

http://t.co/j98llhOmqC $UUP $TLT

RT @ReformedBroker: Felix Zulauf says the dollar rally will crack – but then you BUY

http://t.co/j98llhOmqC $UUP $TLT

Felix zulauf: there is a dollar shortage http://t.co/RaGNqR5TTv

Felix Zulauf: There is a Dollar Shortage by @ReformedBroker http://t.co/R8xO9Adena

Like the bond shortage! RT ReformedBroker: Felix Zulauf: There is a Dollar Shortage http://t.co/G1HEscbz2a

Felix Zulauf: There is a Dollar Shortage http://t.co/fSHAhEit7j

Felix Zulauf: There is a Dollar Shortage by @ReformedBroker http://t.co/hPXD0ULBOj

RT @ReformedBroker: Felix Zulauf says the dollar rally will crack – but then you BUY

http://t.co/j98llhOmqC $UUP $TLT

http://t.co/lOmpDO70Mi

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/01/24/felix-zulauf-there-is-a-dollar-shortage/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2015/01/24/felix-zulauf-there-is-a-dollar-shortage/ […]