The absolute level of margin debt is a traditional boogeyman the bears like to pull out from time to time. This is because large numbers – especially record large numbers – tend to get people’s attention and everyone knows that debt is “bad” or indicates too much optimism / speculative fervor.

But the bears have a point. Margin levels can be an indicator that the party’s gone on too long or has gotten way to aggressive. The thing is, it’s not absolute margin dollar amounts we should be looking at (of course they’ll be high when the market’s gone up!), it’s actually the rate of change and the confirming or non-confirming price action in the market itself that could make margin debt a crucial tell. Unfortunately, this cannot be done in real-time, so using margin debt (or any other indicator) to pick an exact stock market top as it happens is not ever going to be possible. There are people who claim they can for $19.95 a month (plus a free tote bag!), but if you’re reading my blog I assume you already know better.

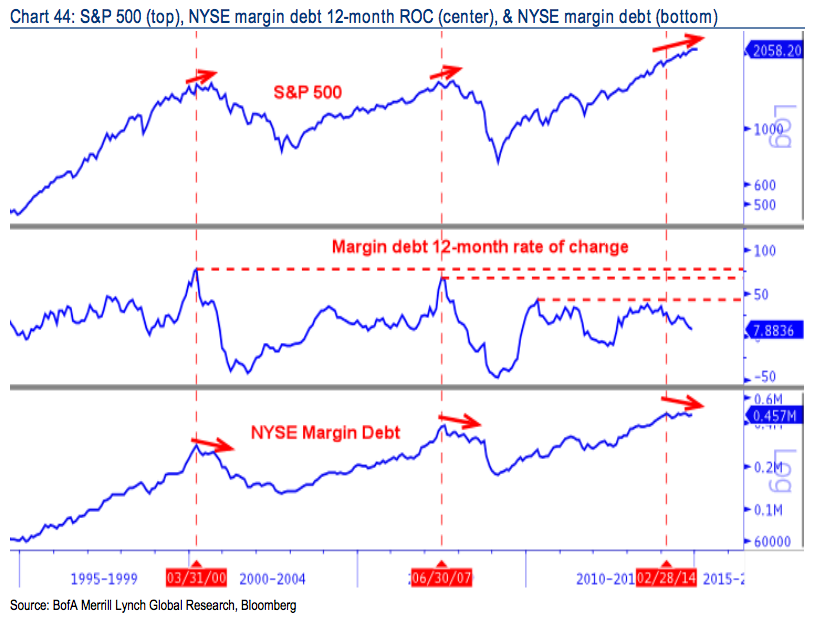

Here’s a look at margin debt from Bank of America Merrill Lynch’s ace technician Stephen Suttmeier, via his giant year-in-preview piece “Welcome to 2015″…

Margin debt: Below the Feb 2014 peak & 12-month ROC not at an extreme

Margin debt is a gauge of market sentiment and positioning. As of November 2014 NYSE margin debt stood at $457b (just below February’s record high of $466b). While the absolute level of margin debt is a source of investor concern, the YoY rate of change (RoC) is lackluster at 7.9% and did not test the extremes near 78% and 68% that accompanied the S&P 500 peaks in 2007 and 2000, respectively. One concern is that margin debt topped out ahead of the S&P 500 on a monthly closing basis in 2007 (4-month lead for margin debt) and 2000 (5-month lead) and this preceded a steep market decline. Since NYSE margin debt remains below its February 2014 peak, the 2014 rally in the S&P 500 between February and November did not occur with an increase in leverage. The same thing happened moving into the 2007 and 2000 peaks and preceded a market drop.

Source:

Welcome to 2015

Bank of America Merrill Lynch – January 13th 2015

RT @ReformedBroker: SHOULD WE BE WORRIED ABOUT MARGIN DEBT? http://t.co/4IptSj1JfI $SPY

BECAUSE YOU ASKED IN ALL CAPS, I’M WORRIED ALREADY! #PANIC RT @ReformedBroker SHOULD WE BE WORRIED ABOUT MARGIN DEBT? http://t.co/PebF9OOLGW

Should We Be Worried About Margin Debt?… (http://t.co/ezah9tYTnu)

RT @ReformedBroker: SHOULD WE BE WORRIED ABOUT MARGIN DEBT? http://t.co/4IptSj1JfI $SPY

RT @ReformedBroker: SHOULD WE BE WORRIED ABOUT MARGIN DEBT? http://t.co/4IptSj1JfI $SPY

“the 2014 rally in the S&P 500 between February and November did not occur with an increase in leverage.”

http://t.co/OCE5auuOk7

RT @ReformedBroker: Should We Be Worried About Margin Debt? http://t.co/lGlfQlkJxD

RT @ReformedBroker: Should We Be Worried About Margin Debt? http://t.co/lGlfQlkJxD

RT @ReformedBroker: SHOULD WE BE WORRIED ABOUT MARGIN DEBT? http://t.co/4IptSj1JfI $SPY

Margin debt today in comparison to previous market tops by @ReformedBroker http://t.co/H6FpV7yCNR

RT @ReformedBroker: “the 2014 rally in the S&P 500 between February and November did not occur with an increase in leverage.”

http://t.co…

Margin Debt. Absolute level is high, but not a concern. http://t.co/LcRNSTnnAY

Using margin debt to pick an exact stock market top as it happens is not ever going to be possible

http://t.co/eU3HesrCQO by @ReformedBroker

RT @ReformedBroker: “the 2014 rally in the S&P 500 between February and November did not occur with an increase in leverage.”

http://t.co…

Should We Be Worried About Margin Debt? by @ReformedBroker http://t.co/5WwTggXJlH why margin when you can mortgage for cheaper?