Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly.

Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly.

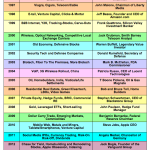

It begins with 1996 because that was my first summer working on The Street and my earliest exposure to the market. I do this every December because I agree with the eminent philosopher Bob Marley in that “If you know your history, then you would know where you’re coming from.” If we don’t document and learn from the lunacy that grips us from year to year, how can we truly say that we’ve grown as investors?

By documenting this stuff, it becomes a permanent part of my knowledge base, a reference to draw from in times to come as similar trends play out and the great wheel spins past an endless parade of fear and greed.

So what was 2014 about?

I would point to four major fads and themes that each captivated the investment community and had some overlapping influence on each other:

Disinflation

General economic weakness in the European economy along with the continued China slowdown and a surprise mid-year technical recession in Japan helped drive prices and demand for commodities. This led to a push back of inflation expectations across the board and the resumption of yield-chasing among investors. Treasury yields hit astounding new lows – the exact opposite of what all of Wall Street’s strategists predicted as the year started. Consumer discretionary stocks and consumer staples stocks were big beneficiaries, as were bond funds and utilities.

USA!

The US stock market – specifically the S&P 500 – outperformed almost every other investable asset class in the universe this year. Investors piled into US large cap stocks as this trend became more and more apparent. The S&P 500’s year-to-date total return of 10.5 percent beat the Barclays Aggregate Bond index by 40 percent in 2014 and doubled the return of the Nikkei. In the meanwhile, MSCI EAFE (developed markets ex-US) was down 7.75 percent this year and the MSCI World Index has barely squeezed out a positive gain of less than 1 percent. Removing US stocks from the world index and its a loss of 7.65 percent for global stocks.

Alibaba

One global market that did manage to perform well was a market that almost no one can participate in – the Shanghai Composite of mainland Chinese stocks. The Shanghai Comp rose 40 percent this year, outperforming Hong Kong, India and the rest of the Asian markets after having underperformed for years. This awakening was brought about through a combination of renewed Bank of China stimulus along with the China Stock Connect (or Through train) plan that linked Hong Kong’s brokerage firms and markets with their mainland counterparts to allow for easier flow of funds back and forth. With foreign investors getting an expanded entrance to the Chinese bourses, the large discount between valuations narrowed a great deal. The bright spot for China bulls, however, took place on the New York Stock Exchange in September, as Alibaba listed it’s shares in the largest US IPO in history. Jack Ma led his company’s coming-out party on The Street and virtually every major hedge fund jumped in to play the theme.

King Dollar

In some way, the incredible strength of the US dollar figured into virtually all of the popular investment themes in the market this year. The dollar rose some 12% versus the yen this year and appreciated all year against the basket. It was on everyone’s lips, skewed the returns of investors in foreign asset classes and informed a great deal about how we went about allocating assets.

***

So those were the big stories of the year that investors and traders bought into. Below is my updated guide to the Investing Fads and Themes by Year, 1996 – 2014. Enjoy!

See previous years below!

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

Investment Fads and Themes, 1996-2014 http://t.co/6DInAx7pZ2

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Investment Fads and Themes, 1996-2014 http://t.co/6DInAx7pZ2

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…

RT @ReformedBroker: Each year I document the biggest investor fads and themes. Here’s the 2014 batch

http://t.co/Yw24mwW19n http://t.co/g…