I’m always on the hunt for interesting investment theses that bubble up far from the Wall Street commentariat mainstream. A trader / blogger named James Farro at Signalinea laid out the following premise, wherein the high yield debt market gets slammed because of oil’s slide, which then spreads a contagion of risk-off behavior around the entire marketplace (emphasis his):

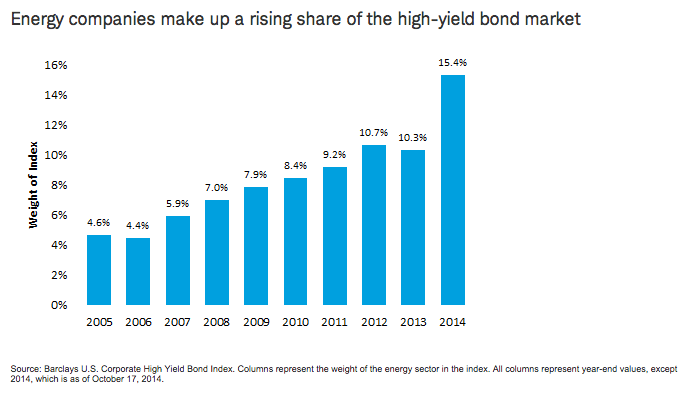

Energy companies are the 2nd largest issuer of HY debt.

With the ongoing massacre in crude oil my thought has been that the highly leveraged players would have debt issues which would just facilitate industry consolidation. But with the state of the credit market excluding sovereigns, we could have something else entirely. The energy sector makes up a large segment of the HY bond market and it’s about to take a big hit.. Sooner or later it’s coming. If the high-yield market in it’s fragile state is given a push we could see a real route in the markets. It’s starting to look like energy debt could go bidless for a time and take HY with it if action isn’t taken soon. And that action, in part should be for the orgy of debt issuance that is being used for buy-backs to stop asap.

But wait.. The stock buy-backs have been a major enabler of higher equity prices.

Yep.

Why is no one talking about potential consequences from this ocean of unproductive debt issuance that’s not used for expansion/capex but merely multiple expansion?

Farro points to this chart from October that Charles Schwab put out which illustrates the growing participation of oil & gas issuers in the junk bond market:

Josh here – As you can see, energy high-yields have tripled as a percentage of the market in the last decade. They are the second largest sector in the junk market after telecom companies – which are businesses with no commodity exposure and much more stable cash flows.

It is well-known that:

a) investors chasing yield have plowed into junk bonds in recent years, with many credit market neophytes accessing the sector using ETFs with a limited operating history and an unknown liquidity profile – they’ve never really been tested before in a bond bear market.

b) this chasing of yield has occurred on an institutional level as well, and the end result has been an ocean of liquidity for any issuer who showed up wearing a clean suit. So-called “covenant-light” deals – which give issuers even more latitude with their balance sheets – have become the rage recently as the desperation for income stretched into a seventh year.

c) all of this high yield liquidity – aided and abetted by the Fed – has engendered an almost consequence-free environment for all participants: Defaults are at generational lows and everything is being priced off the Treasury yield, which never goes up.

d) refinancing and buyback activity have created a massive wave of multiple expansion – some estimate that almost all of the market’s recent gains can be chalked up to shrinking share counts and the earnings-per-share growth they create.

The question now is whether or not the slide in crude can do enough damage in the high yield market to set off a chain reaction of de-risking, default and outflows. It’s an interesting connection made at Farro’s blog, I recommend you read the whole thing.

Source:

Why a credit crisis in the energy sector may be coming at the worst time

RT @tracyalloway: This –> MT @ReformedBroker Plot twist: The oil crash kneecaps high yield, which halts buybackpalooza http://t.co/U008oLY…

RT @ReformedBroker: Plot Twist: The Oil Crash Kneecaps High Yield, Which Halts Buybackpalooza http://t.co/YJ7cisGL4h

RT @ReformedBroker: Anyone who’s serious about understanding inter-market relationships should be pondering this:

http://t.co/962Db68XV5

RT @ReformedBroker: PLOT TWIST: The Oil Crash Kneecaps High Yield, Which Halts Buybackpalooza http://t.co/ZtvWhvfy7U $HYG $USO $JNK $XOP

[…] Ground – WSJ Saudi Stocks Enter a Bear Market on OPEC Output; Dubai Slumps – Bloomberg The Oil Crash Kneecaps High Yield, Which Halts Buybackpalooza – Reformed Broker Could a US energy sector mini-bust take down the bond market? – […]

RT @ReformedBroker: This post I did using @JF991’s thesis on how oil’s crash could impact buybacks marketwide went crazy this weekend

htt…

RT @ReformedBroker: This post I did using @JF991’s thesis on how oil’s crash could impact buybacks marketwide went crazy this weekend

htt…

RT @ReformedBroker: This post I did using @JF991’s thesis on how oil’s crash could impact buybacks marketwide went crazy this weekend

htt…

RT @ReformedBroker: This post I did using @JF991’s thesis on how oil’s crash could impact buybacks marketwide went crazy this weekend

htt…

#Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq http://t.co/7dROOXIWQ9

RT @TheBubbleBubble: #Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq ht…

RT @TheBubbleBubble: #Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq ht…

RT @TheBubbleBubble: #Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq ht…

RT @TheBubbleBubble: #Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq ht…

RT @TheBubbleBubble: #Shale/#Bond #Bubble update – There’s No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/wydwBvxwXq ht…