I swear I’m not auditioning for The Onion. This is what actually happened.

Peter Boockvar on the Fed’s minutes, released at 2pm:

While nothing new, according to the just released FOMC minutes from the meeting 3 weeks ago, a majority of the committee remains deathly afraid of raising rates off zero. They still have very little faith right now in the ability of the US economy to handle a short rate at a range of anything above zero to 25bps…

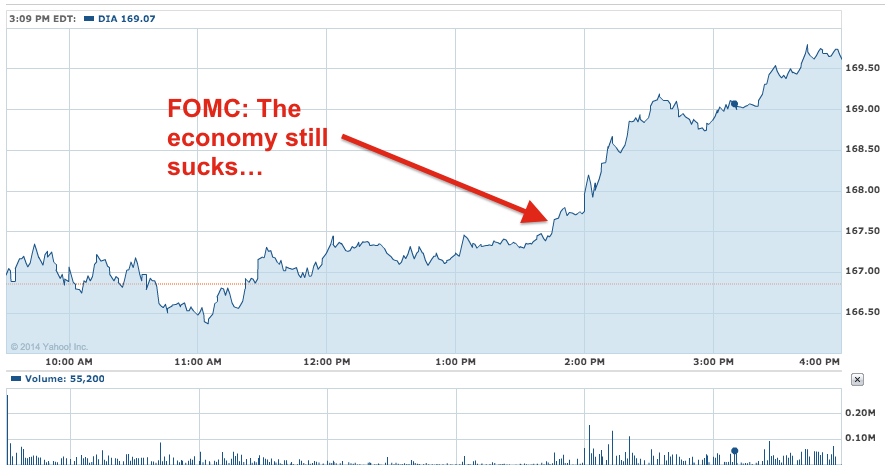

The line that got markets excited however, a market that doesn’t want any policy accommodation removal whatsoever, was this: “a number of participants noted that economic growth over the medium term might be slower than they expected if foreign economic growth came in weaker than anticipated, structural productivity continued to increase only slowly, or the recovery in residential construction continued to lag.”

Of course, this phenomenal news of continued emergency-level interest rates and economic fragility immediately led to a raucous two hours of buying on top of buying, with the Dow finishing up 270 points, it’s best single day performance in a year.

Here’s what it looked like:

Find that in your textbooks.

http://t.co/xFein8J92K http://t.co/xZWZX4A1sS

[…] Stocks Explode Higher on Fears of Renewed Economic Weakness (TRB) but see Fat Lady Is About to Sing, According to the Charts (Barron’s) • Why Companies […]

[…] Stocks Explode Higher on Fears of Renewed Economic Weakness […]

[…] FOMC minutes takeaway: stocks explode higher on fears of renewed economic weakness | Josh Brown (The… Sounds like a paradox, but that’s exactly what happened on Wednesday, when FOMC minutes were released, showing concern with signs of potential economic weakness that pushed-out the market’s expectations for a rate hike: “The costs of downside shocks to the economy would be larger than those of upside shocks because, in current circumstances, it would be less problematic to remove accommodation quickly, if doing so becomes necessary, than to add accommodation.” Notes: – Forward guidance language evolution: “considerable time” language will likely change so as not to misconstrue the Fed as being calendar (as opposed to data) dependent – Strong dollar: monitoring its impact, specifically weaker exports and lower inflation – Inflation: still below 2% long-run target due to fall in energy prices #Bad is good again #ZIRP #Rising rates #Fed Funds Rate $DXY […]

[…] question is to ask why it went up an almost equivalent amount yesterday. And the answer to that is people are out of their f***ing minds. They’re nostalgic for the sentiment-driven, Fed-fueled, multiple expansion market of 2013 and […]

[…] question is to ask why it went up an almost equivalent amount yesterday. And the answer to that is people are out of their f***ing minds. They’re nostalgic for the sentiment-driven, Fed-fueled, multiple expansion market of 2013 […]

.

ñïàñèáî çà èíôó.

.

tnx!

.

ñïñ!

.

tnx for info.

.

thank you.

Thorn of Girl

Superb information is often found on this web website.

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/10/08/stocks-explode-higher-on-fears-of-renewed-economic-weakness/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/10/08/stocks-explode-higher-on-fears-of-renewed-economic-weakness/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/10/08/stocks-explode-higher-on-fears-of-renewed-economic-weakness/ […]