Friday the market exhaled in relief.

The Dow Jones shot up 200 points, ostensibly in response to a better than expected September employment report. This after a tumultuous two-week period during which US big cap stocks succumbed to the weakness happening everywhere else and dropped almost five percent from their all-time record highs. The best thing you could say about Friday’s price action is that it was led, to a degree, by the financial stocks, which are an important ingredient in the “things are getting better” recipe. The second best thing you could say is that the bounce occurred from the long-term moving average and trendline that’s supported the multi-year rally in the S&P 500 – the buyers showed up exactly where they always have once the market had fallen into that zone of support.

And now we await the much-needed follow-through that we’ve seen after each of the last two years’ worth of v-shaped stock market recoveries. Can we count on that follow-through once again?

Amidst the excitement of the day, I saw and heard a lot of people chirping about how the huge one-day rally was some sort of proof that all is well again. I don’t think most people realize that large one-day stock market gains are actually not typical of bull markets necessarily. The truth is that the typical bull market advance is more of an upward grind, not a string of explosive rally days. In fact, the data suggests that the largest one-day gains throughout history have actually occurred during downturns.

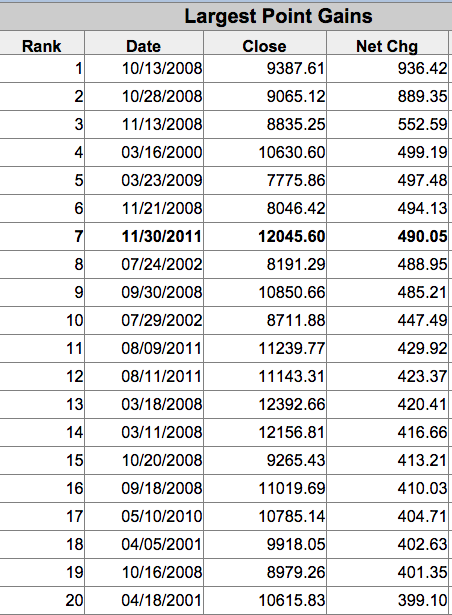

The data below comes from the Wall Street Journal. In it, you’ll note that almost all of these “great” days for the Dow occurred at the beginning, middle or end of a bear market or downtrend. Ten of these top twenty occurred in the teeth of the 2008 meltdown, as things had gotten temporarily oversold (on their way toward eventual lower prices):

The other thing is that huge one-day gains are typically clustered closely together with huge one-day losses. It’s rare to see one without the other. We certainly had these clustered together this time, as this past week featured one of the worst days of the decade.

I think the takeaway is that big one-day gains feel good at the time they’re occurring, but they are certainly not indicative of happy days being here again. Most importantly, they need to be looked at in the context of what’s occurred leading up to them. Frequently, it’s a volatility spike and a massive bout of uncertainty – or a sudden shift in sentiment – that sets these kinds of spikes up.

The thing about big one-day gains by @ReformedBroker http://t.co/bMJydE2dFc

RT @bkollmeyer: The thing about big one-day gains by @ReformedBroker http://t.co/bMJydE2dFc

RT @ReformedBroker: The thing about big one-day gains http://t.co/Tr23W5l7nL

[…] so fast, say some. Like Josh Brown of Reformed Broker, who noted some of Friday’s high-fives may have been premature. He crunched some numbers and came […]

[…] 5 reasons why a 10% correction could be bullish (USA Today) • The thing about big one-day gains (TRB) • Barron’s has an exclusive interview with Bond King Bill Gross on his Next Act […]

RT @ReformedBroker: The thing about big one-day gains http://t.co/Tr23W5l7nL

RT @PeterGhostine: Nice. RT @ReformedBroker: The thing about big one-day gains http://t.co/4qcu1rsRij

The thing about big one-day gains http://t.co/gzdH5qnoPi

[…] The Thing About Big One-Day Gains (TRB) […]

Huge one-day gains typically clustered with huge one-day losses http://t.co/u5bjFCrsZD @ReformedBroker on big picture of last week’s action

[…] “I think the takeaway is that big one-day gains feel good at the time they’re occurring, but they are certainly not indicative of happy days being here again.” (The Reformed Broker) […]

RT @ReformedBroker: The thing about big one-day gains http://t.co/r1ZU6Pi1aY

The thing about big one-day gains via @reformedbroker http://t.co/iPTOM3yc3n

[…] The thing about big one-day gains […]

Friday, this! http://t.co/IoT4PWIzRI @ReformedBroker