When you value a stock, you have many levers you can pull to come up with an answer for “fair value” – whether it’s price-to-book-value or a PE ratio or some sort of discounting of future cash flows. When you value a commodity, you have actual real-world supply-vs-demand dynamics on your side – Will we consume more or less natural gas this year? Are there enough acres of corn planted to meet expectations from food producers?

With something like gold and silver, it’s harder. Because outside of jewelry demand there isn’t much actual use for these metals (we don’t do gold teeth or use silver in photography anymore). These precious metals trade more on an emotional desire to own them given a sentiment consensus about the future among individuals and world governments. Lately, thanks to the ETF financialization of the PMs, there’s an investment component that wags this dog as well.

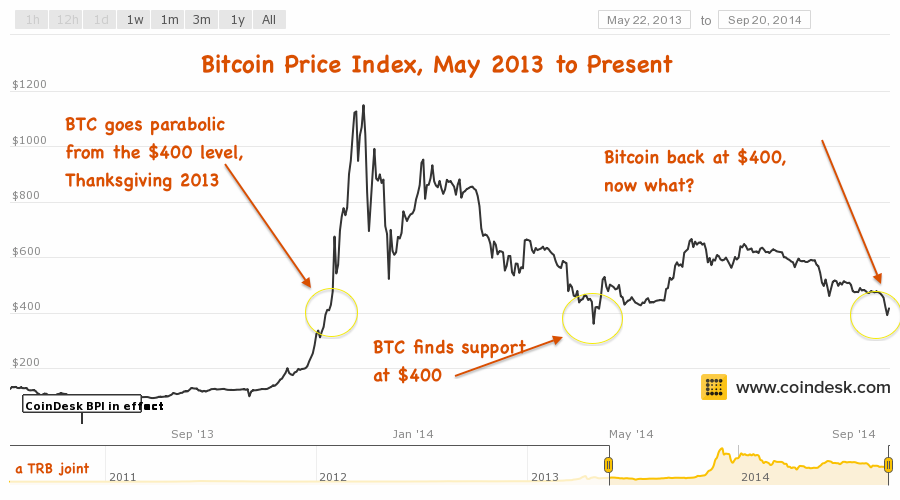

With Bitcoin, none of these things apply. There’s no need for them nor is there any established supply / demand pattern given the novelty and newness of the thing. As such, there are only technicals – the charted manifestation of who wants in and who wants out. I don’t have transaction volume data to complement the below price study I’ve done, but it’s still interesting on its own.

The $400 level seems to have some relevance to the Bitcoin marketplace, probably beyond coincidence. I think it’s because the $400 level is where the parabolic rise began around Thanksgiving last year. If you recall, this rise was driven by the huge surge in headlines about retailers accepting BTC for ecommerce transactions during the holiday season. As the holiday shopping season crested, BTC’s price blew up and then blew off. It’s sucked pretty much every month since – but now we’re headed back into that time of year again.

If I were inclined to trade shit like this, I’d be a buyer here and I’d grow emboldened should it smack $400 again and bounce off as it seems to have done this week. I’d be looking to sell by December as the enthusiasm for BTC purchasing comes and goes. The question for longer-term Bitcoin bulls is whether or not Apple Pay makes it so easy to buy stuff electronically that the idea of mining / storing digital coins and breaking them up for transactions becomes totally ridiculous, other than for narco-traffickers or international arms dealers.

Too soon to have a strong opinion, but this looks like a good risk/reward set-up for the bold:

data via CoinDesk

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/09/20/bitcoin-at-major-support-now-what/ […]