The Great Rotation market meme of early 2013 turned out to have nailed it, perfectly capturing what was happening in the investment business and, by extension, the major averages.

Stocks jumped on the first day of trading last January, never went negative on the year for even a second, rallied a historic 30% and finished the year on December 31st at a new record high. This was almost entirely driven by investors rebalancing their outrageously lopsided portfolios after five years of fear and apathy. Despite all the naysayers, flows into equity funds went mega-positive in 2013 while money going into bond funds slowed to a trickle. The fact that money hadn’t fled bond funds on a net basis is not the point – it was the change in trend that mattered and on that score, the Rotationistas (myself included, see here and here) were correct.

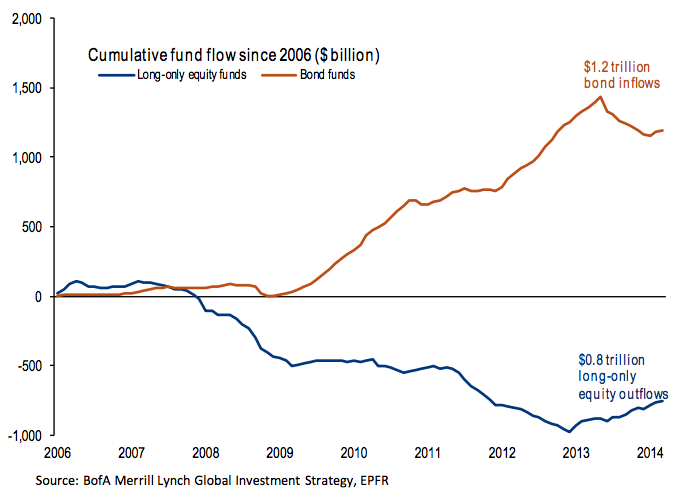

But this year, there’s been a pause in the Great Rotation – or it’s ended before ever having become truly “Great.” Bond inflows are ahead of equity inflows year-to-date once again. As a result, the longer-term move into bonds and out of stocks is still enormous: $1.2 trillion into fixed income funds since 2006 versus a negative $800 billion pulled from stock funds.

In other words, there’s a loooooooooooong way to go before the Great Rotation can be said to be complete – if it gets completed at all.

In the newest Research Investment Committee note at Bank of America Merrill Lynch – also known as the RIC Report – one of the big themes for this year is that bank stocks will signal whether or not the Great Rotation will resume from here. Strategist Michael Hartnett notes the high correlation between the KBW bank stock index and 10-year treasury yields. Hartnett says a resumption in strength for this pair will determine the direction of flows, consumer confidence, wealth effect and belief in economic growth for the second half of this year.

For some context on where we are in the Great Rotation, short and long term, let’s take a look at the standings (emphasis mine):

Investors have put $1.2 trillion into bond funds since 2006, but have taken $0.8 trillion out of equity funds.

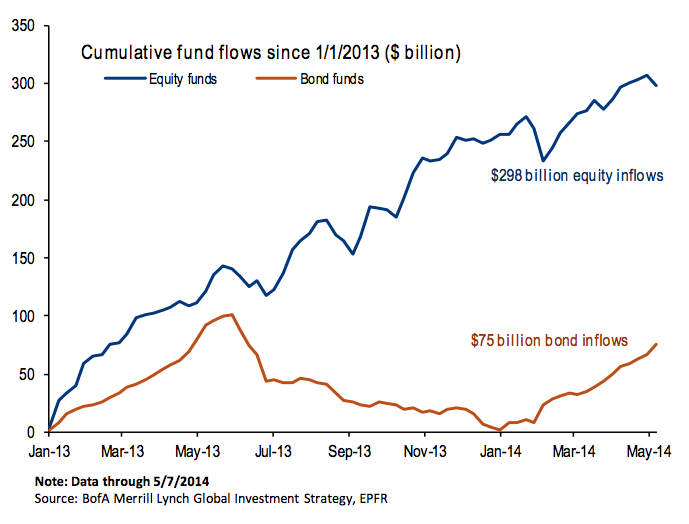

However, fund flow data since the beginning of 2013 shows that investors have been rotating from bonds into equities.

Equities have had $298 billion in inflows since Jan. 2013, while fixed income has had only $75 billion.

However, bond flows have picked up this year with inflows of $71 billion vs. $46 billion for equities.

The first chart below is the cumulative flows – stock funds versus bond flows – going back to 2006. You can see a drastic preference for “safety” that is so large, even last year’s enthusiasm barely dents it:

The second chart shows close-up on this year’s interruption of the Rotation:

Source:

The RIC in Pictures – May 2014

Bank of America Merrill Lynch – 19 May 2014

.

thanks.

.

tnx for info.

.

tnx.

.

áëàãîäàðþ.

.

ñïñ!

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] There you can find 80115 additional Information to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Here you can find 60938 additional Info to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]

… [Trackback]

[…] There you can find 77667 more Info to that Topic: thereformedbroker.com/2014/05/25/great-rotation-interrupted/ […]