The bond market is supposedly “smarter” than the stock market – bullsh*t, by the way – but there is a disagreement between the two that has seemingly captivated the commentariat this week.

The Dow’s new record high in the middle of the week – plus some better-than-expected consumer confidence and jobs data – should coincide with rising bond yields as market participants adjust their expectations about the course of monetary policy. In theory, there’s no reason why continued tapering by the Fed (announced Wednesday) along with a blowout post-weather jobs report in April (announced Friday) should have led to a week-long rally in Treasury bonds.

But should doesn’t matter. It did.

And there is a debate as to why and whether this is something we should expect to continue. Long-term treasurys are up 10% year-to-date, trouncing almost all other investment markets – an outcome that even some bond bulls find themselves unable to fathom (but they’ll take it).

Ethan S. Harris and the Bank of America Merrill Lynch US Economics group took a look at this disagreement yesterday:

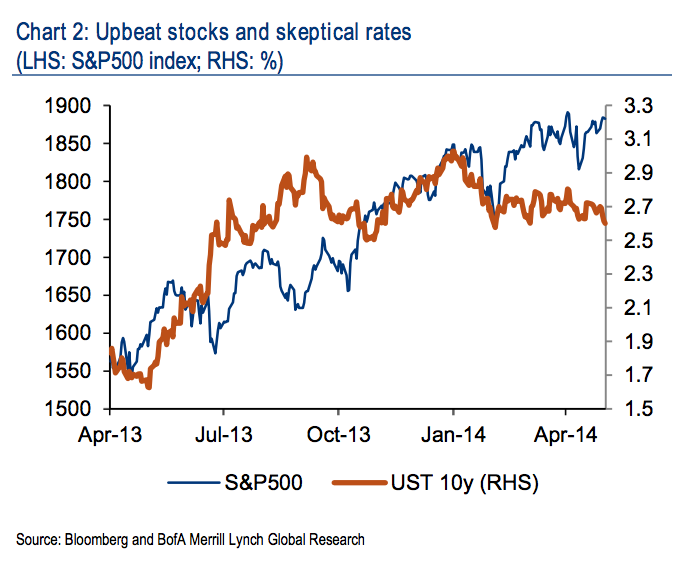

The FOMC confirmed this week that it will continue to taper asset purchases. Alongside expectations that the Bank of England will start raising rates within the next 12 months, Fed tapering epitomizes the incipient normalization of global financial conditions. Market participants, however, remain puzzled by the contrast between ebullient US equity prices and sluggish long interest rates. This is a marked change from tapering tantrum days (Chart 2).

Josh here – the explanation is that there are other factors that influence rates and bond market activity short-term – namely concerns about safety and stability that have nothing to do with current Fed expectations or economic fundamentals and everything to do with sentiment or geopolitical wariness…

Potential growth and the fiscal situation drive DM bond yields in the long run. Over the short term real yields react to growth, changes in the real money market rate, variation in inflation (nominal shocks) and changes in fiscal policy. We apply this error correction framework to US long rates, acknowledging that fundamental analysis does not account for safe-haven or risk-aversion drivers.

Whether risk-aversion is the driver here (Russia-Ukraine headlines heating up again) or there is truly residual fear about deflation, well, who really knows just yet? Veteran market watchers will tell you that when the stock market and the bond market are at odds, bet on the bond market being right.

I’m not so sure about that being such an automatic this time.

… [Trackback]

[…] Here you will find 83303 more Information to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Here you will find 61915 more Info on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/05/03/when-stocks-and-bonds-disagree/ […]