A lot of new investors assume that managing money is like golf – where Tiger Woods whips the amateur who steps out on the course with him 100 times out of 100.

But it’s not like that at all.

In investing, unlike golf, the amateur can crush the pro for an appreciable period of time. That’s one of the most wonderful things about the game and one of the most frustrating things about the game, all at once.

In addition, the professional golfer gets to keep his trophies and wins regardless of the subsequent decline in his skills. In contrast, the professional investor’s average or below-average years will dilute the benefit of his “winning” years as mean reversion knocks his lifetime track record back down to earth. Peter Lynch must have known this when he retired in 1990 at the top of his game – he left the magic intact before reality and probability could strip him of it.

Randomness and Time team up to take almost all of us down, one way or the other.

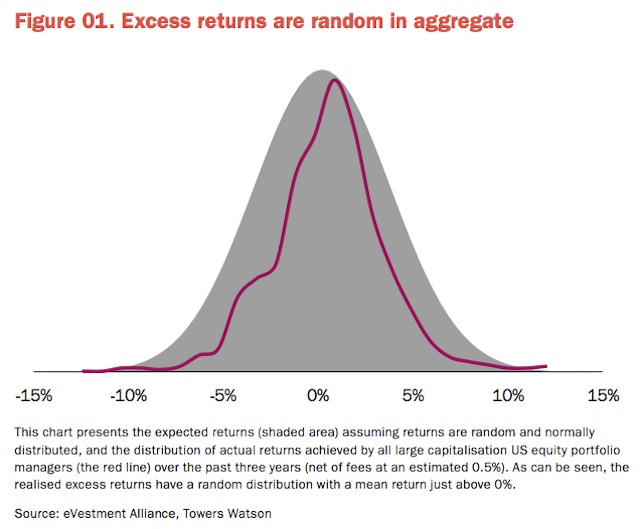

Here are three charts from a recent presentation from Towers Watson on equity investing that show this phenomenon graphically (emphasis mine):

Past performance in particular can sound a plausible basis upon which to form an opinion. This is because we are programmed to recognise patterns in nature and to extrapolate what we believe we have observed. However, studies have shown that there is a high degree of randomness in relative investment returns and that to be statistically significant, a performance record should be intact for nearly 15 years. Few investors meet this criterion. Fewer still meet this requirement and have not experienced other changes which have a direct impact on future performance, such as staff turnover or growth in assets under management which can affect portfolio construction. Consequently, we strongly believe that – considered in isolation – past performance is a poor basis for assessing investment skill.

Josh here – in other words…

Excess returns can show up anywhere, in any portfolio, and are randomly achieved in aggregate:

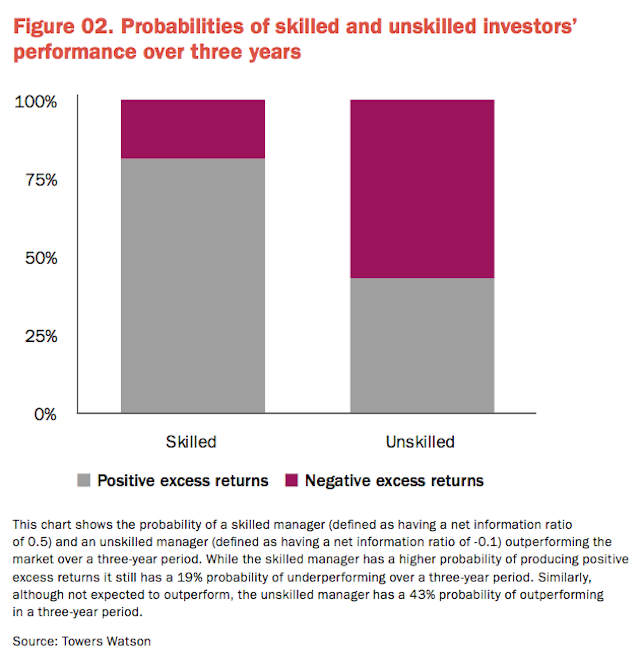

Any schmuck can hang with the pros, for a long time, and beat a skilled investor for years before his information disadvantage becomes apparent. And the skilled managers are very capable of underperformance as well, Towers Watson notes that even Warren Buffett recorded two three-year rolling periods of negative relative-performance, despite his 45-year marathon track record of outperformance:

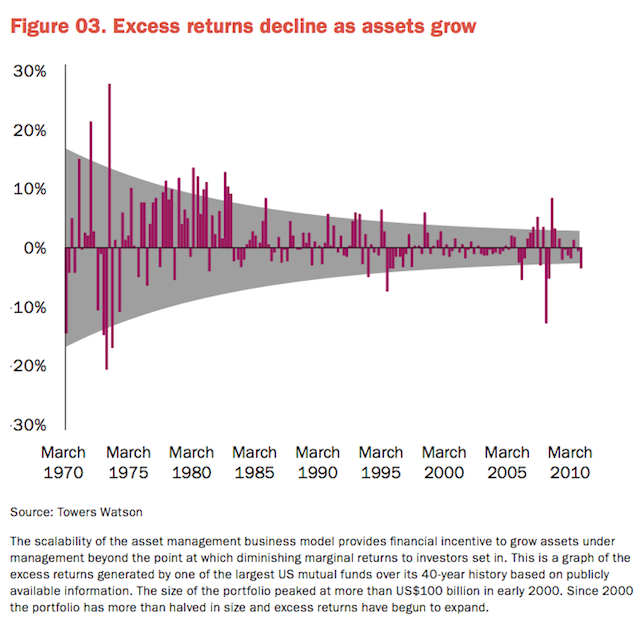

And finally, we are all, in the end, victims of our own success. Identifying a manager with durable skill and a sustainable investing process only assures one thing – that others will discover that manager as well and pour their dollars in. And then, like hearing your favorite indie band on Top 40 Radio, you’re totally grossed out and uncomfortable. And with good reason – your alpha is now dust in the wind. Nothing ruins an outperforming investor or an indie rock band like mass appeal:

After seeing these charts and this evidence of futility, you might be asking yourself the following: If anyone can win and anyone can lose at any time in the markets, why bother trying at all?

Fair question. But I submit to you that successful investing is a lifetime pursuit, and in the end, it’s the pursuit itself that offers the rewards along the way. The destination was never the thing – most of us aren’t meant to end up as Peter Lynch or Warren Buffett. No, it was what you learned on the way there that made all the difference. As the poet C.P. Cavafy reminds us:

Ithaka gave you the marvelous journey.

Without her you would not have set out.

A lifetime of outperforming the markets is unattainable for most. But a lifetime of self-improvement and the acquisition of skill and knowledge – that’s available for anyone who’s willing to go for it.

Chart Source:

Equity Investing – Insights Into a Better Portfolio (Towers Watson)

Read Also:

***

The Best and Worst Thing About Investing | The Reformed Broker http://t.co/h3CrGjDreG #RealEstate

#Investment isn’t like golf. Past #performance is no guarantee of future success. And that’s why you #diversify http://t.co/pn8huoIehW

[…] Investors understand this truth intellectually, but they don’t accept it. See here and here. […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] There you can find 89941 more Information to that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/04/03/the-best-and-worst-thing-about-investing-2/ […]

buy cialis drug

SPA