BRICs…

Russia is a geopolitical basket case – foreign investors don’t know if their investments in the country are on the brink of being nationalized. Putin plays Russian Roulette with five out of six chambers loaded, he just might be insane enough to crash his own economy to prove a point to the world. The Russian economy grew at 1.3% in 2013, has seen its population actually shrink by 10 million people over the last few years and currently pays a 10% interest rate on its sovereign bonds. Stocks in Russia were trading at 4 times earnings before the recent invasion of its neighbor, god knows where that multiple might crash to if things get wilder.

That’s the uninvestable “R” in the acronym, out for the count.

And if China sucks (and you know it does), then Brazil – which essentially exists to supply China, surely sucks even more. And indeed, it does as well.

For some perspective, the Chinese stock market is sitting two-thirds below its 2007 highs while the US, Japan and now Europe are breaking above. This is in the context of China growing their economy more than three times faster than the developed world. Brazil was the worst performing large market last year, down mid-teens percent and has already turned 2014 into yet another tragedy for the believers.

That takes care of the “C” and the “B”.

All three have been atrocious performers over the last few years both on an absolute basis and a relative basis as developed markets have broken out to upside. You’ll notice I haven’t mentioned the “I” yet. This is becasue somehow, some way, India has actually been decent.

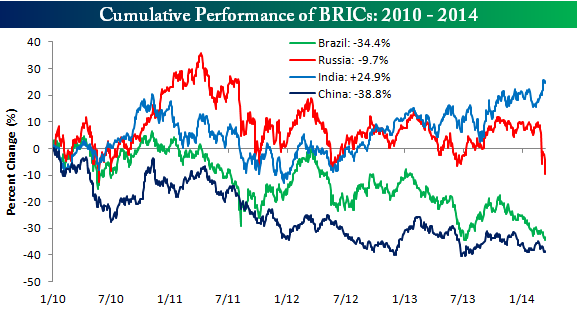

Bespoke has a chart that shows the disparity between the I and the BRC:

And that’s going back to 2010, the disparity year-to-date is just as stark. Below, you’ll see the BRIC’s index charts year-to-date with India actually up by 3% and the rest off between 5 and 25%.

So the question is, why the strength in India?

A few ideas:

1. There are other emerging markets besides the four BRIC countries they are the largest, most liquid markets in which to deploy capital and the ones least likely to raise eyebrows at an investment committee meeting (well, until recently that is, and Russia is another story). EM typically encompasses 23 countries or so, depending on whether you’re indexed to MSCI or CRSP, but the Eastern Europe and LatAm countries ex-Poland, Mexico and Brazil are quite small. If you’re market-cap weighted in your allocation strategy, as many are, it’s hard to get around the BRICs in general.

2. The problem with the BRIC concept is that it’s really a bifurcated situation in reality – the two high population commodity importers on one side (China, India) versus the two commodity exporters on the other side (Russia and Brazil). While all four had an up-and-coming place in global capitalism during the last decade, their similarities seem to fall apart quickly after that.

3. Institutional investors typically have a sleeve allocated toward “emerging markets” and it would be surprising to see them abandon the asset class in its entirety, despite the well-known reasons for the group’s underperformance. That said, it is not uncommon for institutional managers to have a range in which they can oscillate for a given investment class – say between 5 to 15% or 1 to 10%. Even still, if they commit funds to EM, India seems to be the lesser of four evils right now.

4. India is in just as bad economic shape as the rest of the developing world and their key issues – massive corruption combined with chronic poverty – are nowhere near “fixed”. However, the country’s central bank has brought in a ringer to take charge. This past September, Dr Raghuram Rajan, formerly a Finance Professor at University of Chicago’s Booth School of Business, came in to run the Royal Bank of India and get the country back on a growth footing. Possibly this is one of the factors inspiring confidence.

5. It could just be that the Chinese slowdown that economists are now more openly forecasting (some are even daring to use a 6-handle in their numbers for 2014) simply takes that country along with Brazil out of the running for consideration for the time being and that Russia is just not own-able given the headline / real risk of what international sanctions might mean. It’s down 25% this year, which is basically a crash, but this could actually get much worse. And so by default, India is your only choice as new dollars come in to be allocated – the winner by default.

India’s recent strength could very easily be just a passing anomaly and turn out to be meaningless – especially if a real global sell-off gets underway. Or there could be something to it. I’d argue it’s worth keeping an eye on and I’m open to any other theories besides mine if you’ve got one.

Read Also:

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]

… [Trackback]

[…] There you can find 83789 more Info on that Topic: thereformedbroker.com/2014/03/16/i-shares/ […]