ConvergEx looks at year-to-date ETF inflows and outflows and picks up on something rather interesting – after an incredible year in 2013, investors are now shuffling their portfolio assets back toward bond ETFs and away from stock ETFs. We’ve seen $17.7 billion go into bond ETFs since January 1st while a net $16.3 billion has come out of their equity counterparts…

What a difference 62 days makes. Consider the following:

* Year-to-date, the S&P 500 is down 0.14% on the year before imputed dividends.It has only closed with a positive YTD return three times on an end-of-day basis in 2014.

* Meanwhile, bonds prices have been resilient – especially in areas where many investors have the greatest interest. Take, for example, the five U.S. listed Exchange Traded Funds (ETFs) with the largest assets under management (AUM) dedicated to fixed income instruments. These are BND (Vanguard Total Bond Market ETF), LQD (iShares iBoxx Investment Grade Corporate), AGG (iShares Total Bond Market), BSV (Vanguard Short-Term Bond) and HYG (iShares iBoxx High Yield Corporate).

* In aggregate these products have $79 billion in AUM and are up on the year by 0.79% on average. Not bad for the underdog. And a lot better than stocks, the favorite from two months ago.

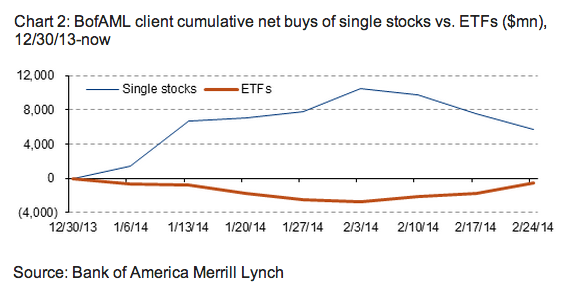

In the meanwhile, the Equity and Quant Strategy team at Bank of America Merrill Lynch chalks up the deficit for stock ETFs to the fact that investors of all stripes began showing a predilection for individual stocks in their accounts versus broad index products from the start of the year. his makes sense – the talk in the media was all about how the easy money had already been made and now we were in much more of a “stock-picker’s market”. In other words, “Dance, monkeys!”

But this is beginning to change course – volatility may have put a lid on the desire to select equities and renewed investors’ predilection for passivity…

Clients remain net buyers of single stocks but net sellers of ETFs year-to-date. But trends in flows have reversed from favoring single stocks through early February to buying ETFs and selling single stocks over the last three weeks-see the Chart of the Week below.

But the big winner so far this year – both in terms of performance and asset gathering – is not the bond market or the stock market. It’s commodities, Wall Street’s most reviled asset class by far. Here’s ConvergEx again:

Commodity oriented ETFs are up $887 million in new assets during February, after losing $25.6 billion over the last year.

We’re only two months into 2014 and already the environment is very different than the one we’ve come from.

[…] and -2.2%, respectively. And bonds didn’t fare any better, evidenced by the -1.9% decline in the Aggregate Bond ETF (AGG), over the same time period. Given the deep-seated fears about the Federal Reserve potentially […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/03/04/how-stocks-became-the-2014-underdog-trade/ […]