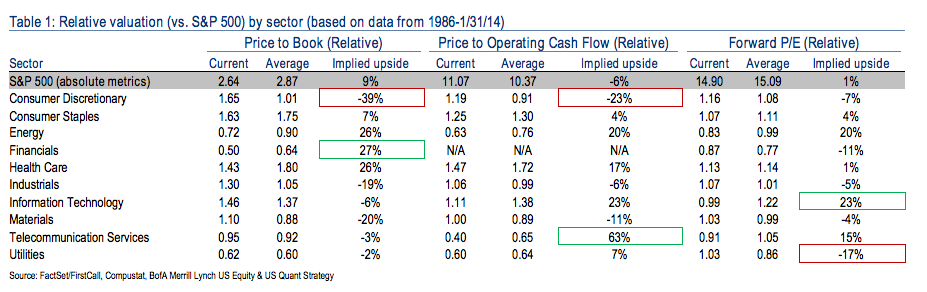

Savita Subramanian’s latest S&P 500 Relative Value Cheat Sheet came out this week and the Equity and Quant Strategist at BofA Merrill Lynch notes the following:

All ten sectors saw their absolute forward P/Es decline last

month, while the relative forward P/E increased only for Utilities, Health Care and

Tech. Utilities is now once again the most expensive sector vs. history on relative

forward P/E (eclipsing Financials); it trades at a 3% premium to the market when it

has historically traded at a 14% discount. Energy and Tech remain the most

attractive, suggesting 20% and 15% upside, respectively, just to return to average.

Subramanian also points out that Healthcare is now trading at a premium to Consumer Staples for the first time since 2006. Biotechnology stocks within the Healthcare sector have had a lot to do with that. The report says that Biotech is now selling at a 60% premium to the S&P 500 on a forward PE basis – which is double the premium it has historically traded at.

In the chart below, some relative valuations by sector within the S&P 500 along with implied upside / downside on three metrics:

(Click to Embiggen)

Source:

S&P 500 Relative Value Cheat Sheet

Bank of America Merrill Lynch – February 13th, 2014

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] There you can find 55822 more Information to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] There you can find 62603 more Info to that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/02/15/sp-500-relative-value-by-sector/ […]