I’ve spent a bunch of my day going through what my friend Meb calls the “best research report of the year,” The Credit Suisse Global Investment Returns Yearbook for 2014. The centerpiece of the report is a reconstruction of all stock returns for both Emerging Markets and Developed Markets going back to 1900 by three of the best data scientists in the field. In terms of the conclusions we can draw from their findings, it is a veritable embarrassment of riches.

I’ll have more insights from it later, but I thought this tidbit was really interesting, about how GDP growth rates for a given EM country affect (or do not affect) the performance of its stock market.

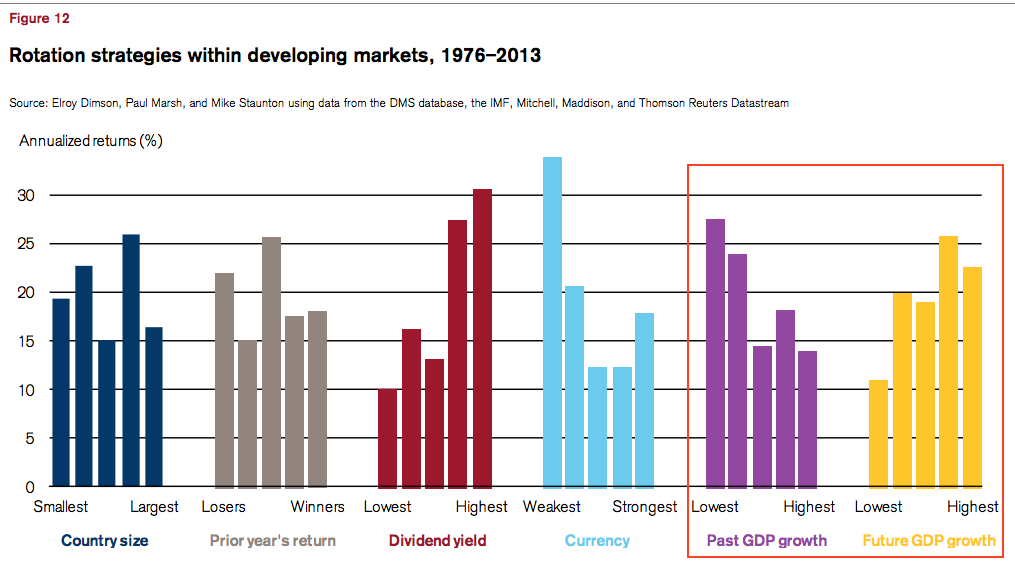

Here’s what we learn from the authors of the study, Elroy Dimson, Paul Marsh and Mike Staunton (London Business School)… I direct your attention to the yellow and purple graphs at right in the chart below, I’ve drawn a red rectangle around them.

These tell us about country stock market returns based on both five-year backward looking GDP growth rates (purple) as well as five-year forward looking GDP growth rates (yellow). You’ll see that countries in the lowest quintile of historic growth rates massively outperform those with the highest. This is totally counterintuitive but undeniable as well – a recent example would be the resurgence of the Greek stock market, which has actually taken place in the aftermath of an outright economic contraction. The study says that the stock market performance differential between the historically slow-growers vs the fast growers is 28% to 14%, a massive gap and a completely opposite outcome of what most people would assume.

So does this mean that emerging market economic growth rates are unimportant? No – in fact, just the opposite. They are supremely important on a forward looking basis and if we actually possessed that data, it would be “invaluable”. As you can see, those countries with the fastest economic growth ahead of them also had the best performing stock markets in hindsight. This added up to an annualized return premium in excess of 10% vs the slower growth countries (see the yellow bars above).

Alas, we can no more forecast the economy of an emerging market country five years out than we can guess at our own. As the authors themselves state, “This strategy is sadly not implementable, except by a clairvoyant who had perfect forecasting ability relating to future GDP growth.”

Source:

Credit Suisse

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Here you will find 35666 more Information to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Here you can find 88093 additional Information to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] There you can find 84582 more Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] There you will find 38276 additional Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/02/13/em-investing-past-gdp-meaningless-future-gdp-invaluable/ […]