361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

October 7, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“We are winning…It doesn’t really matter to us” how long the shutdown lasts “because what matters is the end result.”

(WSJ)

Washington would also like to pressure the financial markets to increase the intensity on negotiations…

President Barack Obama and his top economic officials appear to be pushing for some market unrest to exert pressure on the GOP to throw in the towel. Asked in his CNBC interview Wednesday whether Wall Street is right to remain calm over the standoff, Mr. Obama replied: “No.”

“I think this time’s different,” he said. “I think they should be concerned… When you have a situation in which a faction is willing potentially to default on U.S. government obligations then we are in trouble. And if they’re willing to do it now, they’ll be willing to do it later.”

(WSJ)

Maybe Mark Twain said it best…

“No man’s life, liberty, or property are safe while the legislature is in session.”

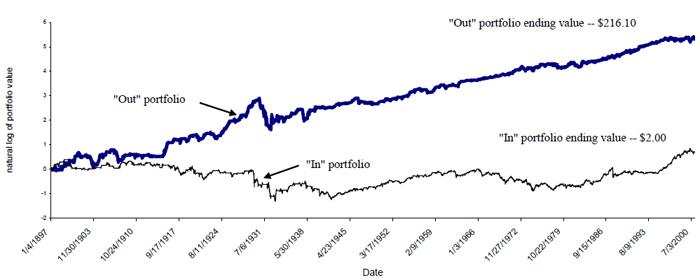

Not sure who is winning the cat fight in D.C., but the raw data shows that Equity Bulls would side with Samuel Clemens…

We find a strong link between Congressional activity and stock market returns that persists even after controlling for known daily return anomalies. Stock returns are lower and volatility is higher when Congress is in session. This “Congressional Effect” can be quite large—more than 90% of the capital gains over the life of the DJIA have come on days when Congress is out of session. The Effect varies systematically with the public’s opinion of Congress: returns are lower and volatility higher when a relatively unpopular Congress is active. Public opinion appears to play a fundamental role in market prices. This is consistent with a mood-based explanation that sees Congress as ‘depressing’ the average investor. Alternatively, our results can also be reconciled with rational explanations that view Congressional activity as a proxy for regulatory uncertainty or rent-seeking behavior.

(Ferguson/Witte)

Portfolio Returns When Congress is In-Session vs. Out-of-Session for the Dow Jones Industrial Average: The “Out-of-Session” strategy is the cumulative return to a strategy that invests $1 in the DJIA on days Congress is not in session and in cash (earning 1 basis point per day) when Congress is in session. Conversely, the “In-Session” strategy invests in the market index on days Congress is in session and in cash on days Congress is out of session.

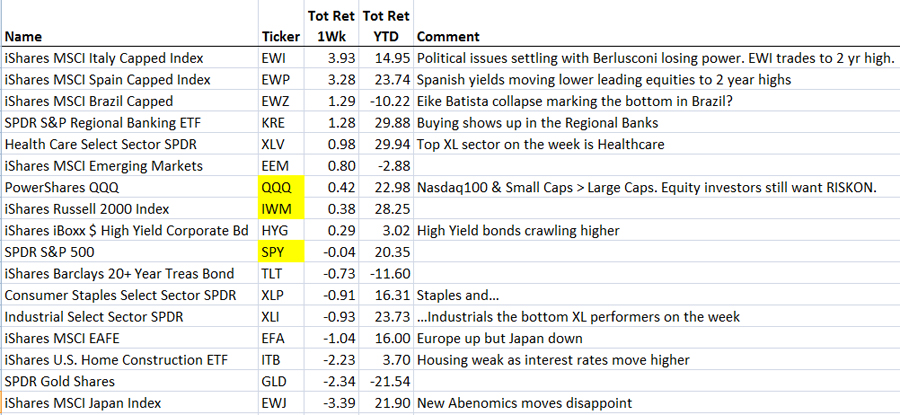

Could Italy breaking to new highs on the political fix in Milan be a precursor to the moves in the U.S. markets if a deal is completed in Washington?

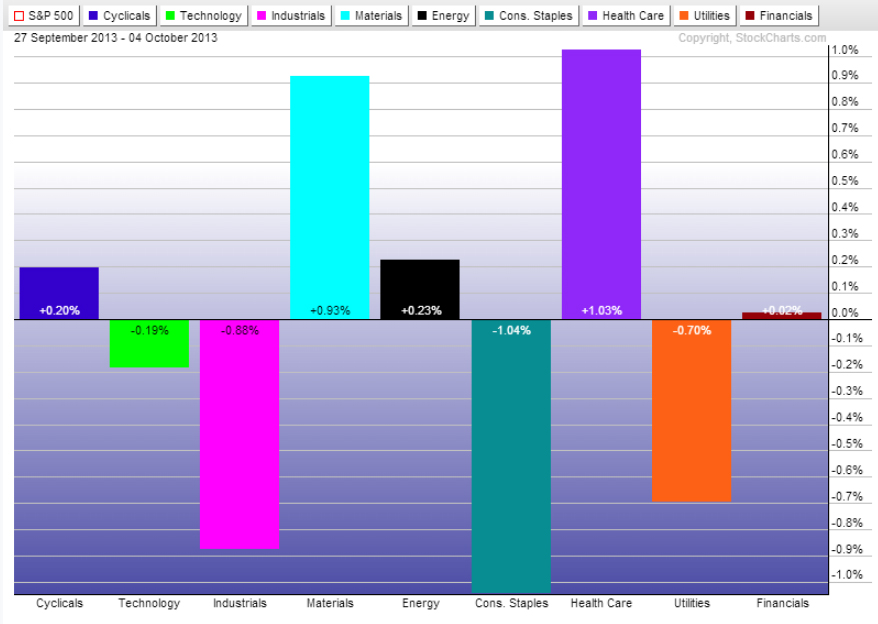

For the week, the S&P500 was flat with plenty of daily moves and some sector rotations…

Among global equities, a RISK appetite was still present with weak Europe, Brazil, Small Caps gaining while Japan, Gold & Bonds fell…

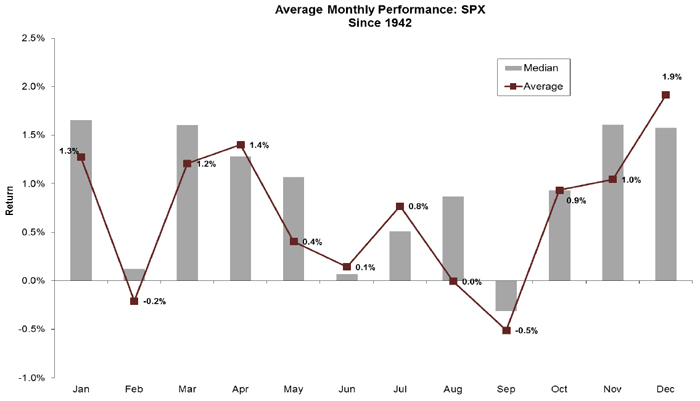

Another look at the monthly historicals as we enter the best quarter of the year to be invested in equities…

(RenMac)

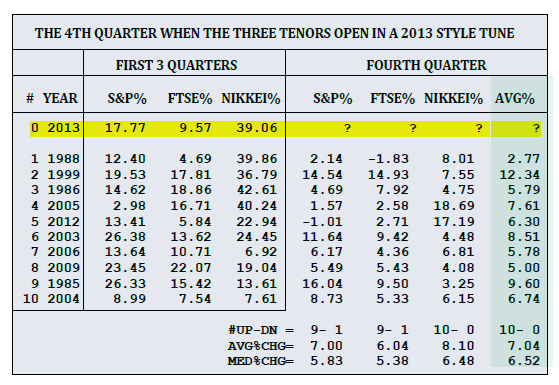

Even more interesting is to note that previous global equity strength leads to even further Q4 gains…

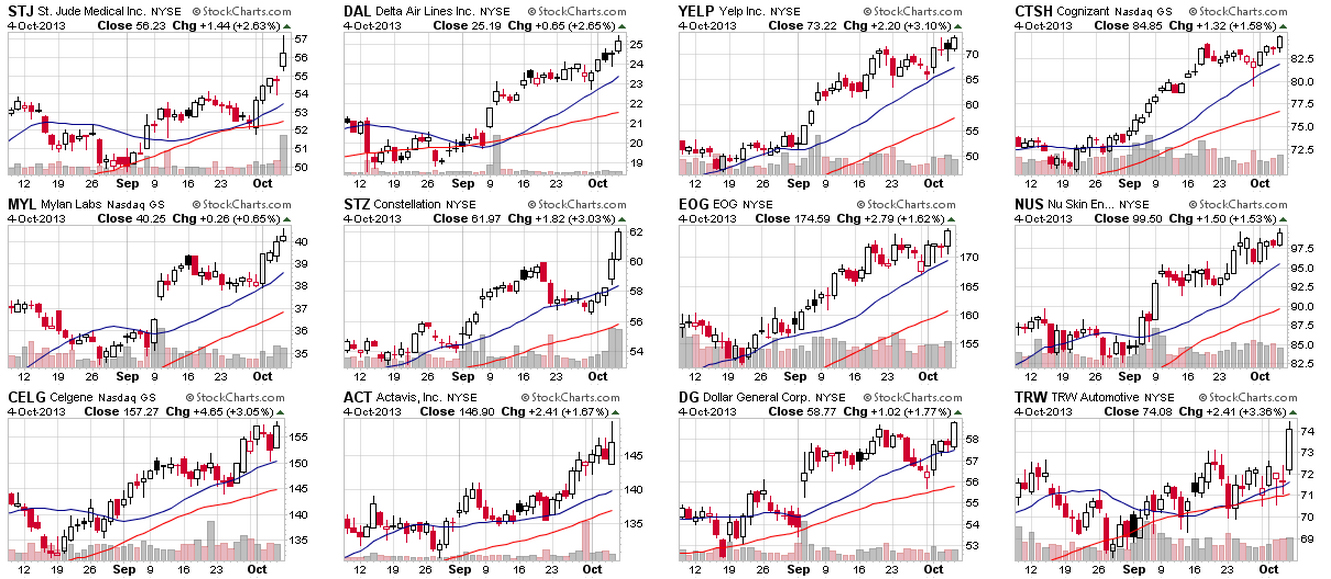

Speaking of market breadth, isn’t this just the most random assortment of stocks hitting all-time highs?

Meanwhile, the market heads into the October earnings reporting season. Did the global powerhouse, Nike, already set the mood for what the season has in store?

The bad news is that analysts aren’t expecting growth to pick up too much in the third quarter. Thomson Reuters estimates that earnings will increase just 4.9% in the third quarter, which would be the 10th consecutive quarter of sub-10% growth. “It will be difficult to generate interest from investors with growth so low,” notes Pierre Lapointe, head of global strategy and research at Pavilion Global Markets. The good news is that expectations are low. Management has spent the previous three months telling analysts that their profit forecasts were too high—there have been more than three times as many companies guiding estimates lower than higher, and now the predictions are far more plausible, says Adam Parker, chief U.S. equity strategist at Morgan Stanley. In fact, an early preview from companies releasing before Tuesday has been surprisingly good. Of the 17 companies that reported through Sept. 27, six beat earnings, eight met expectations and just three missed. And earnings have topped forecasts by 3.3%, the largest for this group since the fourth quarter of 2012. “Earnings should be OK and remind people U.S. companies are in good shape,” Parker says. “That should be supportive for stocks.”

(Barron’s)

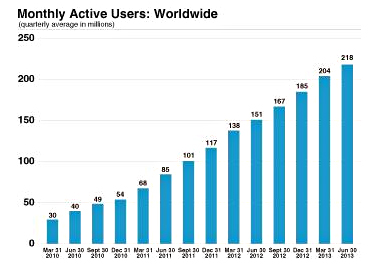

Speaking of growth… Twitter files its IPO…

If you are looking for help in valuing the company, Prof. Damodaran has built you a model framework with his thoughts…

Having learned from the Facebook fiasco, I expect the bankers and the company to make the Twitter IPO a smoother offering. That process will of course start with the road show, where they will package the company like a shiny new present, and unwrap their “offering” price. I am sure that Goldman’s bankers, working on this deal, are a capable lot and will price the stock well, with just enough bounce to make those who receive a share of the initial offering feel special. As I watch the frenzy, I have to remind myself of two realities. The first is that there will be lots of distractions (like this one) during the IPO, most designed to take my eye off the ball. The second is that the bankers have their own agenda, and I cannot make the mistake of assuming that it matches mine. Watching out for my interests, here is how I see Twitter: at a $6 billion market cap ($10/share), I think it is a very good deal, at $10 billion ($17.5/share), I am indifferent to it, and at $20 billion ($35/share), it is a moon shot. Could I be wrong? Of course, but I would rather be transparently wrong (hence the long blog post detailing every assumption that I made) than opaquely right.

(AswathDamodaran)

One firm has just put out their price target…

TWTR – Twitter initiated with a BUY at Suntrust Robinson Humphrey. Price target = $50.

Also worth reading who is using Twitter and why…

If Twitter had never existed, Facebook would still have eventually adopted its News Feed; blogs and RSS would probably have expanded; and maybe Google+ would have been a stronger competitor. But we would feel no aching Twitter-shaped void in our world. Twitter was always surprising, always the dark horse, always counterintuitive.

Hell, it’s still counterintuitive. I was talking to friends of mine not so long ago, both of whom are smarter than me (and better writers too) but who still fundamentally don’t get Twitter’s appeal. Of course they don’t. I didn’t either, until my sister somehow talked me into signing up for it five years ago. Thanks, Jen. Now I’d prefer not to imagine life without it.

To an extent Twitter is like the elephant examined by blind men, different things to different people. To me, at least, it’s where I simultaneously bookmark links of interest, keep track of scores of my friends’ lives, converse with those friends without knowing or caring where they are, share pictures and articles with them and with hundreds of people I don’t know, do research (“Dear LazyTwitter…”), and follow a small number of interesting people and/or news filters I’ve never met.

Of course I could do all these things elsewhere; but the whole appeal of Twitter is that I do them all at the same time, in the same place, with terse brevity. For me it’s like being able to dive into a sparkling river of (usually) witty, pithy, gem-laden conversation whenever I want to, engage with it however I like, and leave again at my leisure. People say we live in the attention economy; well, Twitter offers some of the best value-for-attention you can get. Like everybody else at first I thought that famous 140-character limit was a flaw. Now, though, I believe it’s their finest feature.

(TechCrunch)

Most importantly, look at who Twitter is displacing…

- @gailmarksjarvis: Trouble for newspapers: It’s Sunday & as i walk thru halls of upscale NY apt building there are no New York Times in front doors. (Chicago Tribune’s syndicated financial columnist)

- Matt Wilstein of Mediaite reports that business news channel CNBC just had its worst quarter in 20 years in terms of ratings. Wilstein writes, “The network hit a 20-year ratings low in the coveted 25-54 demo over the last three months. With just 38K viewers in the demo for total day, the network had its worst ratings since the first quarter of 1993. That figure was also a 24% drop from Q3 2012 when CNBC had 50K in the demo for total day. “While not as dismal, the numbers for total viewers were not that much better. With 133K total viewers in total day, CNBC had its lowest quarter since Q2 2005. It was a 19% drop from last year when the network had 164K total viewers in total day.

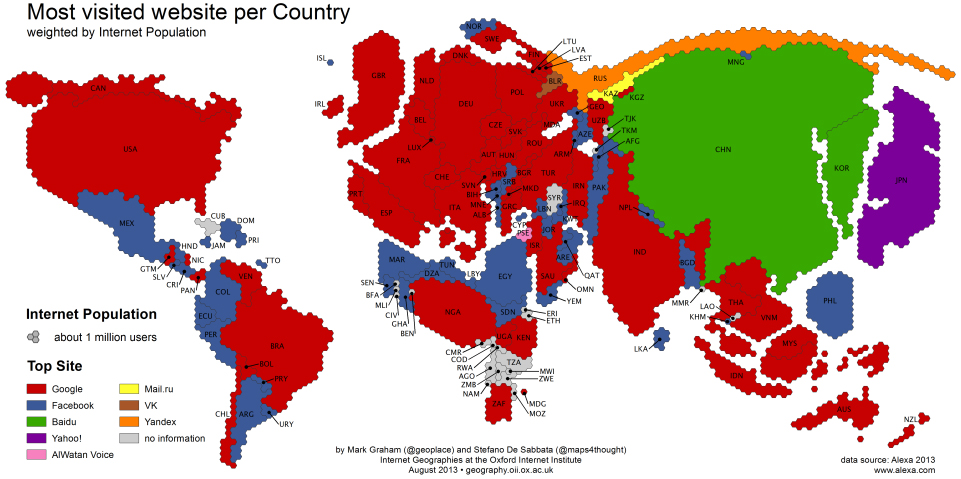

Back to the internet, this is a great chart. Own Google, Facebook, Baidu & Yahoo and you have the world covered…

Speaking of Google and their efforts to hijack your TV…

@RichBTIG: Google’s Chromecast is the #1 Best Selling Electronics Product on Amazon in the US

BTIG

Speaking of non-tech growth, the 10 year rise of gambling in Macau has been incredible…

Macau has grown at light speed since the former Portuguese territory in 2002 abandoned a monopoly system that gave one concession to the tycoon Stanley Ho. Last year, gaming revenues from the six companies with casino licenses – Sheldon Adelson’s Sands China; Wynn Macau; James Packer’s Melco Crown; Mr. Ho’s SJM, Galaxy; and MGM China – reached $38bn, making Macau six times bigger than Las Vegas. CLSA expects that number to double to $77bn by 2017…

Macau’s gambling industry has been propelled by an influx of Chinese tourists. China bans gambling on the mainland, but allows its citizens to visit Macau every three months under a special visa program. Gamblers can also bypass visa restrictions by joining special tour groups. According to the Macau government, the number of mainland Chinese tourists increased 45 percent from 11.6m in 2008 to 17m last year.

(FinancialTimes)

Sports geek story of the week…

Bet me. No QB in the NFL is more accurate, goes deeper or is more effective than the Colts’ Andrew Luck. And that’s just his vocabulary. Wednesday, for instance, in a single half hour, he got in “vociferous” (re: loudmouth, loud-playing Seattle cornerback Richard Sherman, who brings undefeated Seattle to Indy Sunday), “cognizant” (was he aware of big moments as he’s making them? no, he wasn’t), and “implemented” (he was glad to see some more running plays being “implemented” into the Colts’ game plan.)

A 3.48 GPA at Stanford in environmental engineering will do that to a person. “The other day he used ‘paucity’ on us,” says his backup, Matt Hasselbeck. “And ‘chutzpah.’ How many people in this locker room even know what chutzpah is?” “The guy just comes at you all day long with the SAT words,” punter Pat McAfee complains. “I tell him, ‘You know I’m dumber than you. You don’t have to rub it in all the time.'”

(ESPN)

An incredible stat to challenge your kids with this week…

@Alcoa: ~75% of aluminum ever produced since 1888 (when Alcoa invented the industry) still in use today.

We had snow in the Rockies last week combined with a turn in the Aspen leaves. Here is a shot of the Maroon Bells, which is one of my favorite places on Earth…

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Here you can find 40554 more Info on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Here you can find 6205 more Information on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/10/10/361-capital-weekly-research-briefing-59/ […]

can i buy cialis online

Generic for sale

cost of cialis without insurance

Generic for sale