LPL Chief Strategist is out with a clever note pointing out the similarities between fall 2013 and the 1967 environment. Slightly off topic – Jeff is speaking on a panel at our Big Picture Conference on Tuesday, October 8th.

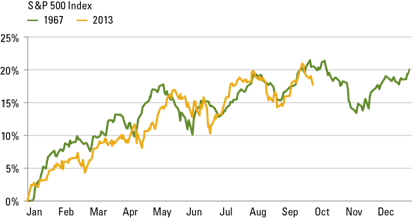

As we wrote last week, the stock market pullback is part of the “kick-the-can” pattern we have seen numerous times this year ahead of a resolution to “kick the can” on various issues to a future date. This is driving market volatility and a pattern of performance this year that echoes 1967, a year when:

- · Republican lawmakers voted down a debt ceiling increase (before they later passed it);

- · Syria was involved in a war;

- · Bond yields rose (most notably from April to August when the 10-year Treasury note rose about one percentage point);

- · Gross domestic project (GDP) averaged a lackluster 2% in the first half of the year;

- · Earnings per share growth for S&P 500 companies was roughly flat on a year-over-year basis; and

- · The United States won the America’s Cup with a sweep.

Figure 1: Stocks Continue to Track 1967’s Pattern

S&P 500 Index 1967 and 2013

Source:

The Comeback

October 1st, 2013

LPL Financial

Read Also:

Ten Reasons Why You Must Attend The Big Picture Conference (TRB)

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/10/01/jeff-kleintops-1967-analog/ […]