361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

September, 2 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Here come the Tomahawks…

NATO statements:

- “The Syrian regime maintains custody of stockpiles of chemical weapons. Information available from a wide variety of sources points to the Syrian regime as responsible for the use of chemical weapons in these attacks.”

- “This is a clear breach of long-standing international norms and practice. Any use of such weapons is unacceptable and cannot go unanswered. Those responsible must be held accountable.”

Secretary of State John Kerry:

“This crime against conscience, this crime against humanity, this crime against the fundamental principles of international community. This matters to us. It matters if nothing happens.”

President Obama:

- “This attack is an assault on human dignity. It also presents a serious danger to our national security.”

- “We lead with the belief that right makes might. Not the other way around. Now’s the time to show the world that America keeps our commitments.”

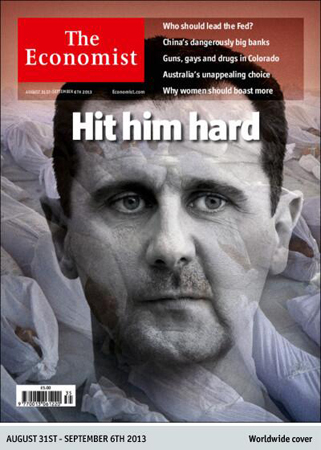

Even The Economist:

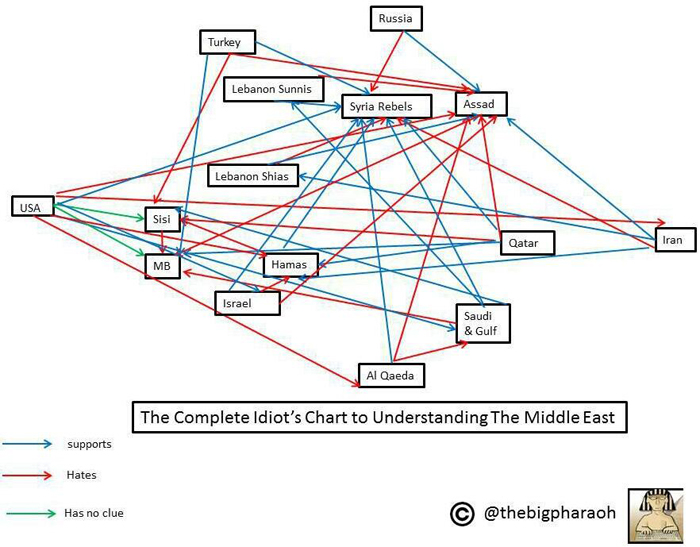

So with the backing of The White House, the State Department, the Senate & The Economist, the United States is going to launch Tomahawks on Syrian targets. The President did say that he will let Congress vote on a strike, but both he, Secretary Kerry and Senator Reid let it be known that they will be lighting fuses soon. So as a refresher as to who is supporting whom in Syria, the chart below will both assist and thoroughly confuse you…

(via @washingtonpost)

JPMorgan’s take on this weekend’s events also highlights that this will not be resolved quickly…

Obama surprised the country (and apparently his advisors) when on Saturday he announced plans to seek Congressional authorization for a strike on Syria. The decision prompted a ton of analysis over the weekend (some praised the move, while many others criticized it and some went as far to call it a catastrophe), but as far as the markets are concerned the resolution will only delay, not derail, a likely Syrian strike. Obama has his work cut out for him as he attempts to persuade Congress (although it looks like the original resolution sent to Capitol Hill will wind up being redrafted to narrow the scope of Obama’s mandate), but it looks like passage will occur (the Senate will be a lot easier than the House). As far as timing, the Senate will hold some hearings this week (week of 9/2), but the House doesn’t get back until next week (week of 9/9) so many don’t think a vote will take place until 9/12 or 9/13 at the earliest. (JPMorgan)

So what will this do to the investing landscape for the month of September?

The markets spoke last week after Secretary Kerry made it clear that while boots will not be on the ground in Syria, every bird, eagle, and hummingbird will be going in. So let me quickly summarize the fun that we have lined up for the markets in September:

- Syrian target practice

- The Fed’s 1st performance of ‘The Taper’

- Congressional scrimmaging over ‘The Debt Ceiling’

- The White House’s confirmation of Larry Summers as Treasury Secretary

- The impact that the Strong U.S. Dollar and High Oil prices are having on the globe’s Emerging Markets for the month

So step right up, pick your favorites and roll the VIX dice! Place your bets on VIX 12, 20 or both in September…

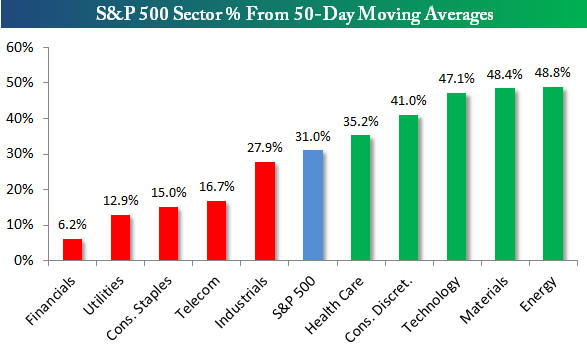

If you are LONG equities; don’t look at this chart on a full stomach. It is the ugliest one on my board…

While the banks should benefit from the steepening yield curve, rising worries over a collapse in housing/mortgage biz have hurt, as well as the government’s daily lawsuits against past activities at the majors. Banks need the economy to continue forward and show lending growth at higher rates of interest than Treasuries and the stocks should recover. If they don’t, then U.S. Equities will get a ball and chain to drag around…

Bespoke also notes the unhealthiest sector in the charts is the Financials…

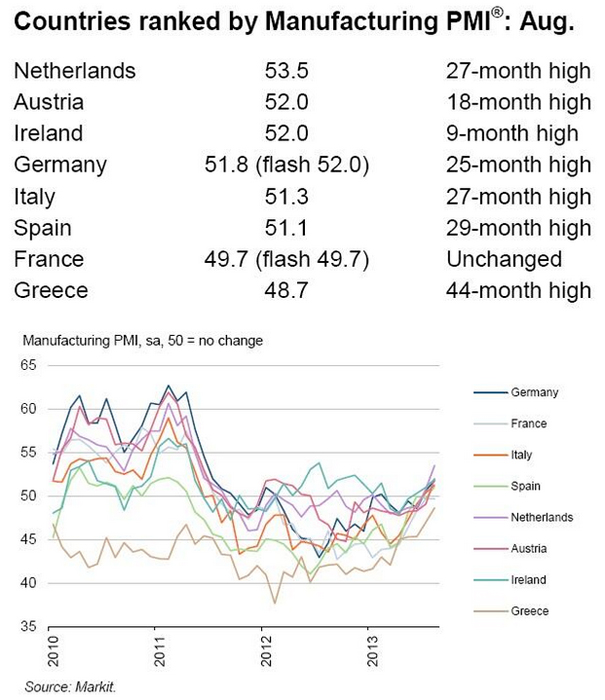

While your Labor Day meats were marinating overnight, Europe put up another very solid month of PMI gains…

So while the Equities have been under pressure due to Syria, maybe it will give your managers another chance to increase their exposure. Check out that 51.1 in Spain which signals further expansion…

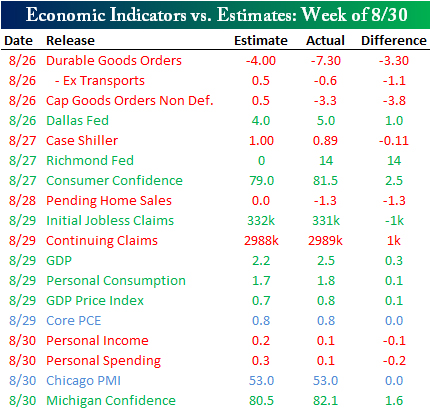

In the U.S. last week, it was a mixed bag…

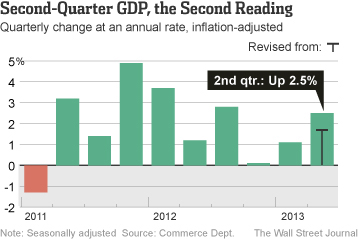

Of much interest was the better than expected revision in Q2 GDP…

Goldman Sachs also noted one of its forward-looking data points has ticked up…

The forward-looking new orders index jumped 28.5 points to 76.6 in August from 48.1 in July. This was the largest one-month gain since the inception of the GSAI, putting this component at its highest level since January 2011. While we would not take this improvement at face-value given the high month-on-month volatility and a contrasting slowdown in the analogous component of the Empire State and the Philadelphia Fed surveys, this increase did reflect a broad pickup in orders. The improvement in the new orders index outpaced that of the inventories index, and the orders less inventories gap consequently rose to +20.7 versus roughly flat over the past three months. The backlog index also rose sharply in August to 74.8. (GoldmanSachs)

To recap the September markets…

Markets had their worst month since May 2012, as many uncertainties exist entering September. We face issues with emerging markets, Syria, Fed tapering, and the German elections. Next week we see the monthly employment report, a key piece of data the Fed will be assessing in making their decision on September 18th. The VIX hit a high of 17.81 this past week. During the last few corrections, we saw the VIX hit its 200-week moving average (which is now 20) before the corrections were over. 75.4 percent of the SPX names are above their 200-week moving average, versus 75.8 percent in June when the SPX was 68 points lower at 1,565. This means fewer stocks are leading and holding up the SPX. The Dow has acted the worst among the major indices, down 4 straight weeks and just 250 points off the June lows. The NASDAQ has acted the best, and is still above its 50-day moving average, and 200 points higher than June lows. NASDAQ is being helped by biotech, which continues to hold near highs.

(FusionMarketSite)

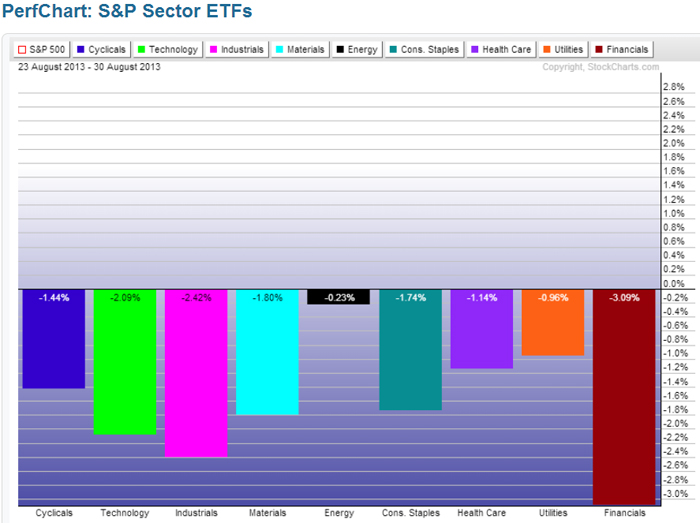

For the Week, all S&P sectors showed losses…

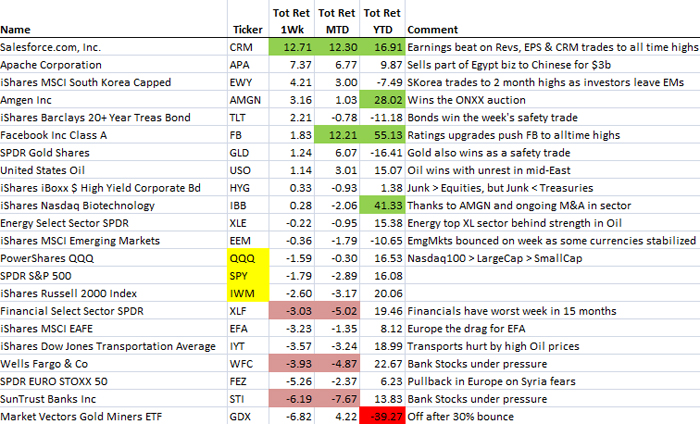

It was a RISKOFF week with Bonds, Gold, Oil, and Facebook outperforming, while Banks, Europe, SmallCaps, and Transports lagged…

A Fiduciary’s must read of the week…an interview with Cliff Asness…

Barron’s: What kind of a return can investors expect using a traditional portfolio of 60% stocks and 40% bonds?

Asness: This is U.S. stocks and bonds, but it’s not that different if you do it globally. Historically, we think about real returns, and that 60-40 portfolio has delivered about 5% per annum over inflation over the long term. However, passive investors now would be better off to assume about a 2.5% real return, which is still positive and still going to beat inflation. But using valuation metrics alone can make for a lonely, long, and sometimes sad ride if one is trying to beat the market. The market can stay overvalued or undervalued for long periods, and valuation isn’t the only factor in the shorter term. But these metrics can help set long-term expectations, such as calculating how much to save.

(Barron’s)

Meanwhile, a Bond Giant gathered some skepticism for its move into Alternative investments away from its core strength…

If you have been seeking unequivocal proof that the 30 year bull market for bonds is over, look no further than this WSJ headline: Bond-King Pimco Plans to Push ‘Alternative Funds’. Think about what this means: From 1980 to 2013, PIMCO enjoyed three decades of rising bond prices — read falling interest rates — and accumulated a massive pool of over $2 trillion in assets under management (AUM). Founded in 1971, the firm rode the bond Bull better than anyone else. The bond bull also led them to manage the world’s largest mutual fund, their Total Return Fund, which has amassed $242.7 billion in assets. To me, the fact that PIMCO is embracing alternative investments signals the end of the bond bull market. While some folks may want to blame a change in culture due to Allianz acquiring PIMCO, let me remind you that was almost 14 years ago.

(Ritholtz)

And other Giants are moving quickly into Alternatives…

Pimco isn’t alone in expanding its alternatives business. Fidelity Investments, the country’s second-largest mutual-fund company, has recently backed two liquid alternative funds. The company invested $1 billion of client funds in Blackstone Group LP’s first mutual fund, which gives money to hedge-fund firms to invest. Fidelity also put investor money into a fund launched by Arden Asset Management in 2012. A Fidelity spokeswoman has said the funds will provide investors diversification and portfolio resilience.

(WSJ)

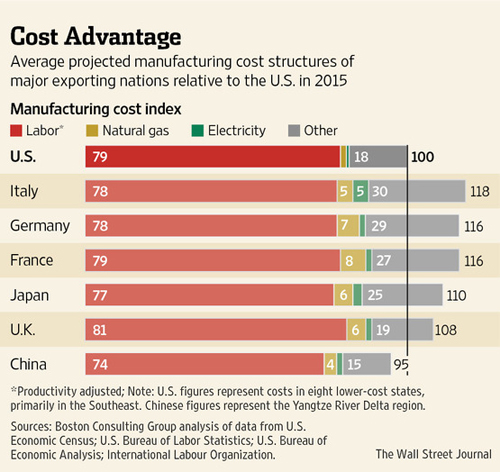

Back to the U.S. Economy, this push into shale will help the U.S. to take manufacturing jobs back from overseas…

Last week, the group published its latest report, which details how declining energy costs — the result of the shale boom — are giving the U.S. a greater competitive edge globally. “The trends are accelerating,” Mr. Sirkin says. U.S. manufacturing is becoming so cost competitive, Boston Consulting says, that by the end of the decade it will grab away $70 billion to $115 billion in annual exports from other countries — products that will be made in the U.S. and shipped abroad. The losers: chiefly Europe and Japan. Add to this some manufacturing that will be “reshored” from China, and the U.S. could gain up to five million new jobs, including service jobs, the group forecasts.

(WSJ)

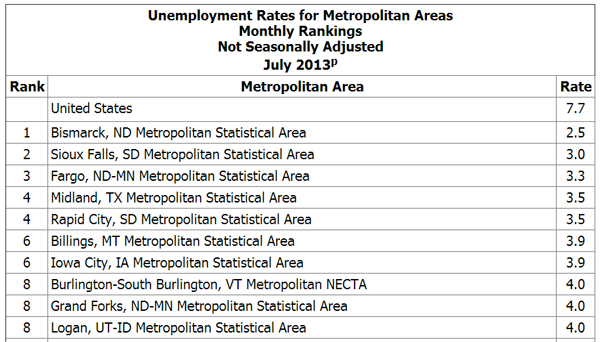

And the development of shale resources is being seen in the City level Unemployment data…

And which State isn’t envious of North Dakota’s bounty?

A savings account North Dakota created to preserve a portion of its oil and natural gas tax dollars for the future has exceeded growth estimates in its first two years and could swell to $3 billion by the time state lawmakers decide how to spend it… This type of windfall is unthinkable in most states, which bring in little tax revenue from natural resources. But mineral-rich states like North Dakota can afford to set up special trust accounts tied to generous revenue from energy taxes, often called severance or extraction taxes, or from money they get from oil and gas royalties and leases. In this way, states safeguard a portion of the riches they enjoy today from a resource that will likely run out in the future.

(TheFiscalTimes)

The #1 financially fit U.S. State is even making waves on the gridiron…

North Dakota State stuns Kansas State 24-21

Regarding the fast food strikes last week, how long until McDonald’s franchisees buy a few thousand of these burger machines…

We will launch the first restaurant chain that profitably sells gourmet hamburgers at fast food prices. Our current device can pay for itself in less than one year, making equipment sales a second path for us. Our current machine can be used in other restaurants, convenience stores, food trucks, and even in vending applications.

Our next revision will use gourmet cooking techniques never before used in a fast food restaurant, giving the patty the perfect char but keeping in all the juices. It’s more consistent, more sanitary, and can produce ~360 hamburgers per hour. The labor savings allow a restaurant to spend approximately twice as much on high quality ingredients and the gourmet cooking techniques make the ingredients taste that much better.

(MomentumMachines)

And for those who travel often for work and who hate junk mail, you might look into this new service if you live in Austin or San Francisco. I have heard good things from my Austin friends…

Outbox, which Baehr describes as “Dropbox for snail mail,” launches citywide in San Francisco today after six months of beta testing. An Outbox “Unpostman” will pick up your mail three times a week, and digital scans made in a secure warehouse are accessible via app on the web, Android, and iOS. If you like, you can even have some physical mail re-delivered. This arrives in one to two days, the company says… At the same time, Outbox may be the most efficient way yet devised to avoid once and for all the delivery of corporate marketing propaganda to your door. (Wired)

Hope that you had a great final dive of Summer. See you back in the saddle on Tuesday.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Here you will find 11335 additional Info on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]

… [Trackback]

[…] Here you will find 81749 more Information on that Topic: thereformedbroker.com/2013/09/03/361-capital-weekly-research-briefing-55/ […]