Savita Subramanian’s ‘Equity Client Flow Trends’ report from Bank of America Merrill Lynch has become one of my favorite regular reads. It gives you solid insight into what each of the four layers of investors are thinking and doing, despite what they tell the surveys. Subramanian’s quant strategy group looks at the net activity throughout the firm to compile the data and then parses it for interesting trends.

This morning, we learned that:

After capitulation, institutions join private clients in net buying

After near-record net sales by institutional clients in mid July, and following five weeks of outflows, institutions became net buyers of US stocks this past week. Flows at extremes can signal a shift in trends, as late last year we saw capitulation by private clients which preceded two months of net buying in by this group.

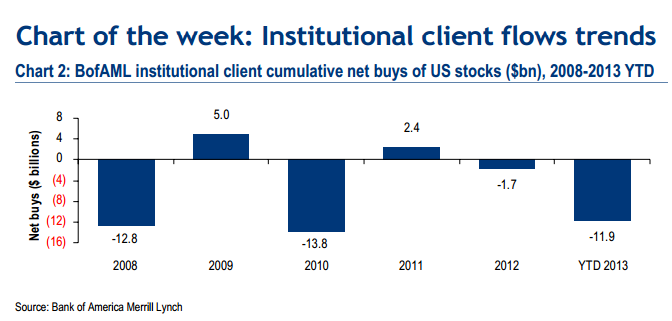

And outflows by institutional clients YTD are now approaching full-year 2008 and 2010 levels, after which they were net buyers in 2009 and 2011.

Private clients—who tend to exhibit the stickiest flow trends of the three groups—were net buyers last week for the ninth consecutive week. While their inflows were chiefly due to ETFs, five of the ten GICS sectors still saw net buying by this group last week. Private clients have largely shunned single stocks over the last several years, and in our view, continued purchases of single stocks would suggest ongoing confidence in the bull market. Overall, BofAML clients were net sellers of US stocks last week for the third consecutive week, though the amount (-$843mn) was muted relative to previous weeks. Hedge funds drove overall net sales, and have been net sellers of stocks for the past three weeks.

By “Private Client”, they’re referring to the high net worth retail accounts at Merrill. Institutions is inclusive of pension funds and endowments.

BAML also notes that on a YTD basis:

Institutional clients became net buyers last week following near-record outflows in mid July. In fact, cumulative net sales by this group YTD have now approached 2008 and 2010 levels. This capitulation could signal a turning point in flows from this group, as in the years following 2008 and 2010, institutional clients were net buyers of US stocks.

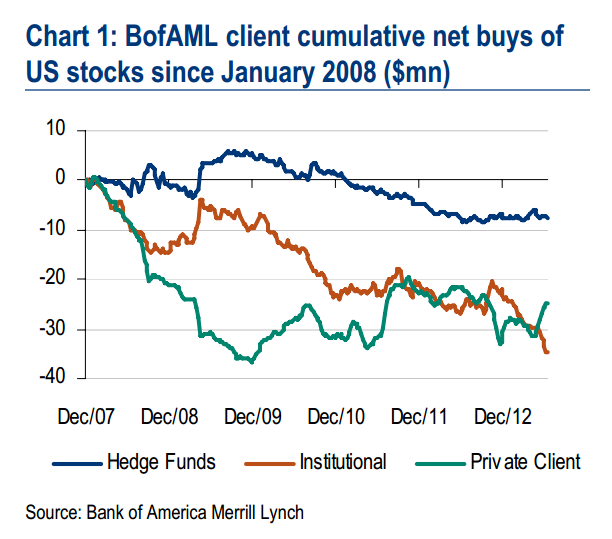

Also, a look at net flows into equities since 2008 – still negative!

Source:

Institutional clients buy US stocks for first time in six weeks (Bank of America Merrill Lynch)

… [Trackback]

[…] There you will find 71926 more Information on that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] There you can find 74829 more Info on that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Here you will find 10939 more Info to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Here you can find 53529 additional Information on that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/30/baml-capitulation-stock-buying-by-institutions/ […]