Gun to my head – I had to pick a single non-US stock market to be invested in for the next ten years and I cannot touch the money in between, which one would I pick?

I don’t even need to think twice about it, the answer is Brazil.

I would be shocked if, by the mid-point of 2023 ten years from now, this country hasn’t become an economic powerhouse. Of course, things can happen politically that may get in the way of that, but that’s investing, that’s life.

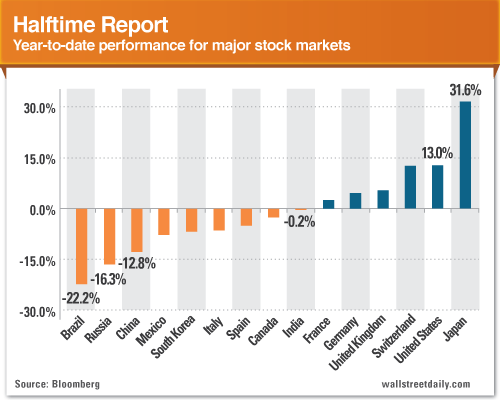

Brazilian stocks are mired in the midst of a bear market that began in 2007 and have given back more than half of their gains from the 2009 global lows. Some perspective in the chart snapshot below:

Brazil (along with all of Latin America and most of the emerging markets) has been a horrendous stock market over the last three years.

After doubling in 2009, the IBOVESPA index began to sag the following year. Brazilian stocks are down 25% over the last three years and 20% just since the start of 2013 – a slow-motion crash that almost no one is talking about. The main reasons for this is the huge drop in commodity demand and the economic slowdown of its big trading partner, China. Much of Brazil’s growth output comes from selling commodities to the far east and a lot of the economy is still dependent on that, although this will change.

Another contributing factor to Brazilian stocks’ massive underperformance is the country’s current leadership. In 2011, Brazil elected its first female president, Dilma Rousseff, who also happens to have been a Marxist guerilla back in the day. The government has become highly involved with the massive commodity and banking concerns that dominate the Brazilian stock indices, sometimes to the point where it is actually issuing strategic or operational directives. These giant corporations, like Vale, Petrobras, Banco Do Brasil, Itau Unibanco and Banco Bradesco, make up a great deal of the market capitalization of the country’s stock market.

Petrobras, for example, is one of the worst-run, most mismanaged oil companies on the planet, including both private and other state-run concerns. There’ve been instances where its been forced by politicians to procure supplies and equipment from Brazilian suppliers rather than from the most competitive vendors. In terms of the banks, government officials are leaning on the ones they control and banks in the private sector all the time to achieve political aims. In the latest twist, foreign banks like Credit Suisse are being muscled out of the capital markets and issuance business thanks to a misguided attempt to steer more market share to local companies.

Brazil’s primary challenges at the moment are poverty and inflation. While millions have joined the middle class over the last 15 years, 13 million Brazilian households are still living in the subhuman conditions of the favela slums. This while the government builds world-class soccer stadiums to prepare for both the World Cup in 2014 and the Summer Olympics in 2016. In the meantime, because the currency (the real) held up better than others from 2009 to 2011, it has gotten too strong and inflation has become an issue again. The Brazilian central bank has been hiking rates, attempting to bring inflation down below its 4.5% target. Most Latin American countries are deathly afraid of inflation given their epic battles with prices and default in the 20th century – this has meant extreme conservatism in monetary policy and, in recent years, subpar GDP growth.

In my opinion, these very real negatives are the signs of adolescence and economic immaturity that we can always expect to see as a developing country awkwardly finds its legs to stand up on. Trade protectionism and jittery financial bourses are eventually seen to be a passing phase as politicians are inevitably forced to understand the greater benefit of open markets, global influence and foreign investment. In addition, these negatives are very well known at this point.

The below chart of country market performance for the first six months of 2013 makes this abundantly clear:

The opportunity in Brazilian stocks from here forward looks excellent, although it could be years before investors – foreign or domestic – care to begin bidding them up. It is always difficult to say when sentiment will turn and “cheap” markets can remain cheap (or get cheaper still). That said, I’ll lay out the positives below as a jumping-off point for you to do your own homework.

195 million people call Brazil home, making it the world’s fifth most populous nation (almost 3% of the global total).

Of this 195 million, the median age is a vigorously young 29 years old. The median age in the United States, by way of contrast, is more than a decade older at 39.5 and the median age in Japan is 44.6.

52% of Brazilians or almost 100 million people, are now considered to be in the middle class. This is a massive consumer base with more disposable income than ever.

The middle class wants to higher quality of life and is prepared to fight for it. Million of Brazilians took to the streets in late June and July in a massive awakening of consciousness the likes of which the world has ever seen. They want better health care, better public transportation and they mostly want to close the wealth gap.

Dilma Rouseff’s popularity has absolutely collapsed to 31% favorability down from 54% between June and July. The people no longer believe in her or in her socialist party’s agenda. Only 33% of the country indicated that they would vote for her in the election next year and there are already three other credible candidates waiting in the wings. Change, in this context, would be a positive.

On valuation, Brazilian stocks are now trading at a cyclically-adjusted price to earnings (CAPE) ratio of 9.96. This is compared to the United States stock market which is now selling for a CAPE of 22. For a closer comparison, Mexico now sells for a 19X cyclically adjusted PE while Peru and Colombia are both above 20. While valuation measures like the Shiller CAPE we’re discussing are not good timing tools, the research does suggest that investing in the countries with the “cheapest” CAPEs gives you a substantial performance advantage over portfolios that are heavily weighted toward the most popular (and hence, expensive) ones. Brazil probably should not trade below a CAPE of 10 times earnings, this is incredibly low relative to both the rest of the world and its own recent historical averages.

The opportunity for Brazil – both the nation and its stocks – is as plain as day: the rapidly developing middle class develops inwardly and begins to consume more and rely on exports less as the years pass by. A young, vibrant nation of people who want more for themselves and are no longer afraid to speak up for it is a tantalizing proposition. In this context, the ramp up to the Summer Olympics could be just the thing to re-introduce Brazil’s domestic potential to global investors once again after years of complete apathy.

It would seem to me that a successful equity strategy for Brazil would be to get long stocks that play the consumption side of the equation and minimize exposure to the large cap mineral exporters that are so dominant in the mainstream country index. This can be done with both non market cap-weighted index ETFs or individual ADR positions.

In my mind, no other country offers as much potential, despite the negatives in the near-term. Let’s check back in 2023 and see what happens.

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/07/18/the-case-for-brazil-the-worlds-most-hated-stock-market/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/07/18/the-case-for-brazil-the-worlds-most-hated-stock-market/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/07/18/the-case-for-brazil-the-worlds-most-hated-stock-market/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/07/18/the-case-for-brazil-the-worlds-most-hated-stock-market/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/18/the-case-for-brazil-the-worlds-most-hated-stock-market/ […]