Where are Wall Street’s analysts raising estimates and where are they cutting them? Are we seeing more upward or downward expectations?

Bank of America Merrill Lynch’s Quant Strategy Group keeps an earnings revision ratio (ERR) to track this stuff – in particular, the three-month rolling average is notable.

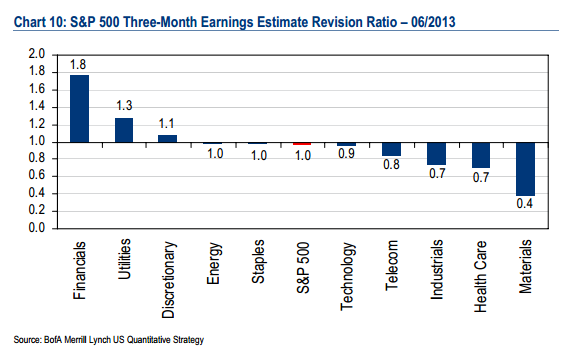

Here’s where analysts have raising and cutting over the last 90 days, by sector:

Financials and the two Consumer sectors

have 3-month revision ratios above one,

indicating more positive than negative

revisions. Materials, Health Care and

Industrials have the lowest revision

ratios.

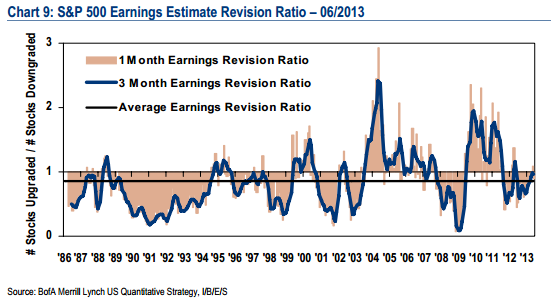

Below is how the S&P looks as a whole – you’ll note that overly optimistic revision ratios tend to coincide with major market tops:

The 3-month earnings revision ratio

ticked down slightly in June to 0.97 from

0.99, following 5 consecutive months of

improvement. The ratio indicates analysts

are taking up as many estimates as they

are taking down, above the ratio’s longterm average. The one-month ratio,

which can be more volatile, ticked down

to 0.9 from 1.1.

Josh here – Analysts have grown more optimistic in their revisions over the last few months. The ratio of upward to downward revisions is a good gauge as to whether or not they are letting expectations get ahead of the reality.

So far, they have not.

Source:

BAML

rechargeable vibrator

[…]The information and facts mentioned within the report are a number of the most effective offered […]

sirius xm gift

[…]one of our visitors a short while ago recommended the following website[…]

naughty rabbit vibrator

[…]Wonderful story, reckoned we could combine a couple of unrelated information, nonetheless truly really worth taking a appear, whoa did one find out about Mid East has got extra problerms too […]

silicone g spot vibrator

[…]one of our visitors just lately suggested the following website[…]

fun board games for adults

[…]one of our guests not too long ago recommended the following website[…]

adam eve discount

[…]that is the end of this post. Here youll locate some web sites that we believe you will value, just click the hyperlinks over[…]

adam and eve sale

[…]Here is a great Weblog You may Uncover Fascinating that we Encourage You[…]

clitoral stimulation

[…]just beneath, are numerous totally not related web-sites to ours, even so, they’re surely worth going over[…]

instrutcii

[…]we like to honor a lot of other world wide web websites around the internet, even if they arent linked to us, by linking to them. Below are some webpages really worth checking out[…]

اسکوتر

My developer is striving to persuade me to move to .internet from PHP. I have often disliked the thought simply because of the charges. But he’s tryiong none the much less. I’ve been employing Movable-kind on a amount of internet sites for about a 12 m…

thai netflix

[…]below you will locate the link to some internet sites that we consider you must visit[…]

iPhone 7 Cable

[…]here are some hyperlinks to sites that we link to due to the fact we believe they may be worth visiting[…]

Iphone charger

[…]here are some links to websites that we link to since we feel they may be worth visiting[…]

Startup

[…]check beneath, are some completely unrelated websites to ours, nonetheless, they may be most trustworthy sources that we use[…]

تعمیر

I totally really like your website and discover a good deal of your post’s to be precisely I’m searching for. Does a single provide visitor writers to publish content offered for you? I would not mind generating a submit or elaborating on a couple of o…