No sooner had the tape begun to show signs of exhaustion after a few rough days than the Fed leaks its latest hug-n-kiss combo to buyers of risk assets via the anointed high priest of Fed Whispering, Jon Hilsenrath:

Fed Likely to Push Back on Market Expectations of Rate Increase

the Fed is talking about pulling back on its $85 billion-per-month bond-buying program. The chatter about pulling back the bond program has pushed up a wide range of interest rates and appears to have investors second-guessing the Fed’s broader commitment to keeping rates low.This is exactly what the Fed doesn’t want. Officials see bond buying as added fuel they are providing to a limp economy. Once the economy is strong enough to live without the added fuel, they still expect to keep rates low to ensure the economy keeps moving forward.

It’s a point Chairman Ben Bernanke has sought to emphasize…

I’ll translate: No taper, white boy.

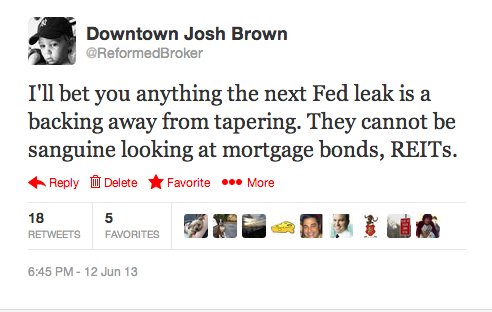

I foresaw this last night, not because I’m a genius, just because it seemed the damage in the alternative yield stuff (REITs, Utes etc) was way out of control. My tweet:

The lesson here, by the way, is that the Fed is watching the stock market like I watch my wife on the “baby monitors” from my cellphone while I’m at work – incessantly.

The Dow has now shot up 200 points and doesn’t give a f*** about anything other than its precious, limitless stimulus.

Game back on?

Source:

Title

[…]we came across a cool site which you may well take pleasure in. Take a search if you want[…]

Title

[…]we came across a cool internet site that you just may well love. Take a look should you want[…]

Title

[…]that could be the end of this report. Here you’ll locate some web sites that we believe you will enjoy, just click the links over[…]

Title

[…]usually posts some extremely intriguing stuff like this. If you’re new to this site[…]

Title

[…]Every the moment in a whilst we pick blogs that we study. Listed below are the latest web pages that we decide on […]

Title

[…]below you will locate the link to some websites that we feel you must visit[…]

Title

[…]one of our guests a short while ago proposed the following website[…]

Title

[…]just beneath, are various completely not related internet sites to ours, however, they may be surely worth going over[…]

Title

[…]although web-sites we backlink to beneath are considerably not related to ours, we really feel they may be really worth a go by means of, so have a look[…]

Title

[…]Wonderful story, reckoned we could combine a handful of unrelated information, nevertheless genuinely worth taking a appear, whoa did a single master about Mid East has got additional problerms also […]

Title

[…]just beneath, are several absolutely not connected web pages to ours, nevertheless, they may be surely worth going over[…]

Title

[…]usually posts some extremely intriguing stuff like this. If you’re new to this site[…]

Title

[…]Every when in a whilst we pick blogs that we study. Listed below are the latest web-sites that we select […]

Title

[…]although sites we backlink to below are considerably not associated to ours, we really feel they are basically worth a go through, so have a look[…]

Title

[…]one of our visitors lately encouraged the following website[…]