No sooner had the tape begun to show signs of exhaustion after a few rough days than the Fed leaks its latest hug-n-kiss combo to buyers of risk assets via the anointed high priest of Fed Whispering, Jon Hilsenrath:

Fed Likely to Push Back on Market Expectations of Rate Increase

the Fed is talking about pulling back on its $85 billion-per-month bond-buying program. The chatter about pulling back the bond program has pushed up a wide range of interest rates and appears to have investors second-guessing the Fed’s broader commitment to keeping rates low.This is exactly what the Fed doesn’t want. Officials see bond buying as added fuel they are providing to a limp economy. Once the economy is strong enough to live without the added fuel, they still expect to keep rates low to ensure the economy keeps moving forward.

It’s a point Chairman Ben Bernanke has sought to emphasize…

I’ll translate: No taper, white boy.

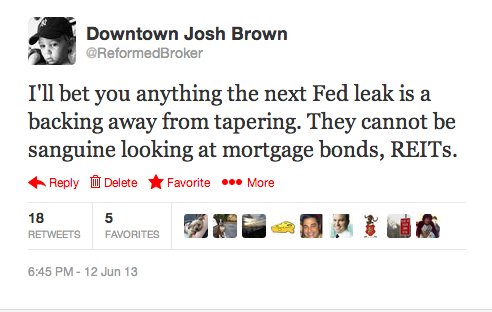

I foresaw this last night, not because I’m a genius, just because it seemed the damage in the alternative yield stuff (REITs, Utes etc) was way out of control. My tweet:

The lesson here, by the way, is that the Fed is watching the stock market like I watch my wife on the “baby monitors” from my cellphone while I’m at work – incessantly.

The Dow has now shot up 200 points and doesn’t give a f*** about anything other than its precious, limitless stimulus.

Game back on?

Source:

Title

[…]usually posts some quite interesting stuff like this. If you’re new to this site[…]

Title

[…]just beneath, are various entirely not connected web-sites to ours, nonetheless, they may be certainly worth going over[…]

Title

[…]below you’ll locate the link to some web-sites that we feel you need to visit[…]

Title

[…]usually posts some incredibly interesting stuff like this. If you are new to this site[…]

Title

[…]usually posts some really fascinating stuff like this. If you’re new to this site[…]

Title

[…]Every the moment inside a although we choose blogs that we study. Listed below are the most recent web-sites that we pick […]

Title

[…]Every after inside a even though we decide on blogs that we study. Listed beneath are the most recent web-sites that we decide on […]

Title

[…]we prefer to honor several other world wide web internet sites on the web, even if they aren’t linked to us, by linking to them. Underneath are some webpages really worth checking out[…]

Title

[…]Here are a number of the sites we suggest for our visitors[…]

Title

[…]Here is a great Weblog You may Discover Fascinating that we Encourage You[…]

Title

[…]very couple of websites that transpire to be detailed beneath, from our point of view are undoubtedly properly really worth checking out[…]

Title

[…]Sites of interest we have a link to[…]

Title

[…]that could be the finish of this write-up. Right here you will obtain some web pages that we consider you will appreciate, just click the hyperlinks over[…]

Title

[…]please go to the internet sites we comply with, including this one particular, as it represents our picks from the web[…]

Title

[…]please take a look at the internet sites we comply with, like this one, because it represents our picks through the web[…]