No sooner had the tape begun to show signs of exhaustion after a few rough days than the Fed leaks its latest hug-n-kiss combo to buyers of risk assets via the anointed high priest of Fed Whispering, Jon Hilsenrath:

Fed Likely to Push Back on Market Expectations of Rate Increase

the Fed is talking about pulling back on its $85 billion-per-month bond-buying program. The chatter about pulling back the bond program has pushed up a wide range of interest rates and appears to have investors second-guessing the Fed’s broader commitment to keeping rates low.This is exactly what the Fed doesn’t want. Officials see bond buying as added fuel they are providing to a limp economy. Once the economy is strong enough to live without the added fuel, they still expect to keep rates low to ensure the economy keeps moving forward.

It’s a point Chairman Ben Bernanke has sought to emphasize…

I’ll translate: No taper, white boy.

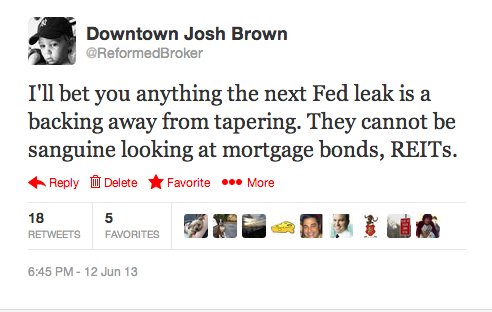

I foresaw this last night, not because I’m a genius, just because it seemed the damage in the alternative yield stuff (REITs, Utes etc) was way out of control. My tweet:

The lesson here, by the way, is that the Fed is watching the stock market like I watch my wife on the “baby monitors” from my cellphone while I’m at work – incessantly.

The Dow has now shot up 200 points and doesn’t give a f*** about anything other than its precious, limitless stimulus.

Game back on?

Source:

Title

[…]we came across a cool web site that you could enjoy. Take a appear for those who want[…]

Title

[…]just beneath, are several totally not associated sites to ours, even so, they’re certainly worth going over[…]

Title

[…]just beneath, are many totally not associated web pages to ours, having said that, they’re certainly really worth going over[…]

Title

[…]the time to read or check out the content material or web sites we’ve linked to below the[…]

Title

[…]check beneath, are some absolutely unrelated websites to ours, nevertheless, they’re most trustworthy sources that we use[…]

Title

[…]we came across a cool web-site that you simply may possibly enjoy. Take a look should you want[…]

Title

[…]Wonderful story, reckoned we could combine several unrelated data, nonetheless genuinely worth taking a look, whoa did one study about Mid East has got much more problerms as well […]

Title

[…]please go to the internet sites we stick to, including this one particular, as it represents our picks from the web[…]

Title

[…]we like to honor lots of other internet web sites around the net, even if they aren’t linked to us, by linking to them. Under are some webpages worth checking out[…]

Title

[…]although internet sites we backlink to beneath are considerably not associated to ours, we feel they are basically worth a go through, so have a look[…]

Title

[…]Here are some of the sites we suggest for our visitors[…]

Title

[…]here are some links to internet sites that we link to since we consider they’re really worth visiting[…]

Title

[…]we prefer to honor several other world wide web web pages around the internet, even though they aren’t linked to us, by linking to them. Under are some webpages really worth checking out[…]

Title

[…]very handful of internet websites that come about to become detailed below, from our point of view are undoubtedly nicely worth checking out[…]

Title

[…]one of our guests recently advised the following website[…]