361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

June 3, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“Houston, we have a problem.” (Apollo 13, 1995)

@MCaruso_Cabrera: U.S. 30-YEAR TREASURY YIELD CLIMBS NEARLY 40 BPS IN MAY, BIGGEST ONE-MONTH JUMP SINCE DEC 2009

The charts even look like a space capsule is tracking back to earth…

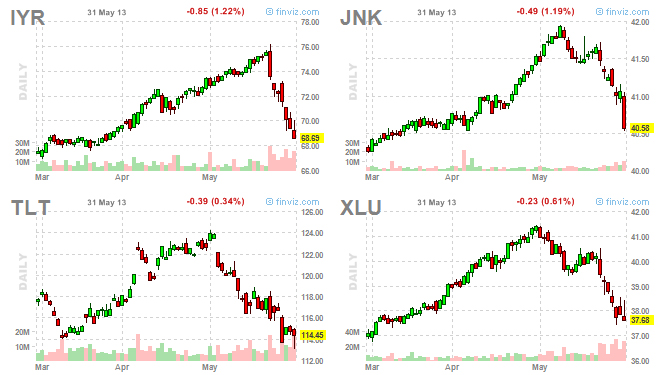

While the equity markets would enjoy a bit of the great rotation out of the 20+ year outperformance in bonds and into equities, the move in May has been too much, too quick for even equity investors to stomach. So while the Long Treasury ETF (TLT) fell -6.8% in May, the size of the move even scared investors in REITs (IYR), Junk Bonds (JNK/HYG), and Utilities (XLU).

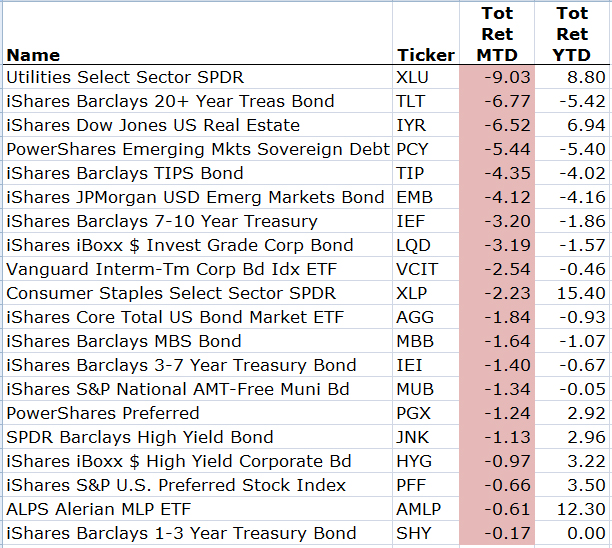

Looking closer at the major income-oriented ETFs shows that every duration and risk level was affected. And even the more bond-like equity proxies were pulled into the loss category, while lower/no dividend equities gained for the month…

Putting the International bond capital losses into years of income…

Cost of Carry: 10yr US Gov’t bonds yielded 1.67% on April 30th. Its price fell 3.63% in May, and now yields 2.09%. Which means it lost 2.2yrs of interest in 1mth. Switzerland and Japan were worse. Investors in Swiss 10yrs lost 2.5yrs of interest in May. Japan 10yrs lost 3.7yrs. Canada lost 2.0yrs, Sweden & Germany 1.9, Britain 1.6, Mexico 1.5, Russia 1.4, France 1.3, NZ/SA/SK 1.0, Australia 0.7, Spain 0.6, and Italy 0.4yrs. For US investors, losses on foreign bonds were far worse as the Dollar soared. A Dollar-based investor with Japanese 10yrs in his index, lost 8.7yrs of interest in May – holy sushi!

(wkndnotes)

Even the largest mutual fund was not unscathed…

It has been an ugly month for some major bond fund managers, including the reigning king of bonds, Bill Gross. The sudden sell-off in Treasuries and government-guaranteed mortgage debt has taken a big bite out of the performance of the Pimco Total Return Fund, the world’s largest bond fund, which Gross oversees. As of May 30, Pimco Total Return, with about $293 billion in assets, was down 0.15 percent for the year, according to data collected by mutual fund tracking firm Morningstar. For the month of May, Pimco Total Return is down 1.9 percent.

(Reuters)

Would a “Velvet Rotation” be less painful?

History shows that major breakouts in equity markets tend to coincide with major inflection points in bond yields. The ideal scenario would be a repeat of the early 1960s, when both equities and bond yields rose in an orderly fashion, a “Velvet Rotation”. But risks of a bond crash are high. A sharp rise in rates that hurts bank stocks and the dollar would be risk negative, as was the case in 1987 (equity crash) and 1994 (bond crash). While the turn in housing should be welcomed by Main Street, the recent melt-up in stock prices in the U.S. and Japan, in combination with surging home prices, threatens to remove the liquidity “punch bowl”. A host of “canaries in the bond-mine” (mortgages, REITs, utility stocks, lumber), are indicating that markets are getting nervous about QE tapering, and suggest the next move in bond yields is more likely to be up than down.

(BAML via FT)

A reversion to the mean bounce in bonds seems logical, but maybe we should wait until fixed income investors open their May statements…

No one has a clue what the economy is likely to do. At the start of May everyone was bemoaning weak global growth. By the end of May investors are desperately positioning for growth and monetary policy tightening, albeit with only a few positive U.S. data points to go on. When big markets like U.S. Treasuries move this much on so little evidence, watch out for sudden reversals. It would not take much in the way of poor economic figures to make investors doubt their new-found belief.

(James Macintosh via FT)

JPMorgan has one word for the pool floating college graduate: “EQUITIES”…

The J.P. Morgan View – Jan Loeys: Trial runs for end of easy money. Asset allocation – The best defense against any fear of an end to easy money is to be significantly OW equities to fixed income.

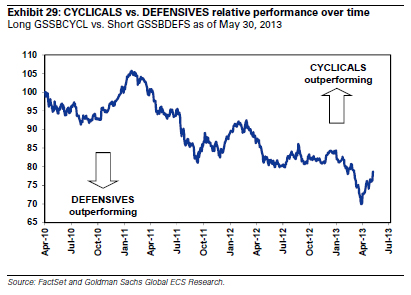

I agree with Michael Santoli in that it is time for the economically sensitive equities to pull the markets for the next several years…

In 2011 the rate on the 10-year Treasury note sank below the dividend yield on the Standard & Poor’s 500 index – something that, since 1956, had only happened briefly near the bear-market lows of early 2009. Yet with the continued stock rally to new highs, and the sharp jump in Treasury yields in the recent bond-market rout, this is changing, and the mad dividend paper chase might be ending. This means, among other things, that the stock market will need new sort of leadership to emerge if it is to continue sidestepping significant setbacks and maintain its uptrend. And these new leaders will, by definition, be more economically sensitive and dependent on the dog whistle of corporate-profit indicators and the crackle of economic data headlines. Friday’s brief decline on a weaker consumer-spending number, and subsequent bounce on a strong purchasing-managers survey, shows the tape is now more captive to the data flow.

(Michael Santoli via YahooFinance)

And with 800 basis points of outperformance in May, that is what Goldman saw also…

(Goldman Sachs)

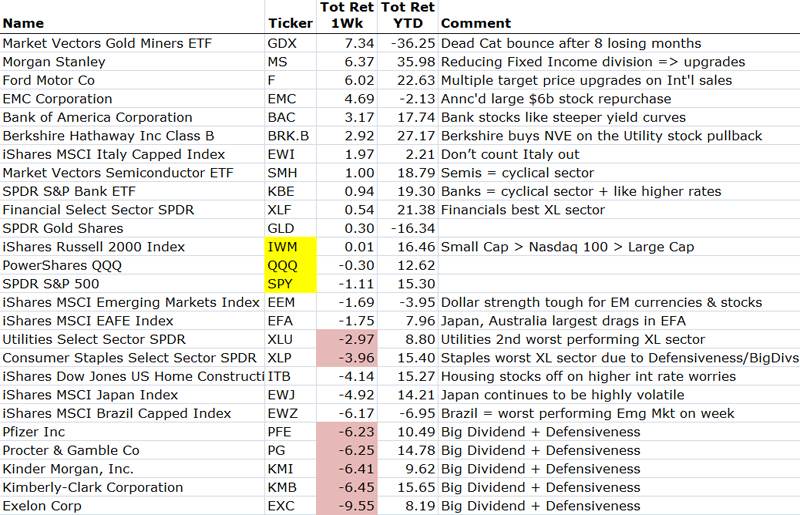

In other signs of equity risk appetite, Small Caps and Financials continued to show much leadership in May…

The team at RenMac expects the move in rates to continue to benefit these groups…

- Bond yields breaking out were the big event last week. While not new news and telegraphed by Utilities and REITs, it is still significant. However, we are having a “Bear Steepener” (10-yr yields rising faster than 2-yr yields), which has traditionally been bullish for equities as better growth prospects trump the negative of higher yields.

- The attributes of Bear Steepeners favor volatility, low valuation, and small caps. This is exactly what has been working, heartening our case for a good equity environment.

- Financials remain our favorite way to play cyclicality, while REITs and Utilities are at risk.

(RenMac)

Paul Krugman had a simple chart over the weekend that might help you surf the moves in equities…

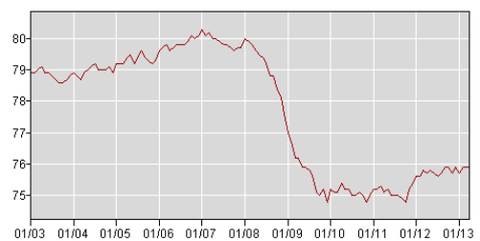

With stocks down and the dollar up, this looks like a market that has upgraded its estimate of the chances that the Fed will tighten too soon. And yes, I mean too soon, for sure. Look not at the unemployment rate, which to some extent reflects people dropping out of the labor force, and instead look at the employment-population ratio — focusing on prime-age workers to avoid demographic issues:

(Employment-population ratio, ages 25-54.)

Our labor market has barely begun to recover. Meanwhile, inflation is dropping well below target, even as a growing number of analysts believe that the target itself has been set too low. So unless Bernanke and company mean to signal their intention to tighten much too soon, and derail recovery, they had better start getting their message out better.

(Paul Krugman via NYT)

I also haven’t heard of a deal, loan, or mortgage being turned down because of May’s move in rates…

“What really counts here for investors is, are rising rates crimping the affordability of credit?” Mr. Stoltzfus said. With two-year Treasury notes yielding just 0.29 percent, he said, “I’d argue that we’re far from that point.”

(John Stoltzfus via NYT)

If anything, a move higher in the SHORTer duration Treasury yields can only be a positive for equities if driven by stronger U.S. growth. But we want Goldilocks-like growth, not Kracken-like growth…

And if you want to hear who is the most excited about higher rates, call your Mom. Or better yet, call someone that you really haven’t talked to in years, like a long-only equity portfolio manager…

On the flip side, rising rates are highly beneficial to savers who have suffered from low interest income for years and encouraged seniors to take on more risk than they would like to get a decent return. Rising rates benefit defined-benefit pension funds because low rates inflate their liabilities. And rising rates may spur potential homebuyers to get off the fence and commit to buying a house now before rates rise further. Keep in mind also that when people sell bonds to avoid losses from rising rates, they have to buy something else. That something else will be stocks, in many cases, which will push the stock market higher as investors rotate out of bonds and into stocks. Rising stock prices will also allow businesses to issue stock for investment and to retire their bonds.

(Bruce Bartlett via The Fiscal Times)

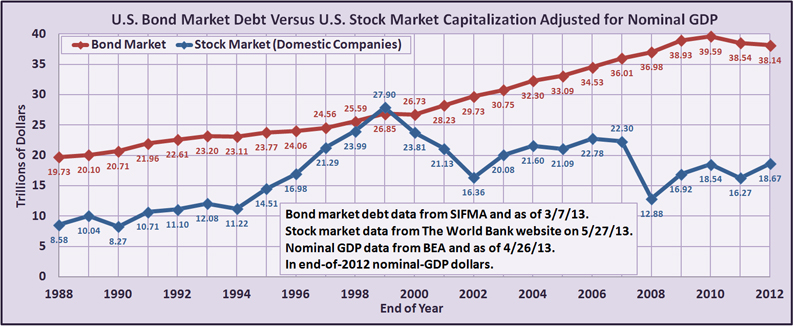

If the “Great Rotation” is not a mirage in the desert, how many TRILLIONs could crumb their way to the NYSE and Nasdaq?

A few trillion $ shift from Bonds to Stocks will more than offset the $3.5b in a certain hedge fund’s redemptions that you were worried about on Friday afternoon.

Economic data points were mixed last week, but the Chicago PMI did stand out on the positive side…

The Chicago PMI jumped to its highest level since March 2012 as the May print of 58.7 followed April’s contractionary reading of 49.0. The large increase was fueled by an improvement in all of the key subcomponents as employment, order backlogs, production, and new orders all posted notable gains. Separately, the final reading of the May University of Michigan Consumer Sentiment Survey moved up to 84.5, its best level since July 2007.

(Briefing.com)

Equity indexes felt worse than they actually performed. That is unless you were an International equity investor. Good news for International stock buyers is that you still lost a lot less than those risk-loving Staples & Utility stock investors…

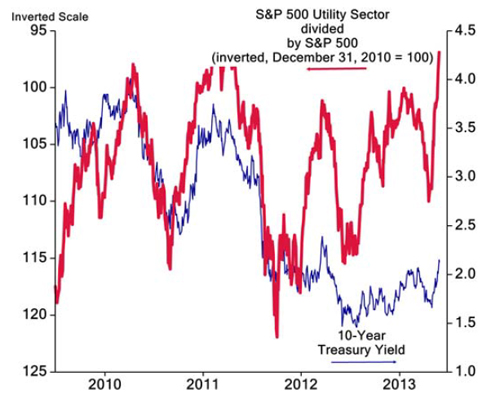

Speaking of Utes, if you are an investor, you had better have a good read on the moves in bond markets…

(ISI Group)

One theme that did not change with the moves in the market last week was the continued increase in allocation of capital by corporate America to its shareholders…

The share buyback bandwagon has rolled into Massachusetts this morning. Or, rather, revisited it. EMC, which is based in the town of Hopkinton and is one of the world’s largest makers of data storage equipment, said it plans to increase its buyback program to up to $6bn from the $1bn it announced just a few weeks ago. The details are here, but EMC intends to:

- Buyback $3.5bn by the second quarter of 2014

- Add debt in the near term

- Start a quarterly dividend of 10 cents a share

The technology company first unveiled the buyback program in April, when its first-quarter results fell short of Wall Street’s estimates.

And after declining 6.5 percent so far this year, its shares need to play catch up with the almost 16 percent gain for the S&P 500. EMC is in a long queue of U.S. companies buying back shares. According to LPL Financial, the volume of share buybacks announced this quarter is running at the strongest pace in five years. With cash available and cheap debt on hand from the debt markets to help fund the programs, companies can hardly be blamed for shooting into an open goal. The trend will cement the view of equity bulls. It will worry those who would prefer the billions to be spent elsewhere.

(@fastFT)

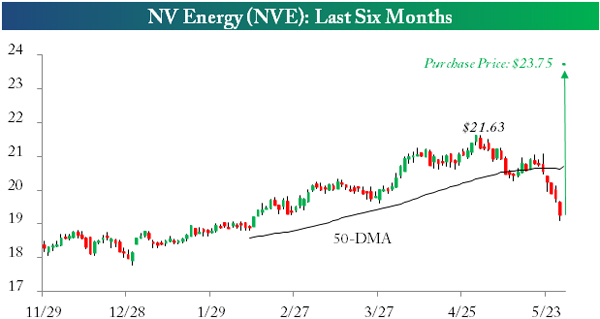

Another theme that continued was M&A. And Warren Buffett took part in ‘Buying the Dip’…

One constant of the market so far this year has been the fact that every time the market comes under pressure, investors step in to buy the dips. Within the Utilities sector today, it appears as though that trend may still be in place, and the dip buyer this time has been none other than Warren Buffett. After the close today, Berkshire Hathaway’s MidAmerican unit announced that it was buying NV Energy (NVE) for $23.75 per share in cash. Compared to today’s closing price, that represents a premium of 23%, which looks pretty attractive for NVE. However, when you consider the fact that the stock was trading as high as $21.63 less than a month ago, you can imagine that if it were not for the sharp selloff this month, this deal probably would have had a higher price tag.

It wasn’t equity M&A but a very big deal is going to occur in the Real Estate world…

NYC real estate – bids for 650 Madison Ave have reached as high as $1.4B according to reports; a deal at that level would mark the biggest real estate transaction since ’10.

(Bloomberg)

The OECD lowered its global outlook for growth last week…

“The global economy is moving forward, but divergence between countries and regions reflects the uneven progress made toward recovery from the economic crisis… World real gross domestic product (GDP) is projected to increase by 3.1% this year and by 4% in 2014… In the U.S., activity is projected to rise by 1.9% this year and by a further 2.8% in 2014. GDP in the euro area is expected to decline by 0.6% this year and then rebound by 1.1% in 2014, while in Japan GDP is expected to grow by 1.6% in 2013 and 1.4% in 2014”.

(OECD)

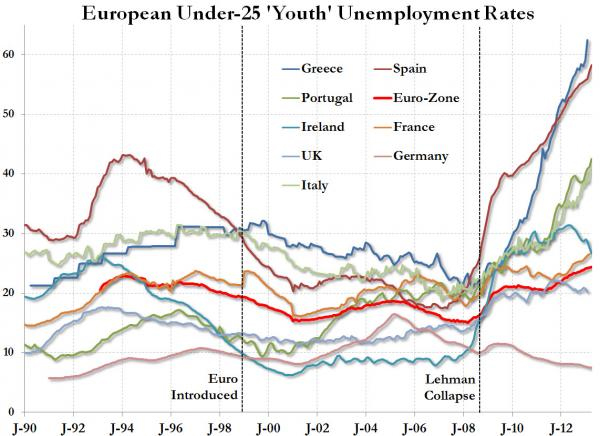

Europe could really use a pickup in economic growth to help get their young people back to work…

If you or your clients are overweight gold right now, this is a thoughtful read…

There are many reasons why the bubble has burst, and why gold prices are likely to move much lower, toward $1,000 by 2015.

(Nouriel Roubini via ProSyn)

A Graduation thought from the Federal Reserve Chairman…

Some years ago I had a colleague who sent three kids through Princeton even though neither he nor his wife attended this university. He and his spouse were very proud of that accomplishment, as they should have been. But my colleague also used to say that, from a financial perspective, the experience was like buying a new Cadillac every year and then driving it off a cliff.

(Ben Bernanke, 2013 Princeton commencement address)

@ritholtz: Best Graduation Cap

And finally, Manhattanhenge occurred last week…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/06/04/361-capital-weekly-research-briefing-44/ […]

buy cheap cialis uk

SPA

ordering cialis online australia

USA delivery