361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

May 6, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

(@marketmodel)

It was a VERY BIG week for the markets to digest information and choose the next fork in the road…

This week’s focus was squarely on central bank policy decisions and the U.S. April payrolls data. Mid-week the FOMC reinforced the “Bernanke put” by stating explicitly that quantitative easing can be increased if conditions worsen. On Thursday, the ECB cut its main refi rate by 25 bps to 0.5% from 0.75%, while press reports indicated that some members of the governing council were prepared to take even stronger action. On Friday, the April payrolls and unemployment reports were much better than expected. Equity markets were flat through mid-week, but then the ECB decision and the U.S. jobs numbers pushed the S&P500 above 1,600 and the DJIA above 15,000 for the first time ever. The DAX closed on Friday at 8,122, its highest closing level ever and only points away from intraday highs. Crude pushed out to one-month highs above $95 as of Friday, and while gold was mostly flat on the week the yellow metal has retraced roughly half its losses from the mid-April slide. For the week, the DJIA gained 1.8%, the S&P500 added 2%, and the Nasdaq rose 3%.

(TradeTheNews)

Note to Self #383: DON’T FIGHT THE FED, THE BOJ, THE ECB, etc…

Markets may not be giving it enough credit, but they’re certainly aware that the Fed, BoJ, and ECB are all easing simultaneously. In any event, it’s a totally unprecedented situation. But probably underappreciated by markets (and policymakers) is the fact that over the past 20 months there have been 383 stimulative policy initiatives announced around the world. There have been 13 new ones over the past month, including rate cuts by Turkey, Hungary, Philippines, Colombia, India, and ECB, as well as more fiscal stimulus by Portugal, Germany, and the EU, which is the last one at #383. Many are not significant individually, but they add up.

(ISI Group)

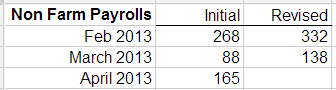

Once the Market saw the February/March revisions to the NFP data, the market quickly put all ‘slowdown’ talk on the back burner and the SPY gained 1.0% while the TLT lost 2.3%…

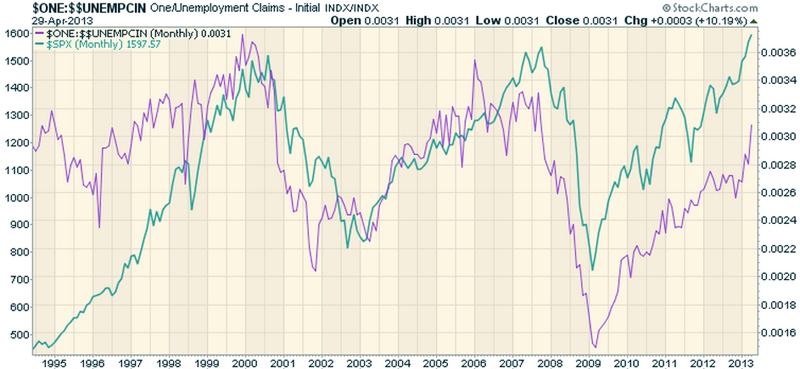

Jobs data remains very important to stocks. Equities continue to follow the inverse trend in weekly jobless claims very closely…

(StockCharts.com)

Speaking of jobs, if you know ANYONE that needs a job, tell them to get to Texas…

Blaine,

In Midland for a wedding – West Texas. The donut house, T and T, is hiring at $18.50 per hour and having trouble. If you have a commercial driver’s license, you will be hired at $105,000 to drive an oil rig, no experience necessary and high school diploma optional. An experienced driver starts at $125,000. Unemployment rate in Midland is 3% and anybody who wants to work will find a job. Lowest unemployment in the country – all energy related.

(From one of our loyal readers)

And if your kids want to earn more than $18.50 per hour, tell them to double up on their MATH studies…

Here’s the list of top 10 majors, with starting salaries:

Petroleum Engineering: $93,500

Computer Engineering: $71,700

Chemical Engineering: $67,600

Computer Science: $64,800

Aerospace/Aeronautical/Astronautical Engineering: $64,400

Mechanical Engineering: $64,000

Electrical/Electronics and Communications Engineering: $63,400

Management Information Systems/Business: $63,100

Engineering Technology: $62,200

Finance: $57,400

(WSJ)

Chris Brewer notes how even simple MATH can improve your health. (Maybe a question Doug Kass should have asked Warren Buffett on Saturday?)

@livestrongcb: Calories matter, & 1 small change can be big, ex: daily 1 12 oz can Coke = 140 cal X 365 days = 14.6 lbs, what can you change? #FitnessTip

Back to the markets… Big smiles if you called New Highs in the Indexes…

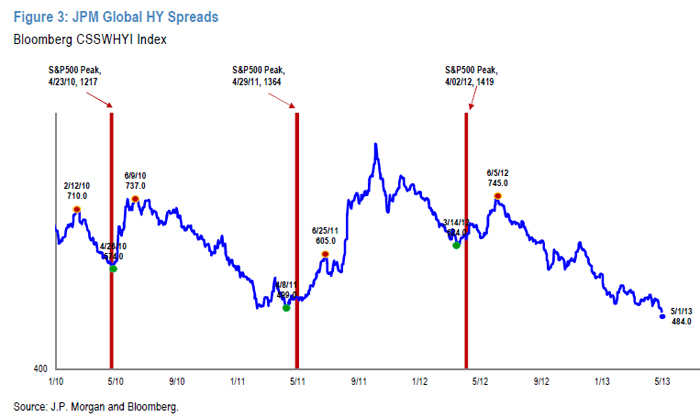

Very important to watch the credit markets here…

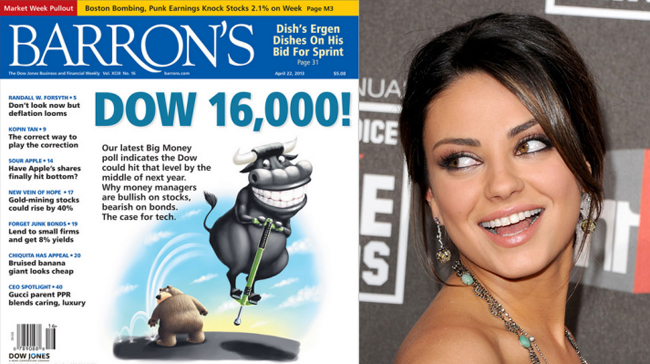

As JPMorgan shows below, the credit markets will give you a sign when equities have peaked. Timing is everything and I was lucky to start my financial career 23 years ago on the Fixed Income side before I moved into Equities. One of the most important lessons that I learned from working both asset classes was that the credit markets are much larger and more risk adverse than the equity markets. Most of the time, I found that big moves in risk were seen first in the credit markets before the equity markets. Pay attention to what your credit teams are saying today and if they see spreads widening, back off the RISKON pedal and protect yourself. Of course, that is not what the credit market is saying right now. It is saying, “Follow Mila and shift into 5th”.

(JPMorgan)

Speaking of extraordinary credit markets, Apple Inc. took full advantage of the low rates last week…

Apple’s debt offering is largest in history. Apple’s (AAPL) first debt offering in nearly two decades was also the largest corporate bond deal in the history of the market. The company, under pressure to return cash to shareholders, sold a $17B offering in six parts Tuesday: $1 billion of three-year floating-rate notes, $1.5 billion of three-year fixed-rate notes, $2 billion of five-year floating-rate notes, $4 billion of five-year fixed-rate notes, $5.5 billion of 10-year fixed-rate notes, and $3 billion of 30-year fixed-rate notes. Goldman and Deutsche led the highly sought-after deal which brought buyers out of the woodwork. AAPL issued the three-year paper at 0.511%, just 20 basis points above the three-year fixed rate Treasury bond.

(SeekingAlpha)

For Grave Dancing investors, the very tight credit markets are a sign to SELL their illiquid, private holdings…

“It’s almost biblical. There is a time to reap and there’s a time to sow,” Leon Black, chairman and chief executive of Apollo Global Management declared to the Milken Institute’s global conference in Los Angeles, alluding to that same Scriptural passage. “We are harvesting,” he added pointedly. That is, the private-equity giant is a net seller because things simply can’t get much better. “We think it’s a fabulous environment to be selling,” he says, noting Apollo has sold about $13 billion in assets in the past 15 months. “We’re selling everything that’s not nailed down. And if we’re not selling, we’re refinancing.” That’s because there has never been such a good time to borrow — which is raising warning flags for Black. “The financing market is as good as we have ever seen it. It’s back to 2007 levels. There is no institutional memory,” he observed, referring to the peak of the last credit bubble.

(Barron’s)

And as highlighted in Omaha this weekend, Berkshire is also best positioned to grave dance when the cracks open…

“Berkshire is the 800 number when there is really some panic in the markets, and people need significant capital. If you come to a day when the Dow has fallen 1,000 points a day for a few days and the tide has gone out and you find some naked swimmers,” they will be calling Berkshire.

(CNBC)

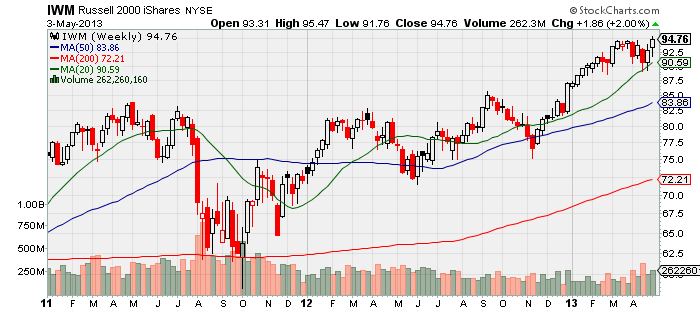

Another index that I am watching closely is the Small Cap index…

This significant RISK indicator could have broken down and pulled the market with it. Instead it ripped to New Highs on Friday along with everything else. A bull looking to shift from 5th to 6th gear would like to see this one lead the markets.

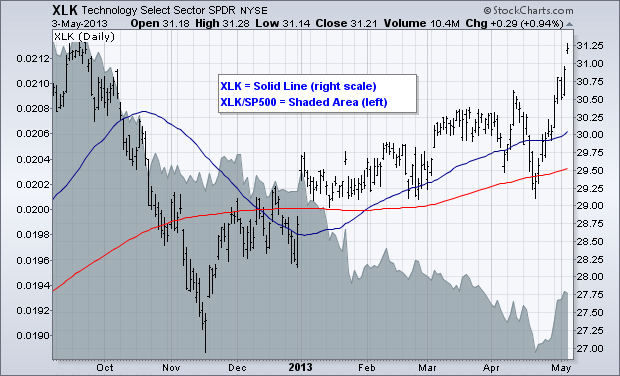

But it will be tough for Small Caps to lead the markets when Mega Cap Tech is playing like the Miami Heat…

As mentioned last week, the biggies have woken up from their slumber. The sector that no one wanted 2 weeks ago is now leading the Nasdaq100 higher.

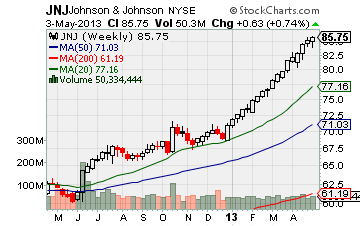

You also have to be impressed with the YTD performance of this $230 billion market cap…

@BenCBanks: $JNJ has been up 18 weeks in a row or 34.6% of a year. Amazing.

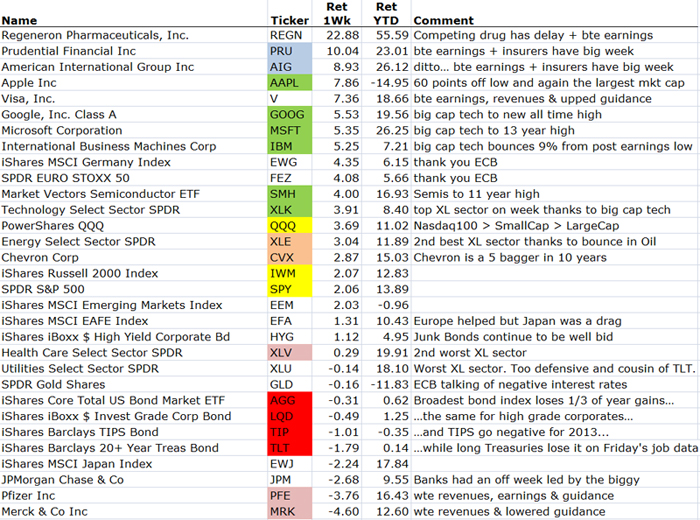

If you want to know what has been feeding the returns of the large hedge funds…

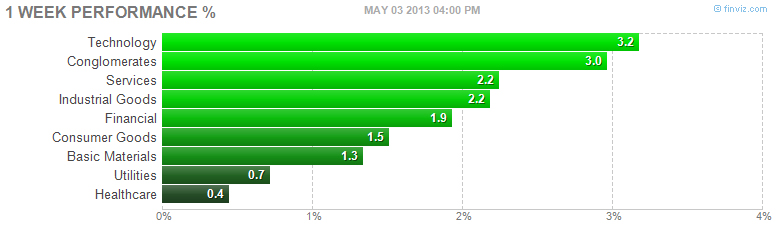

A RISKON week across the market with no sector down…

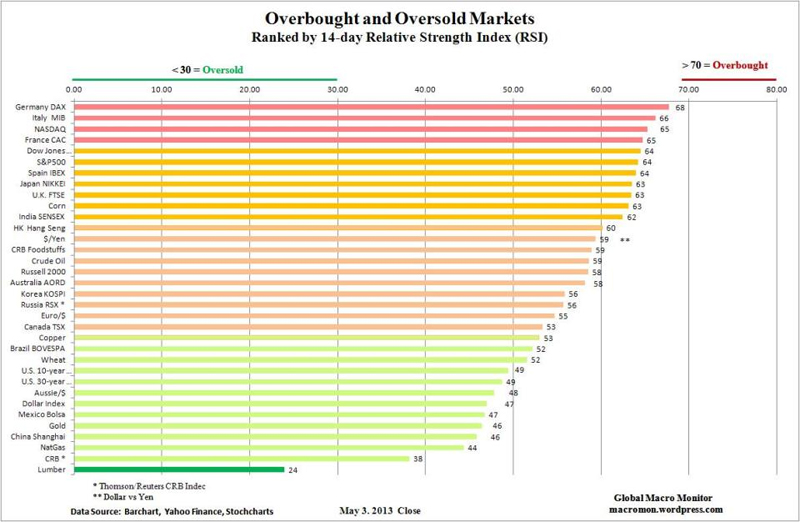

And only lumber showing signs of being oversold…

In the world of stocks and ETFs, last week was all about Big Cap Technology…

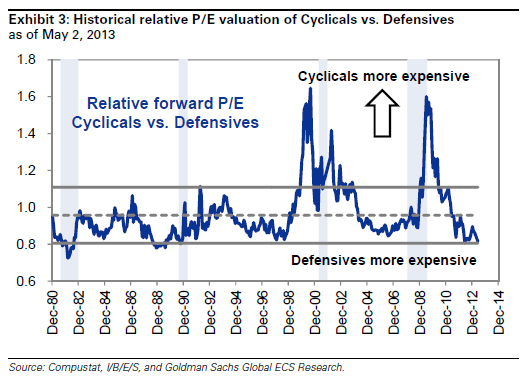

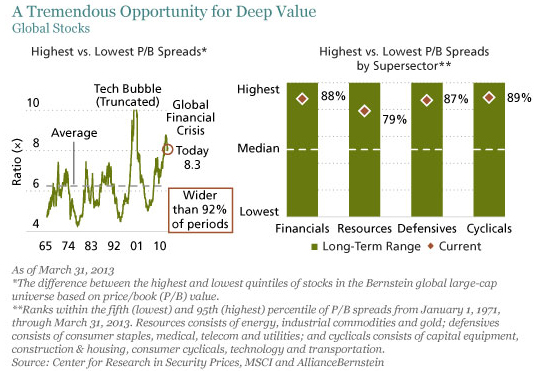

Goldman and AllianceBernstein are highlighting the attractiveness of Cyclicals & Deep Value stocks…

(GoldmanSachs)

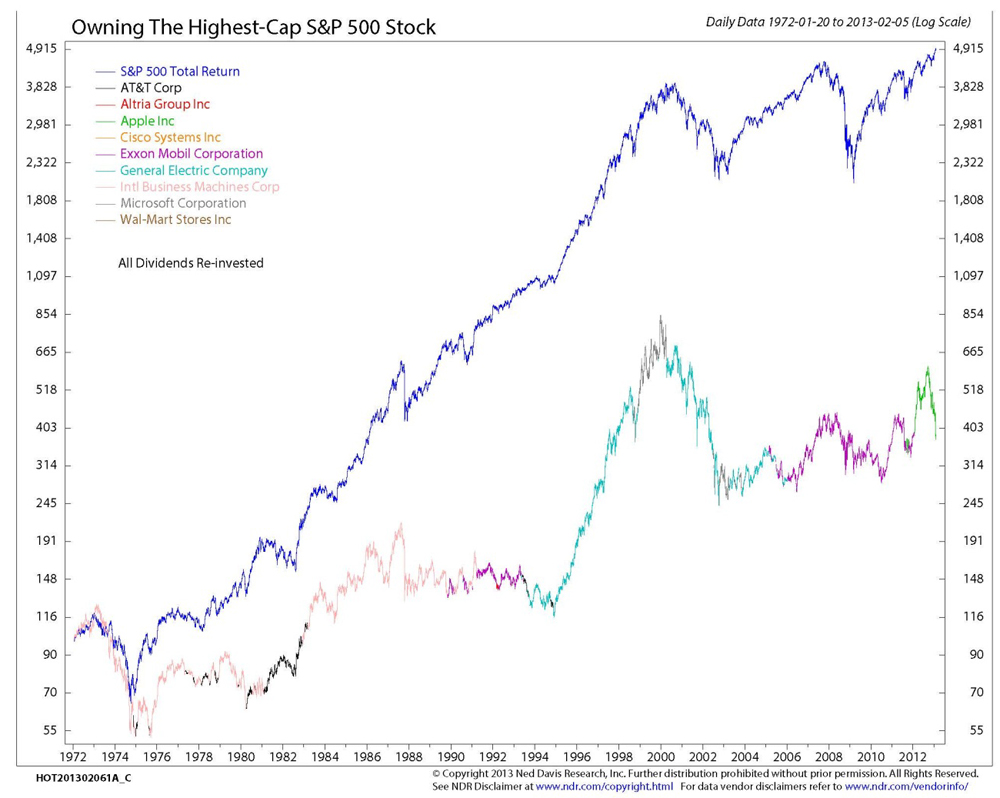

Regarding Mega Cap Stocks, it doesn’t pay to ONLY own the largest company in the S&P500…

One positive housing piece for our many Canadian readers…

Five reasons I’m not worried about a Canadian housing bubble: #4. Canada’s housing supply is mostly igloos, which will eventually melt, thus preventing massive overstock in the market place. This factor should keep pricing somewhat stable over time.

(TheReformedBroker)

North Dakota wins the lottery…again…

A federal reassessment of oil-and-gas resources in North Dakota found the state holds twice as much shale oil — and three times as much gas — than was previously estimated. Technological advancements have made the unconventional fossil fuels in North Dakota’s Three Forks formation “technically recoverable,” the Interior Department’s United States Geological Survey (USGS) announced Tuesday. And by rolling Three Forks into the Bakken shale formation, the region that spans North Dakota, South Dakota, and Montana could now produce 7.4 billion barrels of oil, 6.7 trillion cubic feet of natural gas, and 0.53 billion barrels of natural gas liquids. Compared to 2008 estimates, that’s triple the amount of shale gas and double the amount of shale oil that the region could yield.

(TheHill)

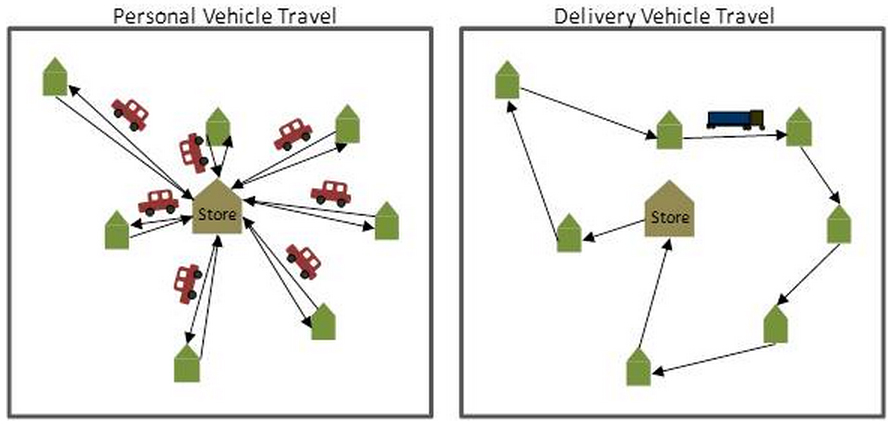

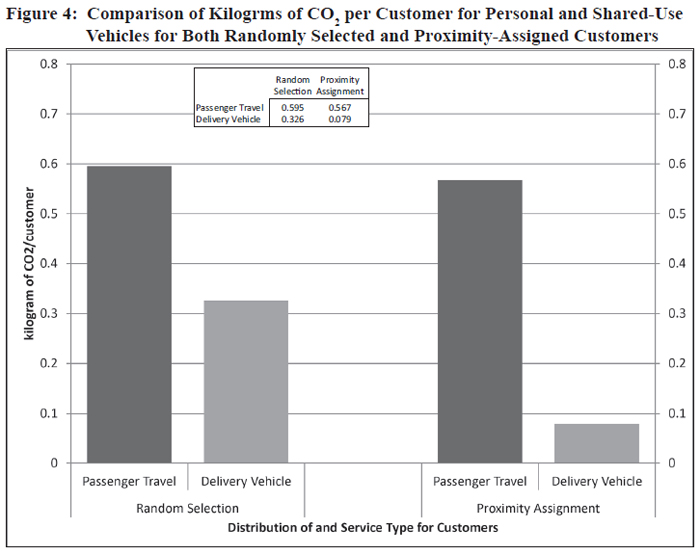

Not only will buying your groceries via Amazon save you $$$ and parking lot door dings, but a new study shows how it better it is for the environment…

So what engineers Erica Wygonik and Anne Goodchild did in their paper (pdf) was to take a look at the actual stores and homes around Seattle and simulate thousands of deliveries and grocery runs around the city. They then analyzed a random sample of those runs.

They found that delivery trucks bringing groceries to people’s doorsteps emitted between 20 to 75 percent less carbon dioxide per customer, on average, than having all those people drive their cars from home to the store and back again.

(WashingtonPost)

Finally, have you ever seen two more excited kids at a sporting event?

@darrenrovell: Nominee for the best pic of crazy kid fans (H/T @margs22)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]

… [Trackback]

[…] There you will find 4183 more Info to that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]

… [Trackback]

[…] Here you will find 58538 more Info on that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/05/07/361-capital-weekly-research-briefing-42/ […]