361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

March 18, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Cyprus is a great place to catch some rays and go scuba diving while your Rubles are being laundered…

With a banking system 8x the country’s annual GDP, no senior debt supporting the country’s banks and loan books that were overextended, the whole world knew that this would not end well. Over the weekend, the entire banking system of the country was going to collapse so the EU threw it a lifeline which included taxing the banking system depositors. The mechanics of the tax are still being worked out as I type on Sunday, but hopefully the government will realize that some minimum value of deposit insurance must be kept in place. Otherwise why would anyone keep assets in a Cypriot bank? Or as the market is jumping to conclude, a Greek Bank, a Spanish Bank, an Italian Bank? Bottom line: $24 billion in GDP means the country of Cyprus is as productive as the entire state of Vermont or the whole city of Jackson, Mississippi. The financial impact of Cyprus to the world is equal to a mosquito on an elephant. But the world is watching the EU for signs that this is their road map to future financial stress scenarios. In other words, does the mosquito carry a DeWALT drill and bucket of malaria?

Volatility nearly broke 11 last week. Cyprus will cause a spike higher on Monday. Pay attention to where it settles by week’s end as the markets digest this small EU island nation…

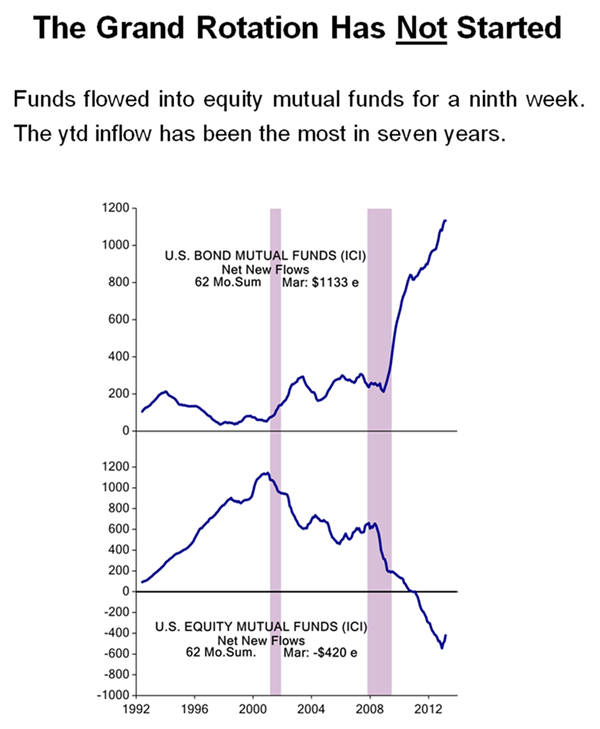

As all large Bond managers have pointed out, the Rotation from Bonds to Stock is not evident in THEIR numbers…

In looking at the ISI Group charts below, imagine what would happen to the Equity indexes once the starting gun fires. Many viewed Mila Kunis’ shift from savings and bank CDs to stocks last week as a certain sign of a market top. What if I told you that she is financially astute and loves to read this weekly note between shoots?

(ISI Group)

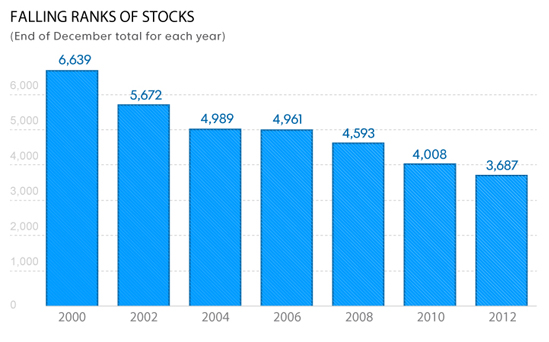

Question: How many stocks are in the Wilshire 5000? Answer: 3,687

Investors have faced plenty of challenges trying to build a healthy stock portfolio. Now, even as the market hits new highs, there is a new hurdle to throw into the mix: the dramatically shrinking list of companies willing to sell shares to the public.

Companies have been gobbled up in mergers or gone private. Some have thrown up their hands in disgust with Wall Street. Others have been involuntarily delisted because their businesses are suffering. Meanwhile, the engine of new stocks, the initial public offering market, remains moribund. The stock market is shrinking. The number of companies that individual investors can buy shares in is in a breathtaking decline, continuing a fall that’s been years in the making, but that’s accelerated this year with its record-breaking start to takeovers, mergers and buyouts. “The stock market is going private,” says Robert Maltbie of Singular Research. “It keeps self consuming.”

(USAToday)

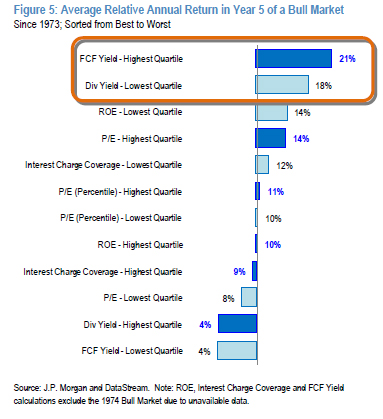

If you don’t think that Cyprus will sink the Global economy, then here is a great chart by Thomas Lee’s team at JPMorgan showing where you should hunt…

This chart shows various factor returns for the 5th year of a bull market (which we are now in). It makes all the sense in the world that in the 5th year of a bull market the economy is well past its panic/fear lows and corporate executives are getting more optimistic as unit volume growth continues to be positive. The continued unit growth will push plants and operations to become more utilized while there is still plenty of capacity in the system. So incremental margins will move higher and accelerate free cash flow (FCF) margins. As the numbers below show, finding those companies with high and rising FCF yields will most benefit your portfolio. For names, look to the industrial sector where companies with paid for fixed capacity that are not in need of capex will gush free cash flow as throughput increases. Interesting to note that high dividend players underperform the market in year 5. Not only will lower quality, more cyclical companies tend to outperform as the economy ramps, but also investors will be looking to move into those rising FCF names where out year dividends could be raised significantly.

Of course we do not want to own cyclically exposed names if a recession is around the corner…

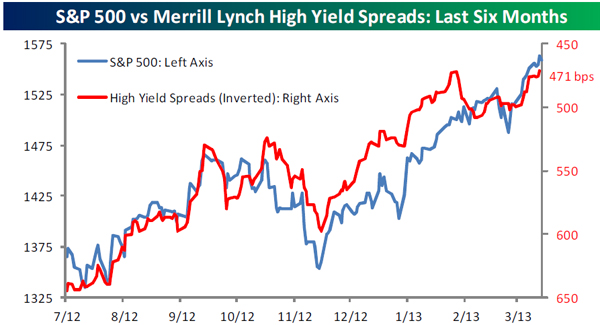

But as this chart of High Yield Spreads (inverted) shows; there is little indication of a significant economic slowdown being priced into the market.

(Bespoke)

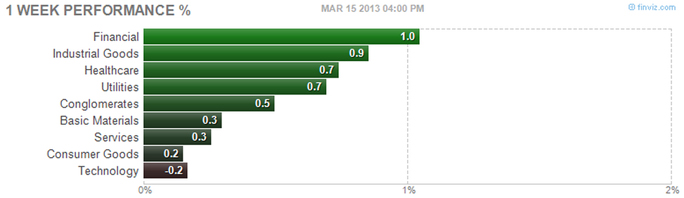

It was a quiet week of performance with the major U.S. sectors mostly floating higher…

Banks got help from the mostly better than expected stress test results.

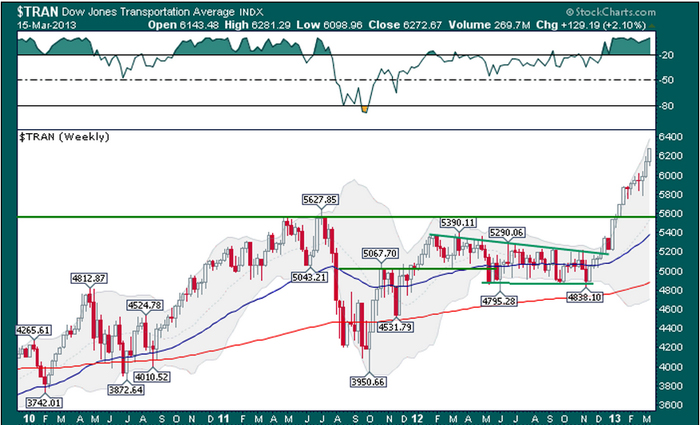

Transports refuse to slow down. If you believe the JPMorgan chart above, this is one sector with significant incremental free cash flow margins. (Just keep an eye on fuel prices!)

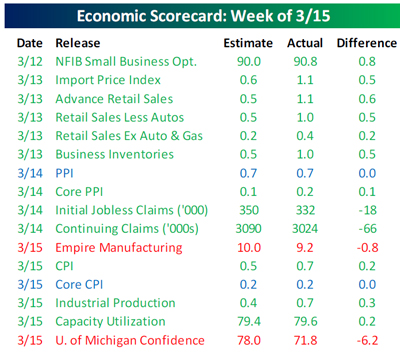

Another week of better than expected Economic data points…

An impressive new low in the weekly Jobless Claims, will the string continue as the sequester hits?

(Bespoke)

There is a big list of housing data to be released this week…

- NAHB Index

- Housing Starts

- Building Permits

- Existing Home Sales

- FHFA House Price Index

- LEN/Lennar is reporting earnings

- KBH/KBHome is reporting earnings

From all the recent surveys and trends, we can expect that orders and permits will be solid. The big question for the new home construction industry is whether or not they can deliver on all the current demand.

Speaking of demand, here is a read on Residential Real Estate in Dallas…’Offer Now or Forever Hold Your Peace’

“Being in the ‘Dallas market,’ I can attest to the rapid-fire approach buyers are being forced to take when showing serious interest in a home. Last night at 8 p.m., my husband and I got an alert from our Redfin mobile app letting us know a home went on the market in our price range. Within 30 minutes, my husband and I had driven by the house, approved of the neighborhood and texted our Realtor to see if we could take a look today. Since the home had everything on our checklist, we all decided it would be smart to move quickly and see the home during our lunch break. By the time we got there at noon, three other interested potential buyers had toured the home (which didn’t even have a for sale sign up yet, by the way).”

(HousingWire)

Meanwhile, institutional investors into the asset class are increasing their allocations…

Blackstone Group LP (BX), manager of the largest real estate private-equity fund, has expanded a credit line to buy single-family homes to $2.1 billion from $600 million, according to a person with knowledge of the deal… “The deal demonstrates that the market for these types of loans is expanding and maturing as major Wall Street banks become more and more comfortable with the asset class,” Stephen Blevit, an attorney for Sidley Austin LLP who represented Deutsche Bank, said in an e-mail from Los Angeles. Blackstone has invested $3.5 billion to buy 20,000 single-family rental homes since last year, making the New York-based company the largest investor of its type in the U.S. The firm is rushing to acquire properties as housing prices recover and as demand for rentals increases among people who can’t qualify for a mortgage or don’t want to own.

(Bloomberg)

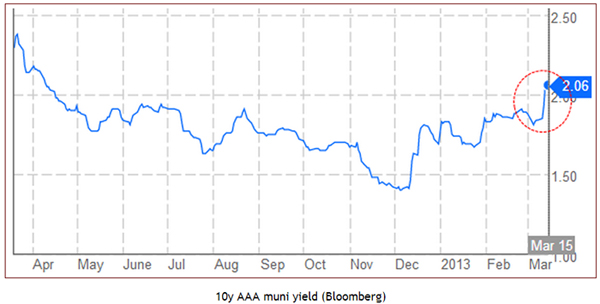

@DividendMaster: Just keep in mind you folks looking at munis. They are NOT down for rate or credit reasons. Obama & GOP have tax changes for munis in play.

So why are Municipal Bonds trading lower (and yields higher)…

- Typical seasonal sell off to fund rising Federal income tax payments?

- Debt battles in Washington D.C. causing lawmakers to eye the tax deductibility of munis for the wealthy?

- Job growth focused states like Kansas and Louisiana looking to cut state income taxes (making munis worth less)?

Illinois pension problems and SEC fraud declaration causing muni investor angst?

Even Chart Geeks are taking notice of the action in Municipal ETFs…

Speaking of Muni’s… there was an Earthquake in Los Angeles on Friday that was felt in Sacramento all weekend…

Bill Maher, the host of HBO’s Real Time:

“You know what? Rich people – I’m sure you’d agree with this – actually do pay the freight in this country.”

“I just saw these statistics,” he continued, “I mean, something like 70 percent. And here in California, I just want to say liberals – you could actually lose me. It’s outrageous what we’re paying – over 50 percent. I’m willing to pay my share, but yeah, it’s ridiculous.”

(YouTube)

Why Amazon loves its Prime customers…

CIRP’s market research found those Prime members annually spent more than twice as much on average ($1,224) than non-Prime customers ($505). Adding in the $79 membership fee, Prime members bring nearly $800 more in sales per customer to Amazon. After subtracting all the additional costs of doing business with Prime customers — mainly greater expenses for sales, shipping and video streaming — Morningstar analyst R.J. Hottovy found that Prime members accounted for $78 more in profit before interest and taxes per customer than non-Prime customers. That’s almost exactly the cost of a Prime membership.

To put that figure in context: Amazon’s average operating income last year per each of its 182 million total customers came to less than $10. In other words, every Prime member is about eight times as valuable to Amazon as a non-Prime member. Put yet another way: More than one-third of Amazon’s profits before interest and taxes came from fewer than four percent of the people who buy stuff on Amazon.

“They have hit on a means of creating some very, very valuable customers,” says Michael Levin, a partner at CIRP.

(Wired)

A new technology application that could help solve one of the planet’s biggest problems…

A defense contractor better known for building jet fighters and lethal missiles says it has found a way to slash the amount of energy needed to remove salt from seawater, potentially making it vastly cheaper to produce clean water at a time when scarcity has become a global security issue. The process, officials and engineers at Lockheed Martin Corp. say, would enable filter manufacturers to produce thin carbon membranes with regular holes about a nanometer in size that are large enough to allow water to pass through, but small enough to block the molecules of salt in seawater. A nanometer is a billionth of a meter.

Because the sheets of pure carbon known as graphene are so thin – just one atom in thickness – it takes much less energy to push the seawater through the filter with the force required to separate the salt from the water, they said. The development could spare underdeveloped countries from having to build exotic, expensive pumping stations needed in plants that use a desalination process called reverse osmosis. “It’s 500 times thinner than the best filter on the market today and a thousand times stronger,” said John Stetson, the engineer who has been working on the idea. “The energy that’s required and the pressure that’s required to filter salt is approximately 100 times less.”

(Reuters)

For those of us who have spent too much time on airplanes…

@jasoncollette: Can we use this for the boarding process as well?

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] There you will find 61563 more Info to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Here you will find 13318 additional Info to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Here you can find 34787 additional Information on that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/03/19/361-capital-weekly-research-briefing-37/ […]