I was having a discussion with the CEO of one of the largest financial media companies in the country yesterday.

A few points I made:

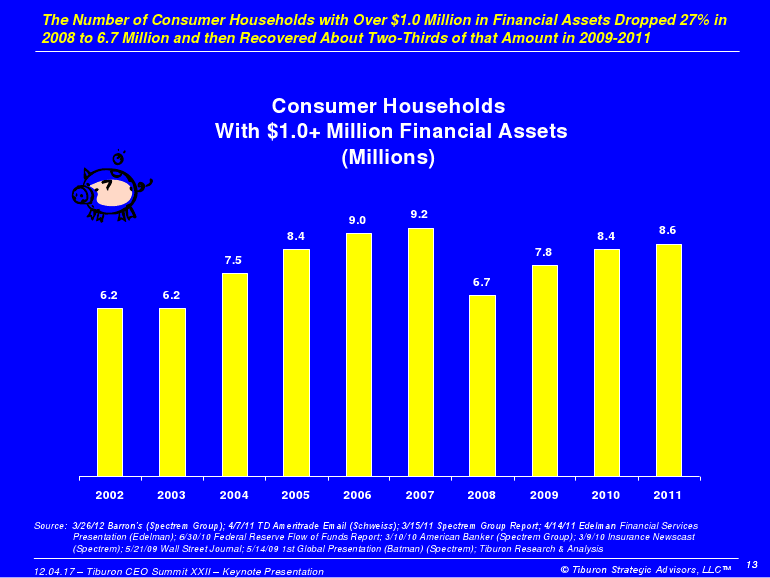

1. The population of DIY investors who want to actively trade their own stocks each day and need news that caters to them is small and shrinking (their estimates are that the number is 3 million people in the US). To focus primarily on this segment misses the bigger picture – the 8.6 million millionaire households that truly need help with longer-term planning, not stock ideas. See the below slide from Chip Roame’s Tiburon CEO Summit last year:

2. But this is how most financial media properties are geared – everyone’s doing sites and apps and content about which stocks to buy and sell and how to react to economic / earnings news. It’s pretty crowded and when people try to stand out in crowds they tend to shout, post things in ALL-CAPS and engage in hyperbole.

3. The real wealth in this country (US investors have $59.4 trillion of net worth excluding their houses) doesn’t give a shit about whether or not they should buy Netflix – they want content, insight and information that helps them with planning, portfolio construction, asset allocation and true investing – not just trading, trading, trading.

4. The financial media is irrationally addicted to trading stories because they have urgency and they’re entertaining, even if ultimately unsatisfying to the 90 million Americans who are trying to figure out what to do with their wealth. There is a relentless focus on analyst research calls, upgrades and downgrades, economic data releases, merger and acquisition buzz, hedge fund activity etc. This is all highly interesting and I personally enjoy both consuming and creating this type of content as well. But it should not be the only thing on the web / airwaves. It is disproportionately dominant when compared to its actual utility for the majority of the audience. There is a huge content arbitrage opportunity here.

5. This is very much a junk food versus eating your veggies conundrum and we know who usually wins these tug-o-wars in real life. It’s not that people don’t need to know the macro news or the state of the markets each day – it’s that this stuff is really only relevant to them as it affects their portfolios and, by extension, their lives. Financial content and journalists can and should do more to connect the two in their reporting.

6. Some media outlet, print or television or radio, is going to figure this out and exploit it. Many media companies do not make the distinction between investing and daytrading, but they should. Making the investing process fun and exciting is not hard to do with the right talent, writers and format. Focusing on process versus outcomes will also engage professionals to share this content and participate in its manufacture as well.

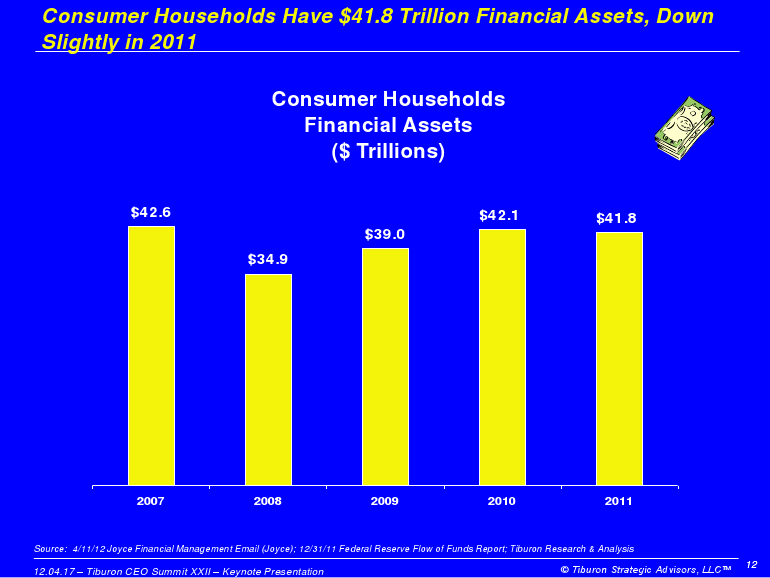

7. The advertisers – from luxury auto companies to ETF arms dealers – will beat a path to your door once you establish dominance in this market. Here’s what is at stake in dollar terms (also from Roame’s presentation):

8. There are thousands of potential content creators from the asset management and wealth management verticals who are essentially untapped and more than eager to participate in this sort of thing.

9. The news of the day is only part of the key to appealing to this audience – portfolio analytics and measurement tools to help them track where they are in their retirement goals – along with risk management gauges – will give people a reason to check back in and engage if you can’t get them in via trading ideas or “breaking news”.

10. Most market commentary – by definition – is stale within hours of being produced or published. I have personally created over 8000 pieces of it and believe me, nobody will ever read 99% of what I’ve done prior to last week unless I’m accused of a triple homicide and claim to have buried clues to the crime within my old posts. But content that deals with real investing as opposed to “trade the news” is a lot more evergreen. Given this reality, you would assume the media would find it more profitable to emphasize this kind of stuff…

I think the existence of this disconnect is fascinating, so many people’s mindsets are locked in this late-90’s paradigm of stockpicking as a hobby. And yet even a casual glance at the fund flows over the last few years would tell you that the Boomers have moved away from this kind of activity while the newer generations of investors (X, Y, Millennials) have never been interested in it.

Anyway, someone’s going to figure this out and do it right. Maybe.

Below, a quick and very incomplete list of financial media outlets, people and sites that emphasize investing:

Tadas Viskanta (Abnormal Returns)

Bob Seawright (Above the Market)

Jason Zweig (WSJ’s Intelligent Investor)

Tom Brakke (Research Puzzle)

Context (AllianceBernstein)

There are more out there, what are your favorite investing resources?

aflampornhd

[…]one of our guests just lately suggested the following website[…]

adult seo

[…]Here is a great Blog You might Discover Intriguing that we Encourage You[…]

best sex toys 2016

[…]that is the finish of this write-up. Right here you will uncover some sites that we think you will enjoy, just click the hyperlinks over[…]

cat drawing

[…]Here is a superb Weblog You may Come across Fascinating that we Encourage You[…]

tongue vibrators

[…]one of our guests not too long ago proposed the following website[…]

best lubricant for sex

[…]that will be the end of this write-up. Right here you will uncover some internet sites that we assume you will appreciate, just click the hyperlinks over[…]

how to masturbate

[…]that will be the end of this article. Right here you will find some web-sites that we believe youll value, just click the hyperlinks over[…]

sex confession

[…]below you will discover the link to some web-sites that we believe you ought to visit[…]

best strap on for lesbian

[…]always a significant fan of linking to bloggers that I enjoy but dont get a great deal of link like from[…]

house dj

[…]very couple of web-sites that transpire to be comprehensive below, from our point of view are undoubtedly well really worth checking out[…]

real estate inspection

[…]The data talked about inside the write-up are some of the top offered […]

home real estate inspections hawaii

[…]very handful of web sites that take place to be detailed beneath, from our point of view are undoubtedly very well worth checking out[…]

lingerie and clubbing boutique shop

[…]Sites of interest we’ve a link to[…]

Adam & Eve G-Motion Rabbit Wand

[…]we prefer to honor lots of other web web-sites on the web, even if they arent linked to us, by linking to them. Under are some webpages really worth checking out[…]

Luxury Vibrator

[…]very few web-sites that come about to become comprehensive below, from our point of view are undoubtedly well worth checking out[…]