Josh here – you might remember Morningstar’s launch a bit more than a year ago of qualitative rankings for mutual funds. The big knock on Morningstar’s star ranking system has historically been that it is extremely backward-looking and overly focused on past performance – which offered little in the way of forward guidance for investors who don’t own time machines. And so Morningstar assigned some analysts to screen for more than just prior performance in an effort to make some judgments about which funds might be able to perform well in the future.

Wall Street Ranter, a financial professional who blogs here has done the below post-mortem on how this ranking system has done after its first full year. There are some interesting observations here, I wonder what Morningstar thinks of this internally….

***

Last year I wrote about Morningstar’s new analyst ratings for mutual funds (here as well). These are different from their Star Ratings in the fact that these are meant to be “forward looking”. From Morningstar (bold added by me)

“The Analyst Rating is based on the analyst’s conviction in the fund’s ability to outperform its peer group and/or relevant benchmark on a risk-adjusted basis over the long term. If a fund receives a positive rating of Gold, Silver, or Bronze, it means Morningstar analysts think highly of the fund and expect it to outperform over a full market cycle of at least five years.“

Now it should be clear that these ratings are longer-term in nature so take the following breakdown with a grain of salt but I said I would follow-up on these so I am.

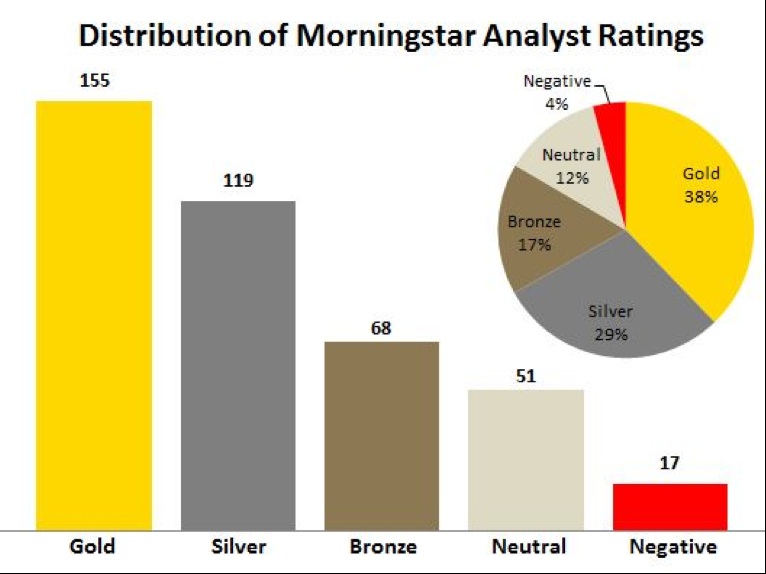

First lets start with a review of what the distribution of Morningstar’s Analyst Ratings looked like at the start of 2012

While the distribution of ratings has gotten a little better it remains a mystery why Morningstar has an allergic reaction to assigning negative ratings. As of the start of 2013 they have now rated 1069 funds but only 52 (or less then 5%) have negative ratings. Although the neutral ratings have increased to 28%, Bronze to 25%, Silver is down to 24% and Gold down to about 18%.

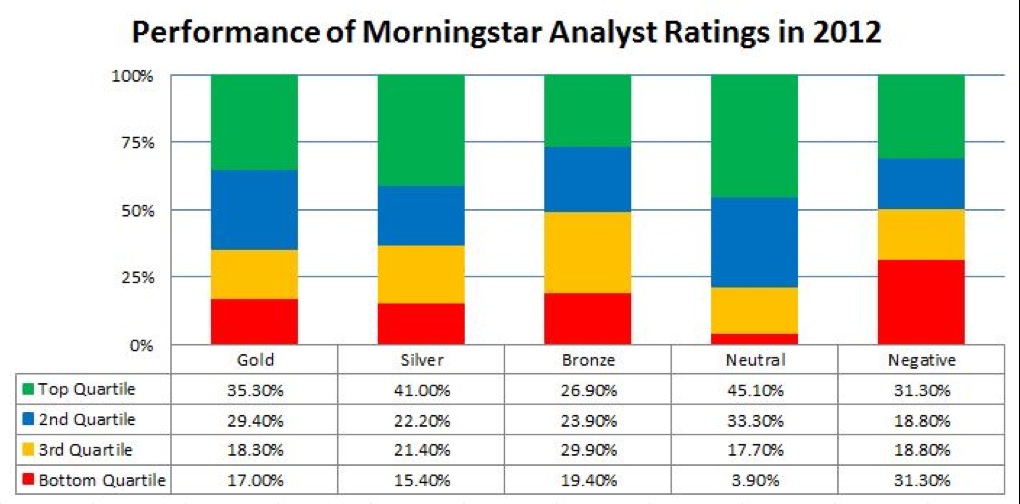

Without further ado, below is how the rated funds performed in 2012. These only include funds rated at thestart of 2012.

Not much really stands out after the first year. While their was a slight positive result for Gold and Silver rated funds, Neutral rated funds did even better. As for Bronze and Negative rated funds, outperformance was pretty much a coin flip.

Below is the Average Rank for each, as you can see Neutral rated funds performed the best and Negatively rated funds performed the worst.

Take this for what it’s worth, which at this point is not much because full market cycles are indeed a better measuring stick. For instance, in 1999 and 2006/2007 a lot of bad managers did good thinking the unsustainable was in fact sustainable while a lot of good managers did bad as they realized irrationality when they saw it. However, this is at least a starting point for looking at the performance of these Analyst Ratings.

***

Source:

Follow @WallStreet_Rant on Twitter

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/02/18/how-did-morningstars-new-ranking-system-fare-in-2012/ […]