Springsteen had it about right.

This morning Apple is gapping down to multi-year lows, headed solidly into Gundlach’s target territory in the low 400s it would seem.

It’s one of the most widely-held stocks in the world, by individuals and pros, and had briefly become the largest stock by market cap as well. Selling the stock had become something of a heresy by early 2012 and those who were not at least equal-weight the name were condemned, by basic arithmetic, to under-performance purgatory.

But nothing lasts forever.

Apple had never been a recommendation of ours but we’ve liked the stock (and certainly the company). We’ve got some clients who had transferred in Apple shares from elsewhere, with cost averages all over the map. Last October we trimmed those AAPL positions by a third to a half owing to the technical breakdown below 600. But the rest of it we were compelled to keep for the much longer-term. The way the stock’s being treated of late, I find myself pining for a time machine…

While the business of Apple is in great shape and the company remains incredibly healthy, the stock itself is in the throes of a major event – the realization that nothing lasts forever.

This blog has always been about taking lessons from both good and bad market events. For those who got Apple right toward the top and were short, this is a great validation of a very contrarian call. For those who’ve held onto the stock or bought any of the false bottoms in the 500s and 600s, this is a tough day but one in which several things can be learned.

Here are what I believe to be the seven most important lessons:

1. A fairly minor change in fundamentals for a company can occur subtly, but have a major impact on share price. In this case, Apple’s growth rate. The company did not slam on the brakes, nor did their customers, and has not hit The Street with a jaw-dropping susprise loss or anything like that (see Rolfe Winkler at the WSJ for the actual growth numbers this quarter). But this growth rate was unimpressive relative to expectations and expectations are everything in the short-term.

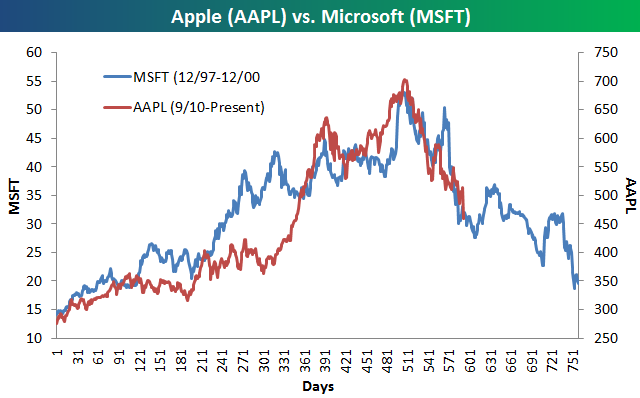

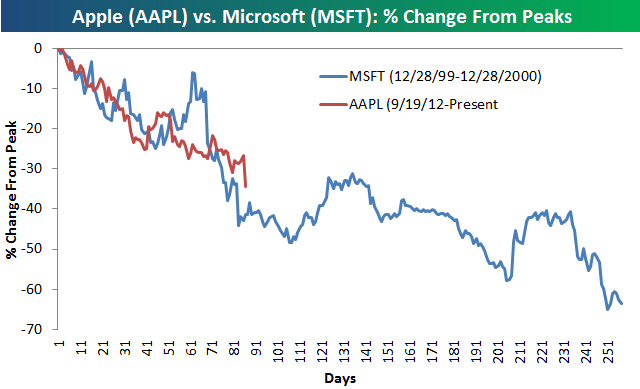

2. There is no King of All Stocks – we merely elect a temporary King, who then serves an indeterminate term at the top. Sooner or later, he is deposed – and frequently beheaded. For a great corollary, please see the below charts from Justin and Paul at Bespoke comparing the rise and fall of Apple to the rise and fall of Microsoft.

3. Jeff Gundlach is dabbling in the Occult. Here he is in May of last year warning that the stock is toast. And his victory lap this morning, lowering his price target to 300 from the initial 425 (from when the stock was 700).

4. There’s no such thing as a tech value stock. This is something we’ve discussed here a lot. Apple’s cash position, which grows by the second, is north of $125 billion or 37% of the market cap. Netting out that cash, the stock trades at 7.1 times this year’s earnings – half the multiple of the S&P 500. Nobody cares. The shareholder base is comprised of trapped momentum guys and GARP fund managers – not value managers. They’ll come in later when growth has truly ground to a halt. For now, the company’s balance sheet will avail it no mercy, no quarter.

5. The good news is that a quarter like last night’s means that expectations are being reset lower, more achievable levels. Jay Yarow says this is the most constructive thing to happen for the company in awhile.

6. My friend Brian Shannon, a technician and hardcore trader, noted this morning that news and surprises from a company tend to follow in the direction of the stock price. This is an insight so completely elemental to investing and trading that everyone should know it. A downtrending stock, unable to hold support and with evidence of distribution, will tend to have negative announcements and news events. A stock under accumulation and “acting well” will typically surprise to the upside. This is because the market knows and there is a such thing as business momentum to go along with stock momentum. Look at Celgene (CELG) of late for a positive example of this.

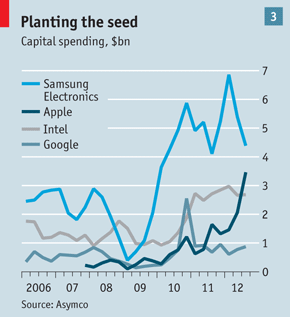

7. Innovate, execute, period. If Apple cannot innovate and execute the way it historically has, nothing else you read or see will matter. I think that’s the bottom line. So can they? Most of the chattering classes believe that they cannot. That Steve Jobs is gone and Cook is a bean-counter. One of the nation’s premier Apple watchers disagrees however, he thinks cap-ex tells the tale of a company just warming up in The Economist today:

“However, Horace Dediu of Asymco, a research firm, says it would be a mistake to think Apple is resting on its laurels. He notes that its capital expenditure has soared in recent quarters, reaching levels typically seen at firms with huge manufacturing operations, such as Intel (see chart 3).

“However, Horace Dediu of Asymco, a research firm, says it would be a mistake to think Apple is resting on its laurels. He notes that its capital expenditure has soared in recent quarters, reaching levels typically seen at firms with huge manufacturing operations, such as Intel (see chart 3).

Some of this money is going into data centres to support cloud services like iTunes. But Mr Dediu reckons much of it is being spent on dedicated production equipment at suppliers. This could give Apple an edge in producing new gadgets.”

On December 15th, in describing the carnage in Apple headed into year end, I speculated that Apple probably had to get under $500 at some point to test the desperation of sellers to be out of it. Well now its here and the sellers don’t seem to be phased by valuations or anything else – this is a broken momentum stock and nobody wants to be caught dead with it on the books.

I don’t have any sense as to when this ends. But I think the points above the best takeaways from the whole episode so far.

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] There you can find 88543 additional Information to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] There you can find 65895 more Information to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Here you will find 31571 additional Information on that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] There you can find 87165 more Info to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]

… [Trackback]

[…] Here you can find 1682 additional Information to that Topic: thereformedbroker.com/2013/01/24/everything-dies-baby-thats-a-fact-seven-lessons-from-apple/ […]