361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

January 9, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Happy 2013!

@BorowitzReport: It’s a great week for America: we didn’t go over the cliff, and a new study says being fat makes you live longer.

@alansmurray: The fiscal cliff deal solves next to nothing — budget, debt, broken government, etc. But the market is happy, so Happy New Year!

@holowesko: Fiscal Cliff deal a sad sign of my generation pushing problems on our children. Youth unemployment too high & we burden them with our debt.

Over the holiday break, I took the kids to see Parental Guidance. There was a timely scene where Billy Crystal teaches his grandchildren how to play Kick the Can. As they played, it began to rain and everyone fell in the mud and became quite filthy. Meanwhile, over in Washington D.C. the same game was being played also in a muddy yard. While it was great that Congress was able to pass a bill that would avoid the sequester and tax hikes that would have created a 2013 recession, it was underwhelming that little was done on the spending side.

As a result, I have created the script outline for Parental Guidance 2. While on a national mathlete competition in Washington D.C., the educated youth lead a hijacking of Congress with their demands to create an achievable budget that will set a timeline for paying off the $17 trillion in debt and $50 trillion in off balance sheet entitlement obligations. The middle of the movie could be slow as finance and accounting professors are brought in to educate Congress, so Jonah Hill and Robin Williams should be cast as the teachers. Unlike the first film, but in keeping in the spirit of Washington, PG2 will be styled as pure horror with comedic elements. The 2nd half of movie will resemble Dog Day Afternoon as if directed by Quentin Tarantino, but being Hollywood, it will have a happy ending…well, that is if you are an American kid not planning on immigrating to China, Brazil or Canada. For Parental Guidance 3, I will just update the Logan’s Run screenplay.

Anyway, back to the markets…

• The first week of 2013 saw a massive global equity rally after VP Biden and Senate Minority Leader McConnell brokered a deal to stave off the fiscal cliff at the last possible moment. Although the deal has deferred hard choices on spending for two more months, investors plowed funds into risk assets in steady one-way trading as uncertainties about tax rates were settled. The VIX Volatility Index saw its biggest one-week loss in more than 25 years and dropped below the 14 level (the measure has finished below that level just 4 times). (TradeTheNews)

• After a short respite, investors should prepare for an escalation of the budget battles between President Obama and congressional Republicans. Looking ahead, getting an agreement to raise the debt ceiling is going to be extremely difficult, and there is a very real possibility — at least one-in-four — that we will have a technical default. The odds of any kind of grand bargain or comprehensive agreement that would reduce the deficit enough to prevent the credit rating agencies from downgrading the U.S. have declined significantly. The sequester will probably kick in beginning in March. Investors should prepare for months of trench warfare on the budget and the odds of the worst-case outcomes are on the rise. (Andy Laperriere, ISI Group)

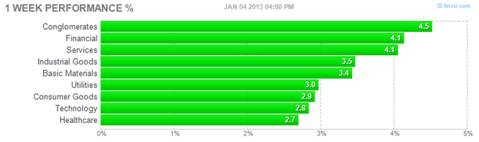

• Did you notice that the markets had a 5 year closing high in the S&P500 on Friday? Not only did many indexes and sectors approach multi year highs, but the internals are very supportive of higher prices with the riskier equity groups leading the charge: Financials, Homebuilders, Transports, Small Caps, Biotechs, Energy, Materials, and China.

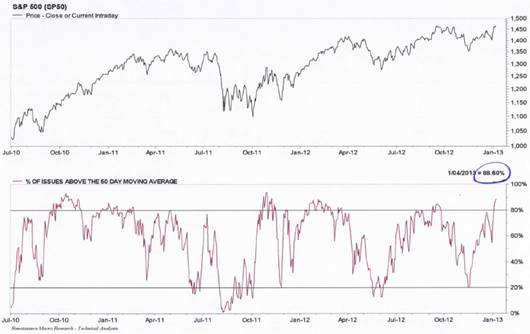

In the short term, the equity market is overbought as nearly 90% of stocks are trading above their 50dMA…

Maybe a pause and a pullback is in store for the rest of January, but with many looking for one, it is less likely to occur. More likely will be reactionary moves to the upcoming Q4 earnings reports. Alcoa starts the show on Tuesday with the heaviest reports coming in the 3rd and 4th week of the month. Stocks are up into earnings period which is not usually a good sign for the bulls. Of interest is that stocks have risen even as estimates have fallen 5% into the earnings prints. So maybe the market is prepared for bad news and guidance. We shall soon see.

(RenMac)

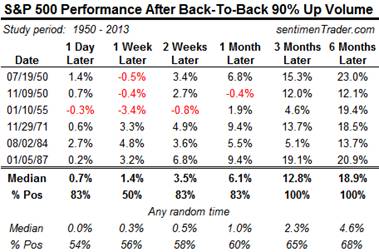

Two of our favorite market seers highlighted the Back-to-Back 90% UP volume days on 12/31 & 1/2.

It could have easily been back-to-back 90% DOWN volume days had Congress voted against the year-end bill, but they didn’t and odds of a 2013 recession shrunk dramatically.

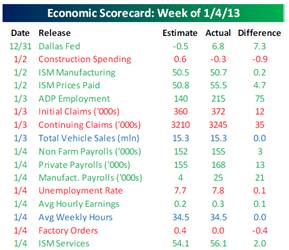

It was a busy week for football and economic data. Helping the markets was a set of data that played like a Duck and not a Gator…

(Bespoke)

But the surprising play that was thrown into the markets on Thursday was a possible disagreement within the Fed…

A new fault line has opened up at the Federal Reserve over how long to continue bond-buying programs aimed at spurring stronger economic growth. Minutes released Thursday of the Fed’s Dec. 11-12 policy meeting showed that officials were divided. Some wanted to continue the programs through the end of 2013, others wanted to end them well before then and a minority wanted to halt the programs right away…

“While almost all members thought that the asset-purchase program begun in September had been effective and supportive of growth, they also generally saw that the benefits of ongoing purchases were uncertain and that the potential costs could rise as the size of the balance sheet increased,” the minutes showed. Officials worried that, among other things, the Fed’s large and growing balance sheet could make it hard to tighten credit down the road if inflation heats up. Though the Fed has tied its decision on bond buying to the performance of the labor market, it hasn’t specified how it will judge whether the labor market has improved “substantially.” (WSJ)

The largest bond fund manager agrees that the punch will not taste any better than it does today…

When the Fed buys $1 trillion worth of Treasuries and mortgages annually, as it is now doing, it effectively is financing 80% of the deficit for free…This is about as good as it can get folks. Money for nothing. Debt for free…

Investors should be alert to the long-term inflationary thrust of such check writing. While they are not likely to breathe fire in 2013, the inflationary dragons lurk in the “out” years towards which long-term bond yields are measured. You should avoid them and confine your maturities and bond durations to short/intermediate targets supported by Fed policies. (Pimco)

“The great bear market in bonds, both corporates and governments, lasted 35 years, from 1946 to 1981. The bull market lasted about 30 years. A new bear market almost certainly has begun.” (Floyd Norris, NYT)

All sectors in the green last week with the more cyclical and least defensive outperforming…

The 3 most watched charts in the market right now…

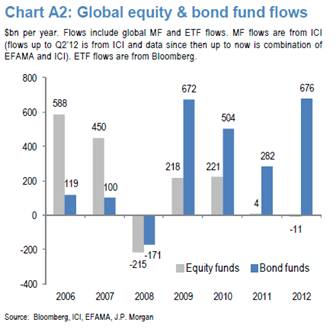

If you thought Apple was overbought in 2012, where do you think bonds stand after 4 years of massive inflows?

And Gold is a great place to hide with inflation on the horizon and corporate earnings risk on deck. But is it also over owned by non-traditional investors who are now looking for more equity risk and dividend income?

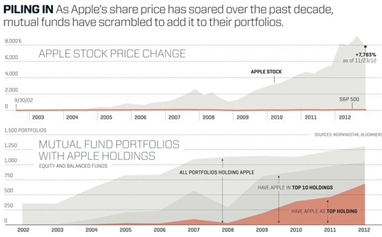

Apple’s chart is closely followed because it is still one of the most widely held equities of all fund managers. While it is a fine company, the stock is still up from $7 just 10 years ago and has been one of the better wealth creators and thus window dressing stock to keep the good times rolling for an investment review and job security. But because it is so widely owned it, can also be viewed as a source of cash for the rest of the market if the shine of the white apple sparkles a little less. And right now, Samsung’s new phone, the William Tell/Galaxy 3 (Samsung) is winning all the geek offs.

A reminder on Apple’s importance to the asset management industry…

(Fortune)

Dr. Damodaran’s thoughts on AAPL…

At $500/share, in my view, Apple is under valued and I believe that my assessment of value is a sober one, with little built in value added from future game changers. Apple reinvented the personal music player business (with the iPod), inspired the smart phone business (with the iPhone), created the tablet business (with the iPad), reconfigured the entertainment retail business (with iTunes and the Apple stores) and there is no reason why it cannot change other businesses and generate additional value for its investors. I am still nervous about my fellow travelers in this stock and how they may cause the price to deviate from value, but I am more sanguine than I was in April for two reasons. First, many of these investors are fickle and I would not be surprised to see the same momentum investors, who jumped on the bandwagon when the stock was going up, abandon it now. Second, l can live with the price noise if Apple were a smaller portion of my portfolio and I can make that choice. So, I have a buy limit order for Apple at $500 and I may or may not be an Apple stockholder this new year, depending on what the stock does in the next two days. I am okay either way! (aswathdamodaran)

Back to looking at Bonds. It is officially a record year for inflows…

Global retail investors bought close to $680bn of bond funds in 2012, surpassing the previous peak seen in 2009. In contrast, they sold $23bn of equity funds in 2012, making the gap between bond fund and equity fund buying also the highest on record. (Nikolaos Panigirtzoglou, JPMorgan)

Barron’s and BlackRock agree that bond yields have more risk…

It’s hard to make a case for two of the lowest-yielding parts of the bond market — Treasuries and mortgage securities — because yields are in the 1% to 3% area, and both sectors could be hit hard if rates rise. Perhaps the best that can be said for Treasuries is that they’re one of the few asset classes that are negatively correlated with stocks, meaning they tend to appreciate when stocks fall, and thus offer a hedge against a stock-market downdraft. BlackRock favors dividend-paying stocks and junk bonds, while warning about the danger in Treasuries. “We believe dividend stocks look attractive,” wrote BlackRock chief investment strategist Russ Koesterich last week. “With current payout ratios near historic lows and balance sheets quite strong, companies have ample ability to raise dividend payments to compensate investors for any changes in tax treatment.” As for Treasuries, he wrote that interest-rate risk is high, as underscored last week when prices fell 4% as stocks rallied. (Barron’s)

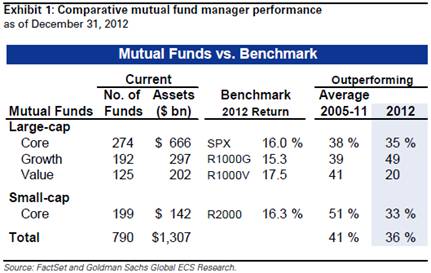

Shifting to Equity fund performance, it was another tough year for mutual and hedge fund managers…

2012 was a strong year for stock returns but a poor year for managers: Nearly two-thirds of U.S. equity mutual funds lagged their benchmarks. Our analysis of $1.3 trillion in U.S. equity mutual fund assets reveals that 65% of large-cap core, 51% of large-cap growth, 80% of large-cap value, and 67% of small-cap mutual funds underperformed their respective benchmarks, S&P 500 (16.0%), Russell 1000 Growth (15.3%), Russell 1000 Value (17.5%), and Russell 2000 (16.3%). Hedge funds also underperformed. 88% of hedge funds were lagging the S&P 500 as of December 21st. With one week remaining in 2012, the typical hedge fund was up 8.1%, with a standard deviation of 10 pp. (Goldman Sachs)

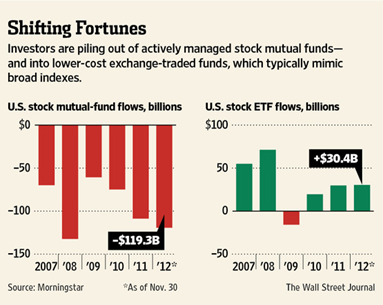

And as a result, ETFs are likely to continue to gain assets versus their actively managed peers…

U.S. mutual funds that invested in large growth stocks in 2012 returned an average of 15.3%, while the similar ETFs tracking the index returned 16.4%, according to Morningstar. (WSJ)

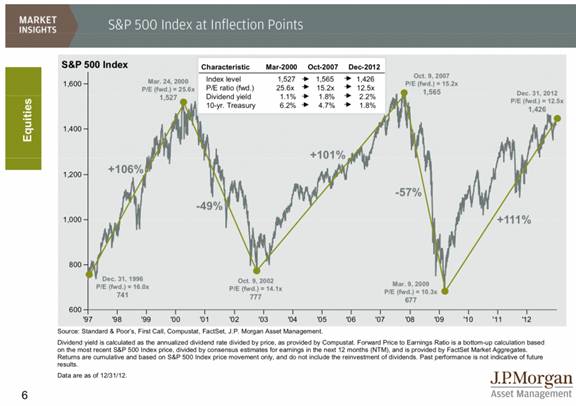

A great chart… Note how the P/E & Dividend Yield valuation improves at each peak…

(JPMorgan via BusinessInsider)

I have always been a fan of Byron Wien’s Surprise list. Here is my favorite choice for his win column…

In a surprise reversal the Democrats sponsor a vigorous program to make the United States independent of Middle East oil imports before 2020. The price of West Texas Intermediate crude falls to $70 a barrel. The Administration proposes easing restrictions on hydraulic fracking for oil and gas in less populated areas and allowing more drilling on Federal land. They see energy production, infrastructure and housing as the key job creators in the 2013 economy. (Fortune)

Maybe the solution to faster employment growth in the U.S. is to shut down the NFL, NBA and MLB?

BTW, did you see Canada employment? That number was a barn-burner. The real upside surprise seems to be taking place north of the border. Canadian employment advanced 39,800 (or close to 400,000 in U.S.-adjusted terms) exclusively because of full-time employment. And, the unemployment rate fell to a cycle low of 7.1%. And, at 66.8%, Canada’s labor force participation rate is over 3ppts higher than the U.S. (RenMac)

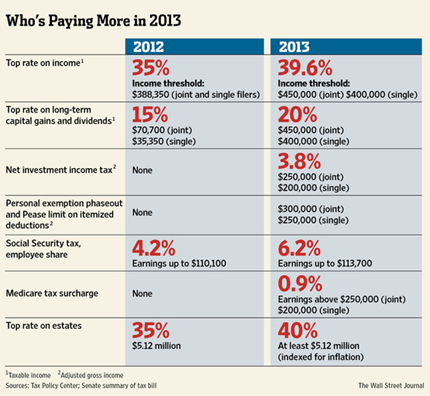

In case you were at a BCS Bowl game last week, here is what top tax rates will do in 2013…

(WSJ)

If you live in a City or State that is addicted to Pension Obligation Bonds, consider renting versus buying and keep U-Haul’s number on your speed dial…

“It’s like borrowing money to pay your groceries. If you do that every month, you’re going to end up with a lot of debt, and you continue to need to pay your groceries,” Van Wagner said…The Center for Retirement Research’s study, which examined nearly 3,000 pension obligation bonds issued by 236 governments between 1986 and 2009, found that most of the bonds did not work as government officials had hoped. “Only those bonds issued a very long time ago and those issued during dramatic stock market downturns have produced a positive return; all others are in the red,” the report stated. Issuing such bonds can also hurt a government’s credit rating and increase the cost of borrowing. According to a December report by Moody’s, pension obligation bonds tend to reflect poorly on the quality of management and is viewed as “part of a continuous pattern of reliance on one-time resources.” (HuffingtonPost)

Geeks get an NFL team to cheer for… the Buffalo Bills

“We are going to create and establish a very robust football analytics operation that we layer into our entire operation moving forward,” Brandon said. “That’s something that’s very important to me and the future of the franchise.” Analytics are de rigueur in baseball, where numbers are more easily crunchable, and have gained popularity in football over the past few years. Brandon is the former executive director of business development for the Florida Marlins. While there, Brandon said he learned a lot about the value of analytics from GM Dave Dombrowski, now president, CEO and GM of the Detroit Tigers. “Dave was all about scouting,” Brandon said. “He was also about layering in the analytics to what the game presented. We’ve seen it in the NBA. We’ve seen it more in baseball. It’s starting to spruce its head a little bit in football, and I feel we’re missing the target if we don’t invest in that area of our operation, and we will.” (BuffaloNews)

And if you have a back country or helicopter skiing trip planned in the future, here is a must read…

The Avalanche at Tunnel Creek. (NYTimes)

Finally…

While I typically shy away from product mentions in the Briefing, I couldn’t pass up the opportunity to mention both Morningstar’s and Lipper’s top performing Managed Futures fund for 2012. Click here for more information.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] There you can find 95634 more Information to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Here you can find 23170 additional Information on that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] There you will find 16220 more Info on that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/01/09/361-capital-weekly-research-briefing-27/ […]