“Fairness” in economic terms (or anywhere else in life) is a bullshit concept, as fantastical as Peter Pan’s shadow or Donald Trump’s self-awareness. Economic equality has never existed throughout human history since the Great Leap Forward 50,000 years ago, nor should we expect it to now.

Post-kindergarten, there’s no such thing as fairness. Some of your classmates turn out to be more physically attractive than you thanks to good genetics, they will live better lives than you with much less hardship and instant advantages in virtually every situation. This makes perfect sense because they are likely the product of a beautiful mother and a smart, high-earning father. Go stop by the elementary school in Westport, Connecticut if you’d like to see this demonstrated in real-life – they’re inadvertently building a Master Race up there of blonde-haired, blue-eyed future hedge fund managers and tennis phenoms, it’s actually quite frightening.

So no, life’s not fair – we make it on our wits, the connections we forge with others, the skills we learn, the lucky breaks that come our way, the sweat equity we’ve put into our work and the sheer statistical fortuitousness of not being struck down by a drunk driver. Some of us win big, some of us lose huge and the rest of us take what we can from this life just to get by. And it usually works out in the end, even though nothing along the way was ever “fair.”

So no, life’s not fair – we make it on our wits, the connections we forge with others, the skills we learn, the lucky breaks that come our way, the sweat equity we’ve put into our work and the sheer statistical fortuitousness of not being struck down by a drunk driver. Some of us win big, some of us lose huge and the rest of us take what we can from this life just to get by. And it usually works out in the end, even though nothing along the way was ever “fair.”

I don’t permit my kids to use “that’s not fair!” in their tearful appeals to me. Tony Soprano once shattered the windshield of his kid’s SUV upon hearing the term and it was probably the single most constructive thing he’s ever done for that little pain in the ass. I also don’t care much for President Obama’s frequent use of the phrase “fair share” either, it’s commie talk and it sparks a kneejerk aversion for half the country that has yet to do him any favors in his negotiation efforts.

So no, the economy isn’t fair and you can make a pretty strong case that it’s gotten less fair, but that fact alone will never sway those in power.

So instead of lamenting the lack of fairness, let’s talk about the stupidity of this hollowing out of the middle class in this country, year after year, with bought and paid for legislation and preferential tax treatment.

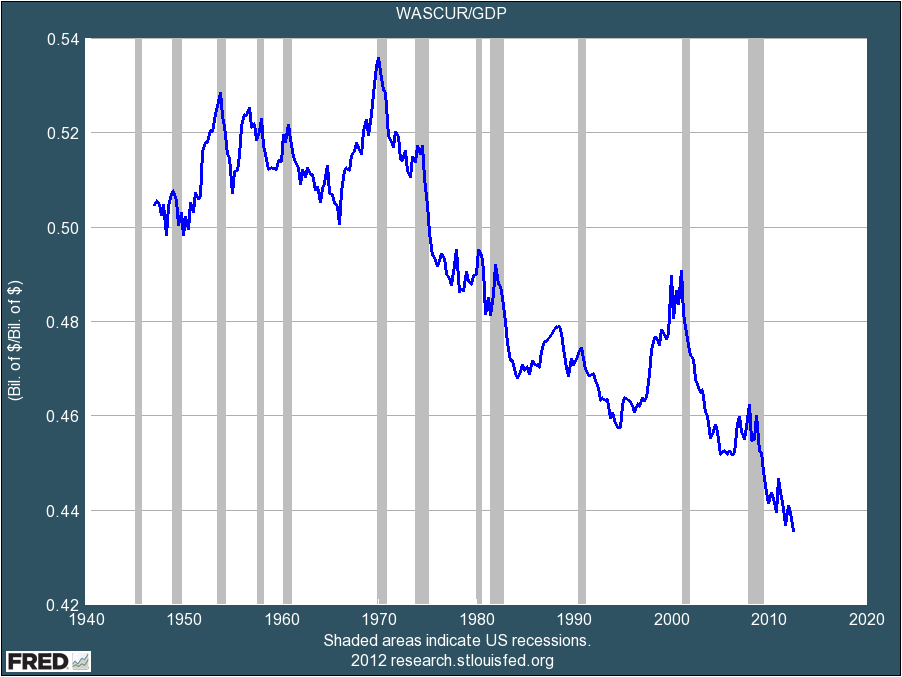

Henry Blodget demonstrated last night how, while corporate profits have never been higher, the wages paid to workers at these same corporations have never been lower. While corporate profit margins just hit a 70-year high, have a glance at wages as a percentage of GDP:

Corporations haven’t magically learned a new secret to profitability, they’ve just found a workaround to the need for a living wage in this country. Fuck it, someone else’s problem.

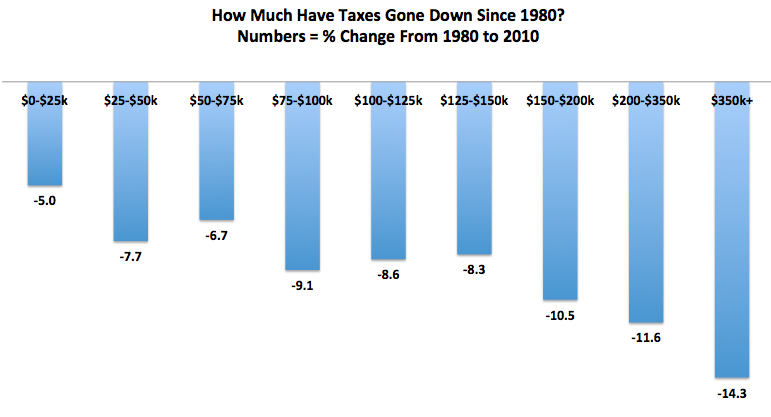

In the meanwhile, over at The Atlantic, Derek Thomson shows how, while tax rates for the median household in America have dropped by 7% since 1980, tax rates for the very wealthiest households have dropped by double, roughly 14%:

The fairness aspect is irrelevant – since when in the history of human civilization did wealthy people not make the rules so that their advantages would be assured? It is only when they go to far that there is a reset, a turning point like the beheading of French monarchs and the storming of the Bastille. Episodes like those are the exception, not the rule, which is why they’re so memorable in the first place. 99% of the time, the rich get richer and there is very little turnover in their ranks. Fine.

But the stupidity of having such an obviously unbalanced economy is the more important discussion we should be having right now. The corporations are every bit as vulnerable to the disappearance of the middle class as the middle class is itself.

They’ve managed around this issue thus far with an increasing emphasis on exports (now responsible for half of the S&P 500’s sales and profits) as well as systemic and legally-sanctioned overseas tax evasion. Consider that Exxon Mobil made $19 billion in profits in 2009 and paid zero Federal income tax (you want to laugh, they actually got a rebate of $256 million). GE earned $14 billion in 2010 and also paid zero in Federal income tax. Microsoft and Hewlett-Packard have each set up offshore subsidiaries which they use as payment conduits so as to keep their profits shielded from the IRS.

But offshoring of profits and the export of goods and services won’t sustain these corporations forever. At a certain point, native companies within the developing world will nudge our adventuring multinationals aside (China’s already building its own version of Wall Street). And when that happens, Corporate America is going to turn around and be horrified by the devastation in its own backyard.

“Where did all our customers go?”

Well, you enormous fucking idiots, you fired all your customers. You’ve spent the last decade or so suppressing wage growth in the name of “creating shareholder value” and now even your shareholder base is disappearing.

You allowed wages to stagnate for a decade and made every decision you could in the service of nudging the quarterly profit higher, thinking less of the yearly profit and virtually nothing of the long-term viability of your business.

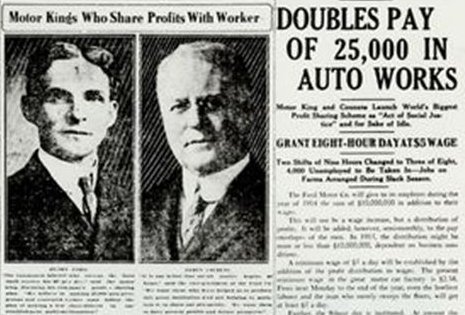

One hundred years ago, Henry Ford gave his employees an unasked for wage increase and, when asked why, he replied “How else will they be able to buy my cars?”

One hundred years ago, Henry Ford gave his employees an unasked for wage increase and, when asked why, he replied “How else will they be able to buy my cars?”

Can you imagine one of these pinheaded pricks in today’s corporate C-Suites ever thinking that far ahead or that broadly? Hilarious.

Now Henry Ford was no sweetheart (when he wasn’t publicly browbeating his son, Edsel, he was busy giving handjobs to Hitler) but he also wasn’t an idiot. He knew that good living wages meant more customers for his product, and they also made for a better workforce and a stronger company.

Take this tidbit from the Michigan State Historical Archives:

At the time, workers could count on about $2.25 per day, for which they worked nine-hour shifts. It was pretty good money in those days, but the toll was too much for many to bear. Ford’s turnover rate was very high. In 1913, Ford hired more than 52,000 men to keep a workforce of only 14,000. New workers required a costly break-in period, making matters worse for the company. Also, some men simply walked away from the line to quit and look for a job elsewhere. Then the line stopped and production of cars halted. The increased cost and delayed production kept Ford from selling his cars at the low price he wanted. Drastic measures were necessary if he was to keep up this production. To combat the high turnover and to boost morale, Henry Ford announced the famous “$5 a day” wage…Nevertheless, Ford’s plan doubled typical wages and sent shockwaves through the other car companies. They thought Ford was crazy and would soon go out of business. Ford knew, however, that this new deal would not only lower costs due to decreased turnover, but it would create more buyers of his cars: the employees themselves!

By improving the lives of his workers, ol’ Henry improved his own company’s competitive position and made it more profitable in the process. A century later and our supposed Captains of Industry don’t seem to understand this concept at all. For every forward-thinking employer like Starbucks, there are ten more who think nothing of shitting where they eat in the course of their ongoing negligence for the American workforce.

Thankfully, the backlash to short-term greed, long-term nihilism is already underway. This piece from The Economist looks at the perversity of the modern-day Profits Now obsession:

One study shows that listed companies have invested only 4% of their total assets, compared with 10% for “observably similar” privately held companies. A second shows that 80% of managers are willing to reduce spending on R&D or advertising to hit the numbers. The fashion for linking pay to share prices has spurred some bosses to manipulate those prices. For example, a manager with share options gets nothing if the share price misses its target, so he may take unwise risks to hit it. Short-termism is rife on Wall Street: the average time that people hold a stock on the New York Stock Exchange has tumbled from eight years in 1960 to four months in 2010. The emphasis on short-term results has tempted some firms to skimp on research and innovation, robbing the future to flatter this year’s profits.

Fairness ain’t got nothing to do with it.

Rather, it is this short-term myopia that has meant a relentless plundering of America’s middle, an industrial-strength strip mining of our once world-beating workforce. And it’s going to bite the One Percenter and his corporate enterprises back when all is said and done.

Already the cracks are showing: consider that 88% of the S&P 500’s profit growth this year came from just ten companies and four of these companies alone accounted for half! It gets worse, half of this top ten are current or former problem-children banks who essentially live off the retiree-punishing financial repression interest rates at the Fed. If that sounds like a bullshit economy, well, it is one. And you want people to be “confident” in the presence of this experiment? You expect the downsized to cheer as the holders of financial assets suck up more and more of the remaining crumbs?

Again, you can thank the poisonous atmosphere we currently enjoy. In 2012, the masses spend their waking hours trying to figure out which credit card loanshark to pay off first while a plutocratic handful use their control of the media and Congress to press their own interests even further. And now they’re doddering about in abject ignorance over why everyone turned on them this election cycle – they are the very smartest dumbasses you’ll ever meet.

It’s this very stupidity that the national debate should be about, economic equality becomes a naturally occurring byproduct once we put an end to the Strong Companies, Stressed Country dichotomy.

So don’t worry about Fair, let’s just stop the Stupid and see what happens.

Further Reading:

Who Got the Biggest Tax Break in the Last 30 Years? (The Rich, Of Course) (The Atlantic)

These Two Charts Show How The Priorities Of US Companies Have Gotten Screwed Up (Business Insider)

Senate Report Details HP & Microsoft Offshore Tax Ploys (Forbes)

The Assembly Line and the $5 Day – Background Reading (Michigan.gov)

US Corporations Evading Federal Taxes (The New Political)

GE’s Strategies Let It Avoid Income Taxes Altogether (New York Times)

Taking the Long View (The Economist)

[…] Also see: Forget Fairness, Let’s Talk About Stupidity […]

[…] Forget Fairness, Let’s Talk About Stupidity (TRB) […]

[…] The Reformed Broker-Forget Fairness, Let’s Talk About Stupidity. […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]

… [Trackback]

[…] Here you can find 93177 more Information to that Topic: thereformedbroker.com/2012/12/02/forget-fairness-lets-talk-about-stupidity/ […]