361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

November 5, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

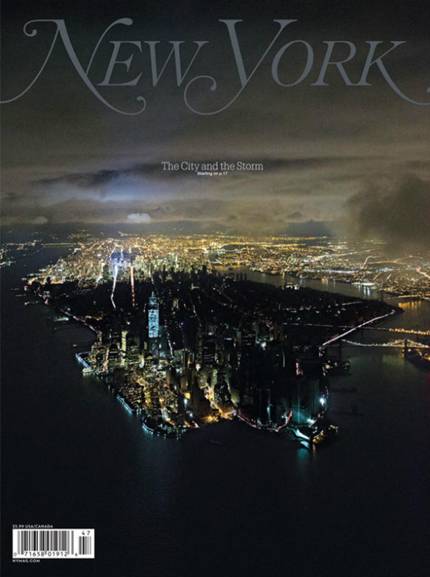

Hurricane Sandy…

8 million people lost power last week. And many are still without it today. Much will be learned from this storm’s direct hit to a major city center so that we hope the next direct hit will result in a quicker recovery, less disruption, and fewer lives lost.

(NYMag)

“We may come from different places, and speak with different tongues, but our hearts beat as one.” (Dumbledore, Harry Potter, 2005)

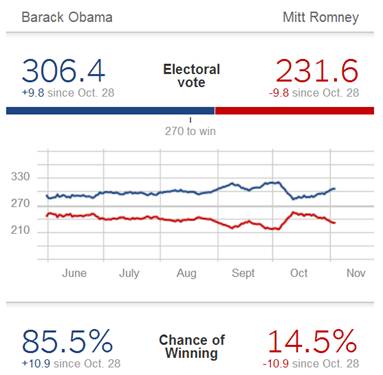

And the 2012 Presidential Election finally draws to a close. For those of us living in a swing State, the end could not have come any sooner. My 8 year old will soon lose all of his recent human pollsters and robot-calling friends and I will wonder how Bugs Bunny and General Grievous are not trending higher in the Colorado polls. Hopefully on Wednesday the election will be decided and the Country will welcome a Congress and President who will lay it all out on the table and get it done. As we all know, there is no time to waste.

The stat geek guru at the N.Y. Times is predicting a strong incumbent win for POTUS…

And the Front Man at CNBC is predicting an even bigger victory…

Tweet of the week:

@EddyElfenbein: If Gary Johnson wins, so many pollsters will be embarrassed.

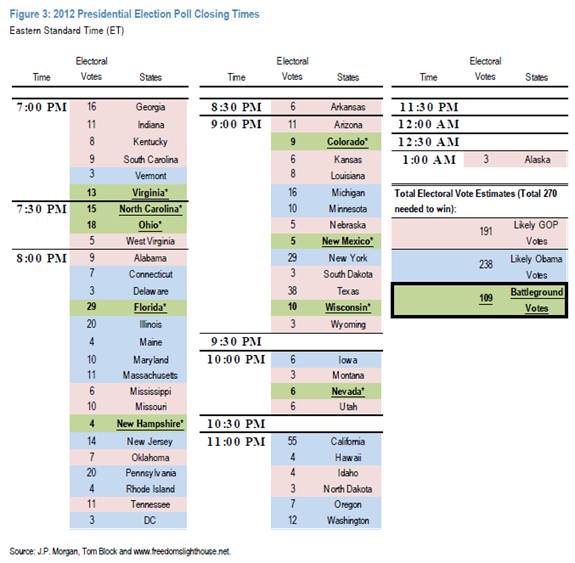

If you are interested in following the results on Tuesday, here is a list of the Poll Closing Times and key States to watch for…

A good read by Clayton Christensen on how to get the economy going no matter who is POTUS…

Whatever happens on Election Day, Americans will keep asking the same question: When will this economy get better? In many ways, the answer won’t depend on who wins on Tuesday. Anyone who says otherwise is overstating the power of the American president. But if the president doesn’t have the power to fix things, who does? (NYTimes)

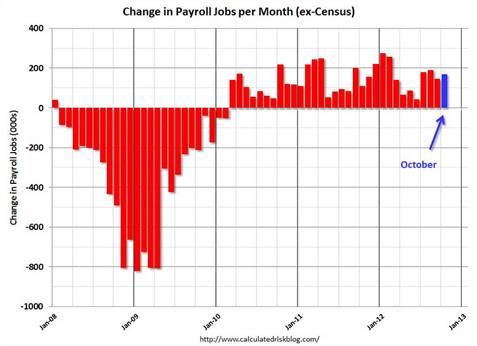

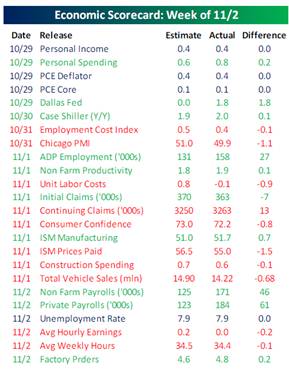

The last Jobs report before the election was just what any incumbent would want to see…

Unemployment Rate rose to 7.9% as expected and Private Payrolls rose much better than expected (+184k vs. +123k expected). The average hourly earnings were lower than expected which is good for inflation worries, but bad for wallets and spending. Manufacturing jobs rose +13k breaking a trend of monthly losses.

(CalculatedRisk)

This stream of thought could explain why Gold and other commodities sold off after the jobs numbers…

The October jobs report “was more treat than trick,” but it had some disturbing elements, says David Rosenberg, chief economist of Gluskin Sheff. While payrolls grew by 171,000, workers’ average weekly hours gained only 0.1 percent in the private sector, and average weekly earnings dipped 0.3 percent. “That has a certain deflationary feel to it,” Rosenberg writes in a report obtained by Business Insider. “The price of labor should hardly be contracting if the jobs market is in fact returning to normal in any meaningful way.” Thus Rosenberg isn’t expecting anything great from the economy, which grew 2 percent in the third quarter. (MoneyNews)

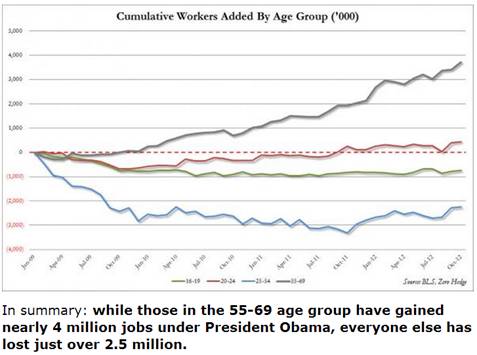

One of the more interesting charts running around on Friday was the breakdown of jobs by age…

(Zerohedge)

Beyond the Friday jobs data, it was a big week of mixed results…

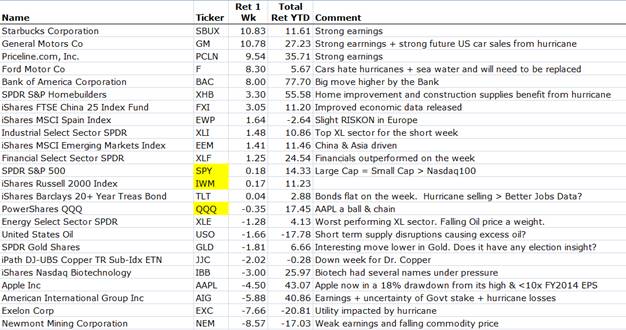

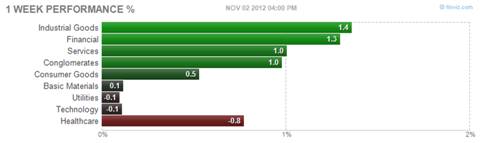

U.S. equities only had 3 days of trading but still lots of activity to reflect upon…

The end of the earnings train came through the station with Starbucks, GM and Priceline posting much better than expected. China pulled up the Emerging Market indexes on its better than expected economic data. And helping the U.S. markets finish in the green were the important Industrial and Financial sectors. On the downside, Apple and several Biotechs pulled the Nasdaq into the red for the 3 day week.

With Apple pressuring the Nasdaq, the Index is now at a key support level…

This week, Barron’s goes long Dividend Funds…

David Rosenberg is also big on cash flowing equities…

As conservative as I have been over the equity market, I have never advocated cash as an asset class. Cash may be the ultimate in capital preservation but it earns you nothing. In a zero return environment – notwithstanding all the financial, economic and geopolitical uncertainties – cash is not king. What is king, however, is cash flow. Within the equity sector, this means a focus on dividend growth, dividend yield and dividend coverage. This includes Canadian banks and some pipeline exposure. It also includes large-cap U.S. technology, where growth in dividends is second to none. (FinancialTimes)

You have to admire their honesty… Advisor of HYG throws up a caution flag on High Yield Bonds…

With yields close to historic lows, and in many cases below the level of inflation, many investors responded by turning to high yield. Indeed, I have argued that in this environment fixed income investors have no choice but to either accept lower income or more risk and given that, investors should consider focusing on credit risk rather than duration. I still believe that marginal credit risk makes sense, particularly for aggressive yield-hungry investors, but the recent rally in high yield suggests that downside risks may be starting to outweigh the potential benefits. (iShares)

Meanwhile, the fixed income ETF market is seeing some big, new investors…

The $49.6 billion Virginia Retirement System, Richmond, for example, revealed at the end of June that it held 1.7 million shares of the iShares iBoxx $ Investment Grade Corporate Bond ETF, eclipsed by only Apple Inc. for total value in the listed portfolio. Similarly, Stanford University in Stanford, Calif., has reported direct holdings in a pair of iShares bond funds in its $17 billion endowment for the last two quarters… Pacific Investment Management Co. LLC, Newport Beach, Calif., estimates that at least 10% of its current $8.2 billion in ETF assets under management is held by pension funds, endowments and sovereign wealth funds, according to Natalie Zahradnik, PIMCO senior vice president and ETF strategist… the fastest growing use of ETFs among institutions has been for an ETF overlay, whereby a manager uses one or more ETFs to replicate the exposure of securities in the portfolio… For a pension fund looking to hold less cash but also have liquid investments available for sale when making payouts, a large, liquid ETF can be simpler to sell down. Similarly, moving into an ETF might not be as difficult as it would seem with internally managed bond portfolios. (PIOnline)

Bill Gates was correct; Khan Academy is one of the greatest gifts to humanity…

“The numbers get really crazy when you look at the impact per dollar,” says Khan. “We have a $7 million operating budget, and we are reaching, over the course of a year, about 10 million students in a meaningful way. If you put any reasonable value on it, say $10 a year–and keep in mind we serve most students better than tutoring–and you are looking at, what, a 1,000% return?”… “This decade is the first opportunity we have ever had to extend quality secondary education to every kid on the planet,” says Tom Vander Ark, a venture capitalist who headed the Bill & Melinda Gates Foundation’s educational programs through 2006. “When you combine mobile devices, free content and an inexpensive, blended learning model, you can serve kids in the slums of Nairobi for $4 a month and you can start to imagine a $100-a-year high school that is quite high quality.” (Forbes)

Fun with numbers… NFL version…

@MikeMcCartney7: Andrew Luck with 2,404 passing yards for 5-3 Colts. Peyton Manning 2,404 passing yards for 5-3 Broncos.

@nowthisnews: Why are these New Yorkers clustered outside a closed Starbucks? Two words: working Wi-Fi. #sandy

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Here you can find 64445 more Information to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/11/06/361-capital-weekly-research-briefing-16/ […]