I’m going to say this here and now for posterity and I hope you bookmark it:

There’s going to be such a brutal bond investor slaughter at some point over the next decade that the streets of Boston’s mutual fund district will run red with blood, the skies will be shot through with the lightning and thunder of unexpected capital losses and those who manage to survive will envy the dead.

Now a slaughter in bonds will not look like an equity market crash, the volatility characteristics are different and bonds eventually mature. But in some ways it will feel much worse than a stock crash because the money parked in bonds is thought of as low or no-risk.

The fixed income guys know what’s going to happen, too. Why do you think the Bond Kings at PIMCO and DoubleLine are pushing into equity funds? They’re getting three-year track records under their belts for when the big switch comes.

And it will come.

You know how I know this? Because you lunatics are plowing money into fixed income at all-time low interest rates during the parabolic final phase of a 30-year bond market rally. You are going limit-up long into one of the most obvious blow-off tops in the history of investing. And you’re doing this with almost guaranteed inflation ahead of us and only the prospects of negative real rates of return on your T-bills.

And you’re doing this because you are mistakenly worried about a possible 20% drawdown in equities at some undetermined future point in time. Many of you are worried about this even despite the fact that you’ve got 15, 20, 25 years left til retirement and the actual use of your invested capital.

Would you like to know the amount of 20-year rolling periods over the entirety of the 1926-2010 period during which US stocks declined in value? OK, sure – the answer is zero. There have not been any 20-year rolling periods – start counting during any month and year you’d like – in the last 85 years in which stocks have not gone higher.

These are the facts, we use 1926 as our start point because prior to that the data is less reliable and comparable. It’s not a thousand years worth of data but as Nick Murray says, the period encompasses every type of economic condition – from depression to recession to stagflation to expansion). This variation, economically speaking, validates the sample size.

Far too many investors are waltzing around as though they’re somehow “safe” because of these massive bond allocations they’re nurturing. They are walking beneath a dangling piano hoisted 10 stories above their heads, its shadow barely noticed in the noon-day sun.

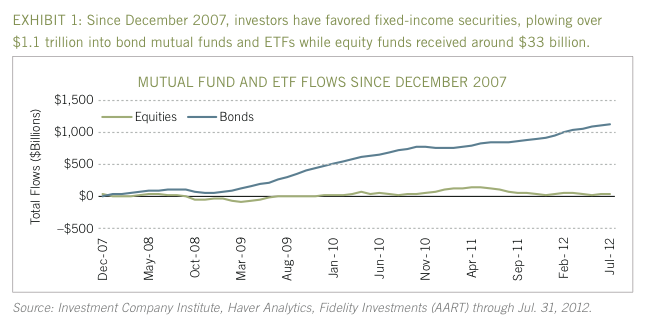

Let me show you something – this comes from Fidelity and it is the statistical equivalent of buffalo herd charging across the prairie toward an unseen cliff:

The below-average real returns for equities during the past 12 years, in combination with the near- uninterrupted 30-year rally for bonds, has led to a recent shift in investor preferences. Since December 2007, investors have poured more than $1.1 trillion into bond mutual funds and exchange-traded funds (ETFs)—more than 33 times the amount allocated to equity funds and ETFs (see Exhibit 1, below). Many institutions also have reduced long equity allocations.

Josh here – To be clear, this will ultimately revert and it will be very unpleasant for the herd. I don’t know when, but as a student of market psychology and history I know that it will. I also know that it will catch many by surprise, be denied for a long time and will ultimately teach some harsh lessons about inflation, its effect on bond prices and the longer-term triumph of equities as the protector of purchasing power.

I don’t hate bonds, they are an integral part of our low-vol portfolio models. But to be doing bonds instead of stocks looks suicidal to me in the context of a long-range retirement portfolio.

Remember I said it. Now if only I could nail the timing, I’d be set for life.

horoscope for scorpio

[…]Every after inside a while we decide on blogs that we read. Listed beneath are the newest web-sites that we decide on […]

سكس

[…]always a large fan of linking to bloggers that I adore but really don’t get a lot of link love from[…]

سكس مترجم

[…]please stop by the internet sites we follow, which includes this 1, as it represents our picks in the web[…]

marketing apps

[…]one of our visitors recently suggested the following website[…]

how to orgasm

[…]one of our guests just lately suggested the following website[…]

finger vibe

[…]we came across a cool website that you may possibly take pleasure in. Take a search should you want[…]

dildo set

[…]here are some links to web pages that we link to mainly because we think they’re really worth visiting[…]

… [Trackback]

[…] Read More here|Read More|Find More Informations here|Here you can find 593 additional Informations|Informations to that Topic: thereformedbroker.com/2012/10/26/33-times-you-poor-dumb-bastards/ […]

massage toy

[…]Sites of interest we have a link to[…]

the best vibrators

[…]very few internet websites that come about to be detailed below, from our point of view are undoubtedly effectively really worth checking out[…]

… [Trackback]

[…] Find More here|Find More|Find More Infos here|Here you will find 34672 more Infos|Infos to that Topic: thereformedbroker.com/2012/10/26/33-times-you-poor-dumb-bastards/ […]

butt plug video

[…]Every after in a while we select blogs that we study. Listed beneath are the most current internet sites that we pick […]

سكس

[…]Sites of interest we’ve a link to[…]

سكس مترجم

[…]below youll find the link to some web sites that we think you ought to visit[…]

… [Trackback]

[…] Read More here|Read More|Read More Informations here|There you will find 17866 additional Informations|Informations to that Topic: thereformedbroker.com/2012/10/26/33-times-you-poor-dumb-bastards/ […]