In a market meltup, it’s difficult for an advisor to make the case to certain clients that bonds have a place in their portfolios. They look at their bond holdings with disdain during periods where they drag against a runaway stock market. These are the same clients who are furious that they’re fully invested through a correction, but that’s a whole other blog post…

Fidelity Investments is out with a piece that shows how a diversified portfolio, in which both stocks and bonds can live together, was the thing that really helped you throughout the credit crash and recovery period.

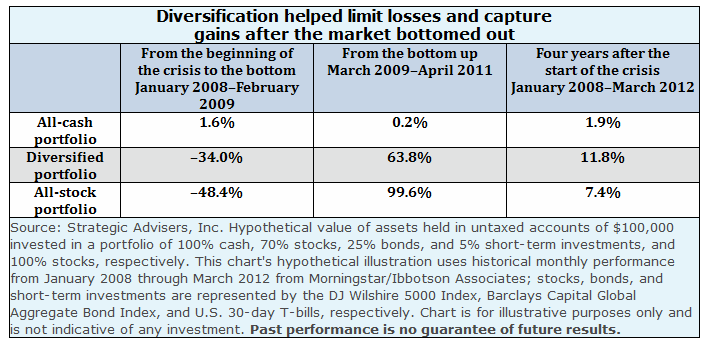

Here’s how a 70/30ish portfolio would have fared since the outset of the crisis (versus an all-in or all-out approach):

Diversification has not failed

While it may have felt like diversification failed during the downturn, it didn’t. The major asset classes are not perfectly correlated, only more highly correlated. There’s a difference—it means that diversification still helped contain portfolio losses, only the benefit was lower than before the market decline.

Consider the performance of three hypothetical portfolios: a diversified portfolio of 70% stocks, 25% bonds, and 5% short-term investments; a 100% stock portfolio; and an all-cash portfolio.

Source:

The pros’ guide to diversification (Fidelity)

Read Also:

… [Trackback]

[…] There you will find 87870 additional Info to that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] There you will find 75237 more Info on that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]

… [Trackback]

[…] Here you can find 57672 additional Info on that Topic: thereformedbroker.com/2012/10/03/the-triumph-of-diversification/ […]