If there is a single buzzword that’s taken up ubiquitous residence in the most fashionable quarter of ETFtown these past few years, it’s “Ex-Financials” – index products designed to give you exposure to a given geography or market but with the financial stocks left out. The reasons are obvious, nobody wants to have exposure to banks when they know the books are being cooked with complicit government regulators looking on. And lest you think the suspension of GAAP standards is merely a US phenomenon, you should see the kind of shit European banks are getting away with.

And Chinese banks? Forgetaboutit.

Which brings me to a new piece of research from Jeremy Schwartz of WisdomTree. Schwartz’s shop has an ex-financials China Dividend ETF (could that be any buzzier?) and he explains that Chinese indices are still way too heavy with financials and bank stocks to be attractive in and of themselves (unless you’re bullish on Chinese real estate development loans, lol). Financials make up a whopping 50% of some mainstream China indices, for example. So WisdomTree created $CHXF as a way to get exposure to everything else and have a dividend orientation. We’re not using the fund here, we’re a little more old-fashioned with our EM exposure at the moment.

But the more interesting question raised here is “If I don’t like the banks of a country, why would I want to be in their stock market at all.” Schwartz’s answer to that below is a good one, the US stock market is a perfect example of why:

If financials are likely to be weak, why bother investing in a given market? An initial reaction to any “ex-financials” equity approach might be to think that if the financial sector is weak, then the rest of the market is likely to also be weak.

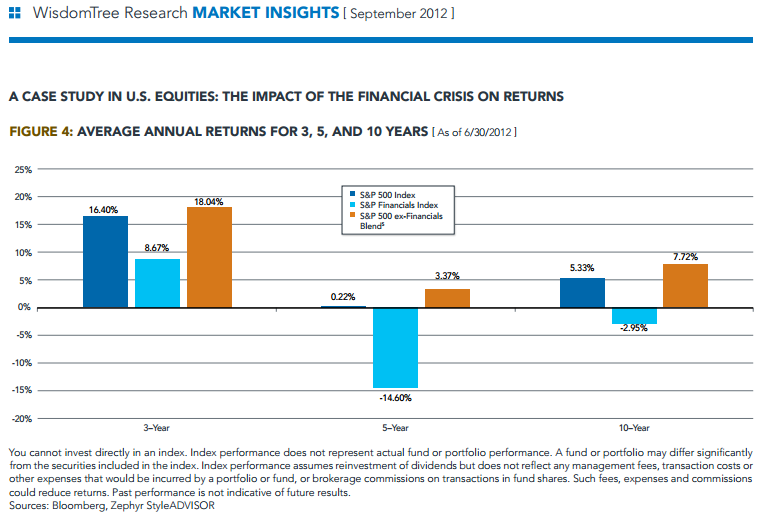

In that regard, the United States, through the use of the S&P 500 Index, presents an interesting case study over the past decade. We look to this index and country mainly because of the breadth of history available—the financial crisis of 2008–09 was without question the worst since the Great Depression of the 1930s. China’s equity markets do not have such a record of performance history from which to draw. Figure 4 indicates that over the past decade, in the face of such a severe crisis, there has been a decoupling between the performance of the broader S&P 500 Index and that of the S&P 500 Financials Sector Index. While we can’t say that this will always be the case or that similar results would necessarily hold true for China’s equities, we can say that it is possible for the performance of financials can to be markedly different from that of other sectors.

- most noteworthy is the average annual performance over the five years ended June 30, 2012, where even though the financials component was down by over 14% per year, the broader S&p 500 index was pulled up enough by the other nine sectors to generate a positive return. the other nine sectors, in an equal-weighted blend, had over 3.3% average annual returns.

- on a 10-year basis, while the financial sector was down nearly 3% per year, the other nine sectors averaged nearly 7.75% per year.

Josh here – by ignoring US banks but keeping your exposure to the rest of the productive economy, you saw quite a difference in performance even despite a rocky ride for the indices overall. Will the same be said years from now about those who kept China on and zeroed out their Chinese bank exposure?

best glass dildo

[…]Here is a superb Blog You might Find Exciting that we Encourage You[…]

chocolate dildos

[…]Every after inside a when we opt for blogs that we read. Listed beneath would be the most recent sites that we decide on […]

vibrator tutorial

[…]we came across a cool website that you just may enjoy. Take a look for those who want[…]

Sex Toy Tutorial

[…]although internet websites we backlink to below are considerably not related to ours, we feel they’re actually worth a go by, so possess a look[…]

MILF Porn

[…]one of our visitors recently recommended the following website[…]

Laverdaddesnuda.com

[…]always a major fan of linking to bloggers that I adore but dont get quite a bit of link like from[…]

mp3juices

[…]here are some links to internet sites that we link to due to the fact we assume they are worth visiting[…]

pocket pussy porn

[…]always a big fan of linking to bloggers that I enjoy but really don’t get a whole lot of link love from[…]

tubidy

[…]that would be the end of this article. Right here youll uncover some web sites that we consider youll appreciate, just click the hyperlinks over[…]

realistic dildo review

[…]Here are several of the web sites we suggest for our visitors[…]

strong vibrators

[…]one of our visitors lately advised the following website[…]

luxury sex toys

[…]one of our guests not too long ago advised the following website[…]

waterproof rabbit vibrator

[…]we came across a cool web site that you may take pleasure in. Take a appear should you want[…]

the bullet sex toy

[…]usually posts some pretty interesting stuff like this. If you are new to this site[…]

Bette Derges

[…]Every once inside a when we pick blogs that we read. Listed below would be the latest internet sites that we opt for […]