There’s a new hot trade on The Street I continue to hear about more and more that involves one of the most hated areas of the global markets: Europe. Hedge funds and go-anywhere asset managers are increasingly circling the concept that the time is now to dig through the rubble for quality euro stocks.

Before I go any further, please understand that I am not advocating that anyone go out and try to put this trade on, I’m merely relaying the fact that many institutional players are talking about it behind the scenes.

The idea is to buy European multi-national companies, which are trading at very low valuations in some cases (see the Bank of America Merrill Lynch chart at left depicting EU equity yields relative to German bunds) The thinking behind it is that Euro multi-nats have been unfairly punished by investor fears over the debt and banking crisis. European stock indices are very heavily weighted toward financials, but not all European companies have big exposure to financials – or even the economies of Europe. Just because they are domiciled there, it doesn’t mean they are doing a majority of their business there. I mentioned this idea a few weeks back after speaking with a huge global fund manager who was actively buying European multi-nat large caps at steep discounts:

The idea is to buy European multi-national companies, which are trading at very low valuations in some cases (see the Bank of America Merrill Lynch chart at left depicting EU equity yields relative to German bunds) The thinking behind it is that Euro multi-nats have been unfairly punished by investor fears over the debt and banking crisis. European stock indices are very heavily weighted toward financials, but not all European companies have big exposure to financials – or even the economies of Europe. Just because they are domiciled there, it doesn’t mean they are doing a majority of their business there. I mentioned this idea a few weeks back after speaking with a huge global fund manager who was actively buying European multi-nat large caps at steep discounts:

A great example would be something like Nestle, a global food company if ever there was one. Nestle reported profits for the first half of the year up 8.9%, thanks to strength in the many emerging markets in which it sells ice cream, coffee etc. Europe is loaded with companies like this and many of them have been thrown out with the bathwater thanks to the problems of the continent’s banks and sovereigns.

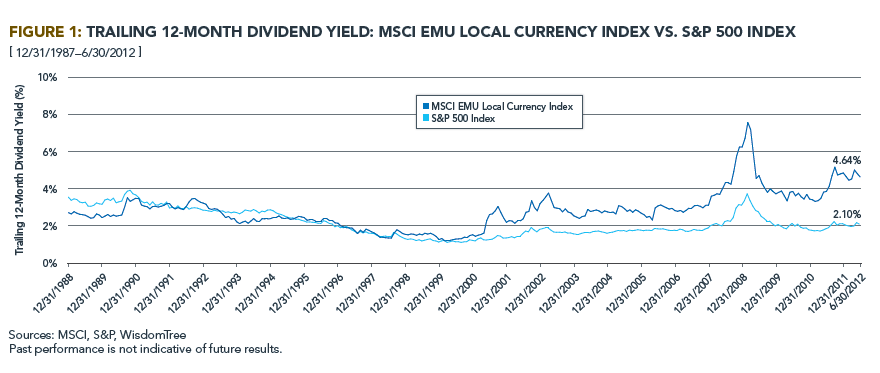

Jeremy Schwartz at WisdomTree has done a lot of work looking at Japanese equities and their trailing twelve-month dividend yield as a portent of good buying opportunities. When this yield is high for a given country’s stocks, it has historically been a great entry point. Schwartz turned his attention to the same metric for European stocks this week and produced the below chart versus the same measure for US stocks:

Above you’ll see a trailing dividend yield for local currency EU stocks that is more than double that of the S&P 500.

The other dimension to the trade is that a weakening euro currency benefits European companies selling overseas – the chatter about eventual euro-US dollar parity has gotten louder of late. WisdomTree believes that the ability to hedge the euro currency as it heads toward dollar parity would serve to enhance the long-euro stock trade even further – you end up long companies that benefit from a weak euro and you net out the eroding effect of this decline in the local currency simultaneously. The fund family is so excited about this idea that they are about to restructure an existing ETF (Hedged Equity Fund) to become a vehicle that owns European stocks and hedges out the currency risk (versus the dollar).

Their plan for the fund, HEDJ, is as follows:

The new Europe Hedged Equity Fund (HEDJ) will provide exposure to European dividend-paying companies that derive more than 50% of their revenues from countries outside Europe, while hedging the single euro currency. The changes to the Fund’s objective aim to:

- Focus on one theme: The Fund will change its objective from hedging multiple currencies versus the U.S. dollar in a broad international basket to an export-oriented portfolio of euro-traded, dividend-paying companies while having to hedge only the euro vs. the U.S. dollar.

- Provide access to exporters poised to benefit from a weakening euro: In a weakening euro but healthy European export scenario, a euro hedged equity strategy may provide greater returns than an unhedged portfolio of European stocks. Conversely, in an environment in which the euro is appreciating and global demand for goods is low, the Europe Hedged Equity Fund may underperform an unhedged portfolio of European stocks.

- Improve operational efficiency: By hedging a single currency rather than multiple currencies, we anticipate tighter trading spreads3, which may result in greater trade volumes and interest in HEDJ.

There are, of course, plenty of risks to this strategy. For one, European stocks are up roughly 14% in the last two months and may need to cool off a bit. Second, September is going to be a very headline-driven month, German votes on the ESM’s legality on the 12th while disgruntled voters in Holland go to the polls for a general election. In other words, expect whipsaws and volatility to return for the near-term.

But if you’re interested in learning more about this trade, Jeremy’s work is a good place to start. See below (PDF):

Read Also:

Some Anecdotal Stuff from a World Class Value Manager (TRB)

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Here you can find 37938 more Information to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Here you can find 38113 more Information to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] There you will find 29144 additional Info to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] There you will find 38732 more Info to that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]

… [Trackback]

[…] There you will find 22397 additional Information on that Topic: thereformedbroker.com/2012/08/22/the-hottest-trade-on-wall-street-european-stocks/ […]