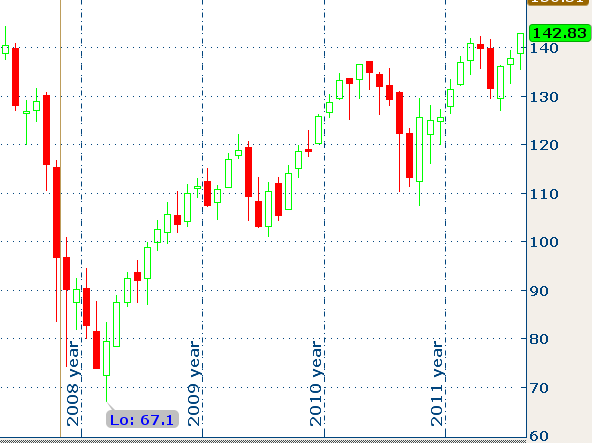

The market is now eclipsing four year highs. How? She don’t know. That’s what makes her beautiful.

Since the lows in June we’ve pretty much gone in one direction – higher.

Many of the reasons I mentioned in my “Why I Like Stocks for the Second Half” post are coming to fruition, including a resumption of $AAPL leadership and an attitude amongst investors of “F*ck Europe.” There is plenty of fear and doubt but investors keep coming back to the idea that, aside from stocks, what else are you going to do? And so the underinvested chase and those in the game hang on. Money leaves the safety of healthcare and utilities, finds its way into sectors that are helping to propel the averages higher – semis, energy, banks, tech.

Here’s Reuters:

In early trading, the S.&P. 500 rose 0.3 percent, the Dow Jones industrial average gained 0.1 percent and the Nasdaq composite index added 0.4 percent.

The S.&P. 500 briefly exceeded this year’s high of 1,422.38 set in April by a fraction of a point to make a four-year intraday high. That would take the index back to May 2008. The index closed at 1,418.13 on Monday.

Here’s your four year SPY chart:

generic cialis 20 mg tadalafil

Generic for sale