“My broker gets me IPOs” is one example of things clients don’t say anymore.

The pitch used to be a very simple one:

“Open a brokerage account with me and I can handle all of your banking, mortgages, business lines of credit, credit cards, insurance, estate planning and retirement accounts. And by the way, when the firm does an IPO underwriting, we can totally hook you up.”

Try that now, see how it works out.

The clients don’t want their broker having knowledge of or access to or guardianship over their bank accounts anymore. These places almost all bit the dust, for god’s sake! They can’t even manage their own money!

The clients have the ability to price mortgages and credit cards online now as well, and they see no benefit to having any of that linked to their investment portfolio (because there isn’t one).

And lastly, the clients don’t want your stupid IPOs anymore either. Not that the average advisor can really get much access to the good ones for a household account anyway, but still. Because the clients now recognize these so-called “hot deals” for what they are: the investment bank favoring the corporate client over the retail client, in the name of margins and profits. Bankers maximize the valuation for the company going public, which is their job. Brokers -sorry – “Wealth Managers” are left to clean up the shares that the firm’s hedge fund clients don’t gobble up.

And when everyone’s excited about the new paradigm and the ducks, as they say, are quacking – well, you must feed them.

That’s how you get a syndicate (was there ever a more apt description?) pumping out a deal like Zynga at $10 per share last December – a $9 billion valuation for a company that literally sells virtual bullshit and whose revenue stream was 95% reliant on Facebook, a totally unrelated company other than the fact that there was a revenue share between them. To put this valuation in perspective, consider that more than 200 S&P 500 stocks were worth less in market cap upon Zynga’s debut. Zynga was sold to the public at a valuation higher than that of TD Ameritrade, Xerox, Alcoa, Petsmart, Carnival Cruiselines and Staples.

It dropped 5% on the first day of trading and only the insiders and the underwriters reaped any reward from that day forward.

In other words, the muppets clients who were sold shares of this deal by their brokers never had even a fighting chance minus the presence of a ludicrously larger bubble than the one we had already had building into the Facebook IPO the following spring.

And then came a handful of massive expenditures and acquisitions and warnings and vague promises and misses etc; management acquitted themselves with aplomb of a junior varsity hockey team playing the Boston Bruins. The share price fluctuated between modest gains and losses from the IPO price all winter and spring, mostly tied to the vicissitudes of the overall market’s risk appetite. And then came the penultimate slap in the face – an incredibly disrespectful and shocking secondary offering of 43 million shares priced at 12. The filing, which hit The Street in late March, made it abundantly clear what a scam this whole thing was: Not a single dollar – not a penny – of that approximately $500 million share dump went to the company. The entire share sale was insiders unloading even more of their stock just a few months after the IPO.

From TechCrunch:

Zynga revealed in an S-1 filing from last week that CEO Mark Pincus will sell 15 percent of his shares, and his voting power post-sale will go from 36.5 percent to 35.9 percent. Investors IVP, SilverLake, Union Square Ventures, Google, and Reid Hoffman are also selling in the offering, as is board member Jeffrey Katzenberg. Owen Van Natta, General Counsel Reggis Davis, COO John Schappert and CFO Dave Wehner are selling shares as well.

The company explained that this share sale was favorable to the stockholders because it meant an orderly dumping of half a billion dollars worth of stock as opposed to a haphazard one. “Wow, thank you for fucking me in an orderly fashion!” said no one.

In addition, the Wall Street syndicate once again had a chance to double dip here on fees. Here’s Silicon Alley Insider’s Henry Blodget:

Zynga’s April stock offering was managed by Morgan Stanley, Goldman Sachs, Bank of America, and other premiere Wall Street underwriters. All of the stock sold in the offering was sold by Zynga insiders. None of the cash raised in the offering went to the company.

The Zynga underwriters were paid ~$15 million of fees to arrange this cash-out.

Zynga, the company, also paid $1 million in expenses to facilitate the cash-out (legal fees, private jet rental, etc.)

After that offering, the stock never saw 12 again and this morning, it’s trading down 75% from the levels of the April deal. It’s a $3 stock now and still worth $2.25 billion.

Now why, you might ask yourself, would anyone still be long this stock, given the disgusting treatment of shareholders from start to finish?

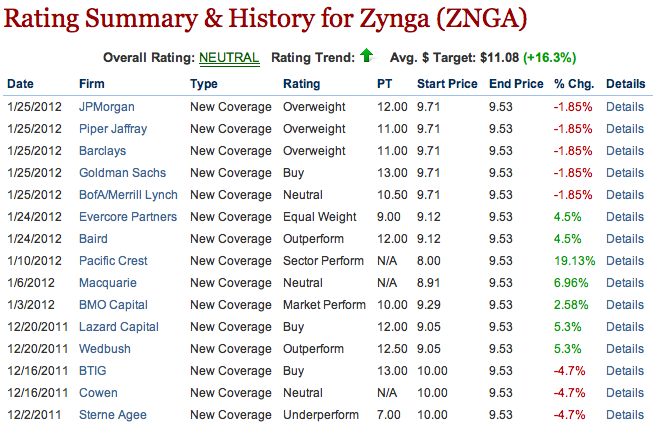

I present to you the below hideous tableaux of Wall Street’s finest sell-side analysts’ unbiased and Chinese Walled-opinions that surely could not have been influenced by firm banking relationships in the slightest:

And to add insult to injury, I present you with the eternally hilarious shut-the-barn-door-after-the-horses-bolt downgrades that have come out this morning, which are a terrific help, as usual:

And so I ask you, clients of brokerage firms and investment bank brokers who offer new issues to clients:

Are you not entertained? Is this not why you are here?

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Here you can find 29037 additional Information to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] There you will find 22145 additional Information on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/07/26/are-you-not-entertained/ […]