361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

July 23, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

On the surface the week didn’t look that bad, but lift the hood and it gets ugly…

Euro trades to a new 25 month low. Spanish yields rise to 7.2% on Friday. Italian yields go through 6% and Italian equities get just blistered. U.S. Financials and Transportation stocks underperform. Big caps outperform Small caps and Growth outperforms Value. U.S. and German yields trade to new lows and the LQD (High Grade Bond ETF) chart looks like Yahoo in 1999. If the world wasn’t so risk averse right now, I would be bringing a hard hat to work this week. Keep an eye on U.S. Homebuilders, China, and Junk Bonds. If they roll over, we will need more than hard hats.

Spanish Debt trades like the news flow sounds, terrible…

- The Budget Minister went on in Parliament this morning to proclaim, “There is no money to pay for public services,” which is quite a statement to make after the Prime Minister had told everyone that Spain was fine and that only the banks were having some issues.

- “It’s difficult to say to what extent the contagion comes or came from Greece, or from Portugal, or from Ireland, or from the situation of the Spanish banks, or of the one apparently emerging from the streets and the squares of Madrid,” Mario Monti told reporters. “Obviously, without the problems in those countries, Italy’s interest rates would be lower.” (Bloomberg)

Meanwhile, the Laffer Curve is being validated in France…

The latest estate agency figures have shown large numbers of France’s most well-heeled families selling up and moving to neighboring countries. Many are fleeing a proposed new higher tax rate of 75% on all earnings over one million euros. (£780,000) The previous top tax bracket of 41% on earnings over 72,000 euros is also set to increase to 45%. Sotheby’s Realty, the estate agent arm of the British auction house, said its French offices sold more than 100 properties over 1.7 million euros between April and June this year – a marked increase on the same period in 2011. Alexander Kraft, head of Sotheby’s Realty, France, said: “The result of the presidential election has had a real impact on our sales.” Now a large number of wealthy French families are leaving the country as a direct result of the proposals of the new government. (Telegraph)

And also in Italy…

Around 30,000 yachts have fled Italy this year, costing €200 million in lost revenue from mooring fees, port services, and fuel sales, according to Assomarinas, the Italian Association of Marinas. “We’ve lost 10 to 15% of our regular customers,” said Roberto Perocchio, the president of Assomarinas. “This is the worst crisis in Italian boating history. The authorities are using scare tactics and creating a climate of fear.” …Plans for a further 30,000 new berths have been put on hold. Business is down by more than a third in many marinas, with some half empty compared to last summer. “We’ve lost 40 boats in the last few months, all between 20 and 25 meters long,” said Giovanni Sorci, director of a marina at Rimini, on the Adriatic coast. “Most went to Slovenia – in fact it is so popular that there’s now barely a berth to be had there. …At Porto Rotondo in Sardinia, Giacomo Pileri, the general manager of a 700-berth marina, said at least 150 boats had fled to nearby Corsica. A steep new tax of up to €700 per day on the largest yachts mooring in Italian ports, introduced by the Monti government in December, was watered down in March to exclude foreign-owned boats. But it has further fuelled the exodus of Italian boats abroad. (Telegraph)

In Greece, the country can’t sell its own assets for fair value if it tried…

In 2010 a small German airline called Cirrus offered $23m each for them. But the Greeks rejected this because of a rule that state assets could not be sold for less than 75% of their declared value. (Economist)

But the final blow for Greece may have come late Sunday night from Germany and the IMF…

“Germany and other important international creditors are not prepared to extend further loans to Greece beyond what has already been agreed, German newspaper Süddeutsche Zeitung reported on Monday. In addition, SPIEGEL has learned that the International Monetary Fund (IMF) too has signaled it won’t take part in any additional financing for Greece.” (Spiegel)

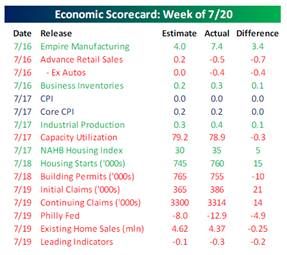

Another tough week of economic data. Too many negative surprises…

(Bespoke)

Gary Schilling speaks out on the recent numbers…

“You look at retail sales they were negative for three consecutive months, April, May, June. That’s happened only 27 times since they were first reported in 1947 and in 25 of the 27 it was in a recession or within three months of a recession.” Gary Shilling on (Bloomberg)

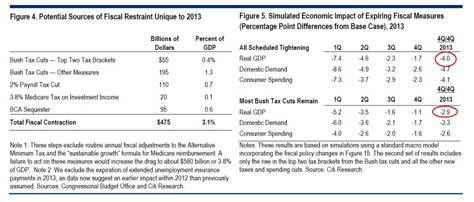

Citigroup penciling in a 2013 recession with or without the fiscal cliff…

(AEI/JamesPethokoukis)

Business leaders still trying to save Washington from itself…

The Business Roundtable, which represents U.S. CEOs in Washington, on Tuesday called on Congress and the President to enact a stopgap measure to avoid the “crisis” of a “fiscal cliff” of major tax hikes and spending cuts, saying the uncertainty was slowing economic growth and job creation. In a letter, released and signed by its chairman, Boeing President and CEO W. James McNerney, Jr., the group said “the current political paralysis (in the nation’s capital) has fueled needless economic uncertainty that impedes a more robust economic recovery. Without effective action soon, this uncertainty will spawn a dangerous crisis, threatening our economy, businesses and workers.” (Reuters)

Lloyd Blankfein’s recommendations for Washington…

The cyclical and structural challenges are considerable, and in some cases, even daunting. But when I meet with chief executive officers and institutional investors and they ask me where to invest, my response is that the United States remains as attractive as ever. And it would be even more attractive if it can make some short-term progress in a few key areas:

- Make progress on the long-run fiscal situation

- Make it easier for people to legally immigrate

- Invest in infrastructure

- Compromise for the sake of progress and stability

And more economist recommendations: Tax Policies Economists Love (And Politicians Hate)…

1: Eliminate the mortgage tax deduction

2: End the tax deduction companies get for providing health-care to employees

3: Eliminate the corporate income tax

4: Eliminate all income and payroll taxes (replace income with consumption tax)

5: Tax carbon emissions

(NPR)

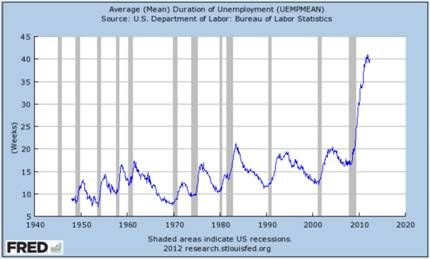

This economist suggests that now that GDP is positive, it is time to peel back the incentives…

Nearly all studies of unemployment insurance find that increasing the duration of potential unemployment benefits increases the length of time individuals are unemployed. The debate is only over the magnitude during past extensions of benefits. And while the magnitude is also unknown for the current round of extended benefits (which could have lasted up to 99 weeks for some), there is no reason to believe that basic human nature has changed since past recessions. People still respond to incentives. (Yahoo Finance)

Investing thoughts from Hugh Hendry…

Mr. Hendry insists that his reputation as a “contrarian” investor is wrong, and that his approach is in fact to take advantage of the prevailing momentum in markets. “Our ideas are harshly disciplined by market trends. You will never see us pursue a homegrown idea when it is to the detriment of the prevailing trend.” For example, he reckons U.S. government bond yields, already at record lows, will continue to fall. And, although he professes not to be a contrarian, he is more optimistic about the U.S. than many investors and is “long the debt-saddled west and short the vastly over-vaunted and over-owned” BRIC quartet of Brazil, Russia, India and China. He believes that financial markets are single-digit years away from a crash that will present investors with opportunities of a lifetime. “Bad things are going to happen and I still think the closest analogy is the 1930s.” (CNBC)

Any insight from Stephanie Pomboy is always a must read…

Stephanie Pomboy, founder of MacroMavens, sees the world hurtling toward a day in which money will again be backed by gold or other hard assets. Until then, she also sees plenty of trouble. (Barrons)

As for the markets this week, here were the most interesting movers:

- Natural Gas/UNG +7.4% (interesting chart T. Boone)

- Oil Services/OIH +5.2%

- Oil/USO +4.9%

- Australia/EWA +4.5% (go commodities)

- China/FXI +4.4%

- Energy/XLE +3.0%

- Agriculture/DBA +2.8% (as it remains HOT)

- Nasdaq100/QQQ +1.3% > Large Cap/SPY +0.5% > Small Cap/IWM -1.2%

- Gold/GLD -1.2%

- Euro Stoxx 50/FEZ -1.6%

- Financials/XLF -2.1%

- DJ Transports/IYT -2.5%

- Regional Banks/KRE -3.3%

- Italy/EWI -5.2% (Ugly in Italian = Brutto)

Next week 173 firms representing 37% of S&P 500 market cap will report results.

By sector: 69% of Energy, 47% of Industrials, and 40% of Health Care as measured by market cap will release results. Large caps reporting include: AAPL, T, MRK, PEP, MCD, AMZN, UPS, MO, COP, OXY, UTX, TXN and FB’s 1st earnings report on Thursday night.

So far, U.S. Companies are making the bottom

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Here you can find 3331 more Information on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Here you will find 17236 additional Info on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Here you will find 12885 more Info to that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] There you can find 87423 more Information on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/07/24/361-capital-weekly-research-briefing-7/ […]