“Sell-side analysts will look past certain things for long periods of time — and buy-side clients will too. Then something happens that quickly changes the dynamics and the price.”

– Tom Brakke, Research Puzzle

Sell-side analysts on Green Mountain Coffee Roasters, are you fucking kidding me?

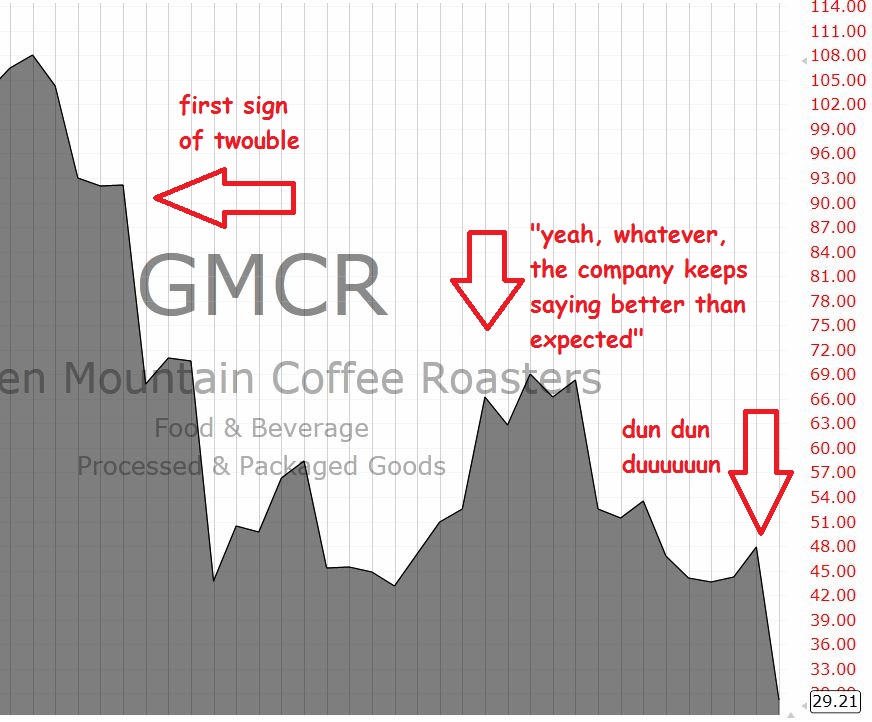

Here’s a company with a declining moat, accounting discrepancies, inventory Three Card Monte, brilliant short-sellers vocally involved and a looming patent expiry on the bread-and-butter product line…

And you have Buy and Hold ratings on the stock? What do you do for a living?

I bumped into Herb Greenberg last night, who has been dead right on this thing for a hundred points now, and he told me the analysts on the $GMCR call were just stunned, absolutely shellshocked by the debacle they were witnessing. But not me. And not my friends who actually manage real money and know the pain of a blown-up position. The street smart guys were not in this stock, only the schnooks.

Guys like me have suffered through a hundred disasters just like Green Mountain over the years, we’ve been galvanized by the fire and fury of halted stocks, gaps down, earnings restatements, auditors resigning etc. We know what it feels like when a great “story stock” turns into a living nightmare. We’ve made the calls to clients to apologize, we’ve witnessed the outgoing ACATs and destruction of our books of business.

But a punk analyst sitting in his office cranking out DCF-driven “research” with assumptions literally supplied by management itself? He doesn’t know that pain, he doesn’t know shit. He doesn’t get it, has never felt it firsthand. He doesn’t understand the following three iron-clad rules of stock selection and risk management (because he has no risk):

1. Accounting controversy is a red flag, red flags mean automatic Sell, let someone else play Sherlock Holmes with their own money and try to figure it out

2. Where there’s smoke, there is ALWAYS fire

3. Management always lies

Once you’ve been beaten to death in enough controversial stocks, you learn to sell immediately and never wade into them. And only a clown with no money of his own on the line would disagree with that or not get it.

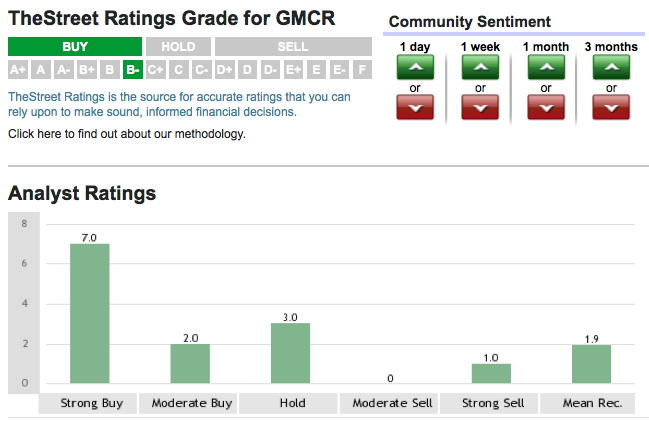

Heading into this earnings report, 69% of the analysts covering it had a Buy rating and there were also a handful of “Neutrals” or “Holds” – whatever that means. There were even some earnings estimates on The Street that had been ratcheted up this Q. This amid the backdrop of a very publicly laid-out short thesis loaded with reasons why the company’s guidance could not and should not be trusted.

But analysts always trust the guidance.

On the other hand, real traders and investors know better. These lessons have been beaten into them and branded on their hides. Income statement and earnings quality controversy equals Sell. It’s not an “opportunity,” it’s a low-probability, dumbass bet. The one time you get lucky is not worth the ten times you get the OJ treatment.

The greatest stockpickers of all time know this. Warren and Charlie don’t screw around with low quality earnings streams even though they will buy into a stock they feel is severely undervalued or misunderstood (these days they do so via bespoke preferred offerings, not just common stock shares). James O’Shaughnessy, one of the best true quant equity managers on earth, wrote about these automatic sell signals in his Bible (What Works on Wall Street) and explained it to me face-to-face in my office last fall – there’s never just one cockroach.

To be clear, O’Shaughnessy (and I) are not saying that a stock under the cloud of potentially weak controls or accounting issues can’t go up – what we’re saying is that based on decades of market data, the odds are against you in this situation. And when has this game NOT been about probabilities and stacking the odds in your favor to the degree you can? When has this game NOT been about survival? Try to explain that to a guy at a sell-side research job who survives pretty much no matter what.

And one other thing that almost always gets overlooked by brokerage firm analysts – insider selling. I spelled this out here on the blog back in October, it was the most riveting part of Einhorn’s presentation (see: Green Mountain Coffee: We’re a Great Company, Buy Our Shares From Us). But analysts aren’t trained to think that three dimensionally. Many of them are too afraid to lose access to management, they’d never publish a report on massive insider selling no matter how extreme it gets in a coverage name. Plus, their colleagues on the other side of the building (you know, beyond the “Chinese Wall”) are usually trying to drum up banking biz from the company – gotta be a team player!

I used to read sell-side brokerage research. I used to use it to help me find stocks to recommend to my clients and to put my own money to work. I had to have my head blown off and my ass kicked in several dozen times before realizing what a joke that was.

And then I wizened up. I got street smart. Don’t get me wrong, I still make plenty of mistakes, just like every other human being – but not this mistake.

Not anymore.

[…] distribution looks similar to what we see from Wall Street sell-side analyst ratings, and we know how unreliable those ratings are. At least on Wall Street you have multiple firms providing ratings and vying for influence, in the […]

The Slave of the Husband

Looking for in advance to learning added from you afterward!…

The Slave of the Husband

Trying to get forward to learning additional from you afterward!…

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] There you will find 30762 additional Info on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Here you can find 91886 more Information to that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/05/03/you-are-now-about-to-witness-the-strength-of-street-knowledge/ […]