One of the highest-trafficked and best received posts I’ve ever done was my Notes from the DoubleLine Lunch from last September. There seems to be an insatiable appetite on the part of investors and pros alike for the insights of asset allocators who are thinking and speaking lucidly during this post-crash “transition period” that is now in its fourth year. Jeffrey Gundlach seems to be one of those knowing figures and so on the few occasions where he does speak publicly, his insights are almost universally sought after – by pure bond investors, equity-only investors and everyone in between.

And so it is my great pleasure to present you with my notes from the DoubleLine Lunch I attended this past Thursday, April 26th 2012. I hope this is interesting and helpful information:

***

It’s an overcast day in Manhattan this past Thursday and I’m walking the 20 feet down 44th Street between my office and the New York Yacht Club when I hear my name called. It’s Joe “The Stalwart” Weisenthal from The Business Insider – another cat who, like me, never misses Jeffrey Gundlach speak, whether it’s live or via webcast.

We’re early so we grab the table furthest to the back, that way I can take notes and screw around with my phone etc without distracting anyone. Barry Ritholtz arrives shortly after 11 and grabs a seat, then Jeffrey comes over to say hi. The event space at the Yacht Club is jaw-dropping and awe-inspiring no matter how many times you’ve been in the room. You’re surrounded by scale-model ships from all different eras encased in glass displays, amazingly orate carvings of wood that once adorned ships’ prows from hundreds of years ago. The front two windows looking out on the street are the wooden quarter galleries from the back of an old ship’s stern, from the street they hold their shape under a mold of poured concrete – there aren’t windows to be found like these anywhere else in the city. Jeffrey remarks about how funny it is that JP Morgan himself donated the land for the building and had it commissioned (he was the Commodore of the New York Yacht Club back in the day) and now there is a table up front with a placard reading “Reserved for JP Morgan” as though the man himself is going to show up any minute!

Gundlach is cool and collected ahead of his show. Joe, Barry and I make a bit of small talk with him (not sure if my smartass remark that “I hope you’ll touch on the bond market today,” went over so well, lol) as the dining room begins to fill up. Matt Goldstein and my friend Jenn Ablan, two ace reporters at Reuters, head back and join our table. Matt Phillips from the Wall Street Journal comes over to sit with us as well. Then some poor guy with a badge reading Morgan Stanley comes over, hears us talking, and says “I hope there’s no media at this table, I actually try to avoid the media as much as possible at these things.” Jenn, Joe, Matt and I look at each other and we all laugh like bastards. I tell him he came to the wrong table, then I hit his Morgan Stanley ass up for some Facebook IPO shares.

Anyway, enough scene-setting, let’s dive in…

DoubleLine

We are told that the DoubleLine has now raised $28 billion in mutual fund assets with only a handful of funds and in less than two and a half years The next big launch from DL will be a variable annuity product, the announcement will be made this coming week. The suit then introduces the man we’ve all come to see and hear from.

“Getting There”

The theme this year is that we are making progress – particularly in the housing market – although the way forward will be anything but a straight and narrow path. He is still very much in a low-risk posture and mindset. “We are in a transition period that began in 2007-2008 and we don’t yet know what the next paradigm will be. Because we don’t know and this is a transition, it simply means that investing time horizons have to lengthen.” By this he means that success over at least the next ten years should be the focus over the next five years of investing. “Natural gas will almost certainly succeed in a 10 to 15 year time horizon.”

A World of Developed Nation Indebtedness

Gundlach rolls out the slides of developed nations and all the amazing statistics on how in debt everyone is. No matter how many times I see this stuff, I am still in shock. It just makes me want to sell everything and run. Joe Weisenthal next to me remarks “I’ve already seen these slides before,” and I’m all like “Yeah, but you’re an Econohipster, Joe. The people in this room work at wirehouse firms and banks – they’re not even allowed to access the internet, so this is all new to them.”

Anyway, Japan is the most royally f***ed with a 200% debt-to-GDP ratio – most of it is government debt. The UK, also choking, has a lot of financial institution debt. Spain probably ends up defaulting, they have a lot of non-financial corporate debt.

“Austerity and Growth at the same time – that’s just empty rhetoric in the media. I’m always amazed when I see people put words and thoughts together that don’t mean anything and aren’t meant to be together.” In Jeffrey’s view, there is no way to cut your way to prosperity. Austerity is guaranteed to lead to a weaker economy no matter where it takes place and the alternative, a continuation of debt-financed solutions – is even worse. In other words, there’s no way out other than rolling back over and seeing more defaults at non-currency issuing countries who have unworkable liability structures. He’s looking at you, peripheral Europe.

He’s also got nothing but disdain for LTRO and the other rescue measures designed to prolong the inevitable in Europe: “The firewall they’re putting up is just more debt! How are you going to go on a diet by eating more food?!?” he asks rhetorically and incredulously.

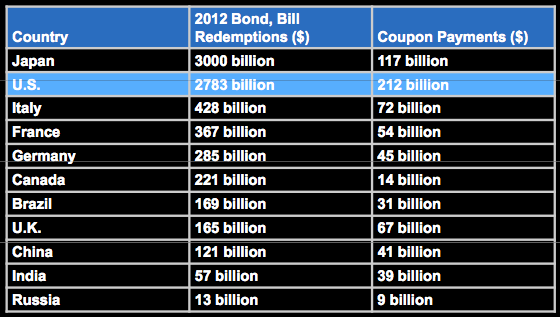

The most devestating slide to me is the schedule of rollovers and interest payments due this year:

Looking at Italy, you realize how ridiculous the prospect of them escaping this year is. Gundlach says there are two very important dates to be aware of this summer, on June 18th there is a big Euro ministers summit and June 20th is when the Fed next meets (just as Operation Twist is expiring). Speaking of the Fed, he calls this week’s past announcement from the FOMC “just another dose of confusion.”

Europe is Getting Worse Not Better

On Portugal: “Portugal is at Defcon 5 levels already, 10%-plus yields on 10-year bonds usually leads to default.”

On Spain: “Nothing is more dangerous than a bunch of 20 year olds with nothing to do. Spain has 23% unemployment and 45% unemployment among young people.” He views it as a powder keg and sees civil unrest as highly possible.

On Italy: Italy currently has three workers for every retiree and that ratio is rapidly heading toward 2 workers for every retiree. “The message here is that people are going to have to work longer,” he says. But the problem with that is when older people hold their jobs for longer, it makes it harder for young people to earn decent wages or find work at all.

On Italian and Spanish bonds: Gundlach cannot understand why anyone is investing in these bonds at all, it makes no sense to him given the less-risky alternatives that exist. “Why would anyone – anyone – touch Italian or Spanish bonds at 6%? When their neighbor just to the east (Greece) just returned 50 cents on the dollar?

On the UK: The United Kingdom is – according to official calculations – in a double dip recession already. Half of British exports go to the Continent and the Continent is now in recession.

“Nationalism is on the rise in Europe.” He notes that cooperation is deteriorating and tells a great anecdote about how some racist German reporter, upon noting that Gundlach was a German last name – just laid into the French, criticizing their leadership, economy, crisis response etc. “I bet the reporter wouldn’t have said those things if my last name was Cousteau.”

The United States of Economic Unfairness

That’s my term not Gundlach’s, but the next set of comments/slides are centered around how absurd the distribution of income versus the effective tax rates has become in this country. “In the US, the middle class is facing Biflation – middle incomes are stagnating while the price of necessities rises.”

In terms of the US debt load, it is “soaring” as but it is unproductive debt – government spending on R&D and Infrastructure are flatlining or declining while spending in general continues to rise.

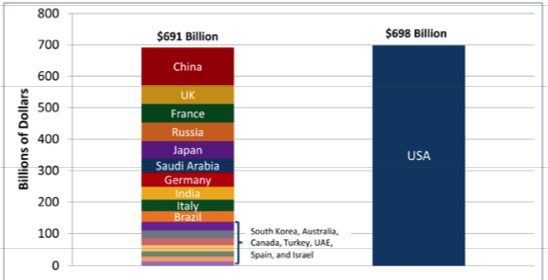

The military – while a huge expense every year – is not the culprit for the rise in spending. But it is still an enormous and outsized portion of the budget. In the slide below, we see that the US is spending $700 billion on the military each year (not even including bombs and missiles, which are off-budget items). We are not only number one in military spending each year – but we are larger than countries 2 through 18 on the list – combined!

2010 Military Expenses, US vs rest of World

He makes his usual reference to the fact that the Roman Empire fell, in part, due to ballooning military costs.

But again, the military is not even what’s busting the budget. Healthcare and Medicare spending are destroying us (rapidly heading toward 30% of all government capital outlays up from only 5% 20 years ago). Jeffrey notes that he is typically cynical about government spending anyway, “Government programs usually come out to be 10X the cost projected and .1X the benefit expected.”

In the meanwhile, there are 50 million Americans on food stamps. 67% of children living in the St Louis area are on food stamps, an extreme case but an amazing stat indeed. “And these are expensive, non-productive, debt-financed food programs.” Jeffrey relates an anecdote about when he was a kid and his mom was having trouble putting food on the table for the family. He asked her why she didn’t just buy groceries with a credit card and she very firmly explained that this was the last thing she’d ever do.

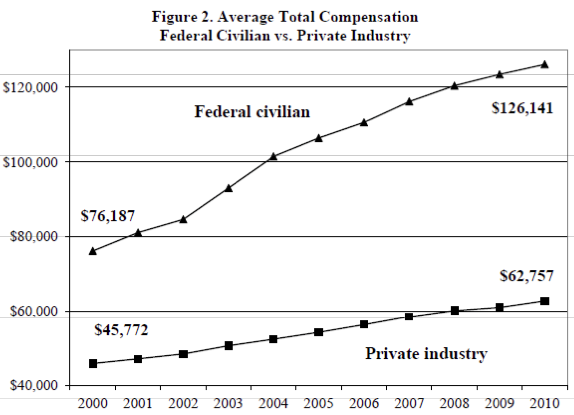

Then Jeffrey pulls the slide out that Ron Paul has probably had made into a bedspread so he can wrap himself in it nice and snug each night at bedtime – the one showing how federal employees now make double what private sector employees make (largely thanks to pension and retirement benefits that “have got to be cut. Benefits will be slashed.” He notes that federal employees are not payers of taxes, they are “receivers of tax dollars.”

Check this out:

The war between ideologies as far as this widening gap (the party of Taxes are too Low vs the party of Taxes are too High) is one of the major reasons why there is so much non-cooperation, and cooperation-leading-to-bull-markets is one of Jeffrey’s recurring themes. “Everywhere I look these days, I see signs of non-cooperation.”

The Debt Ceiling Debate is Coming Back

“They’ll need to debate the debt ceiling again in time to raise it, this lands in October of this year- almost perfectly timed to make it a centerpiece of the election.”

Jeffrey sees this new debate virtually guaranteeing a dip in the economy if the GOP gets its way. “It is metaphysically clear that if we attack the deficit, the economy will go negative.” That actually may have been the money quote of the whole event, we’ll find out this fall I guess 🙂

The Futility of the Fed’s Efforts Thus Far

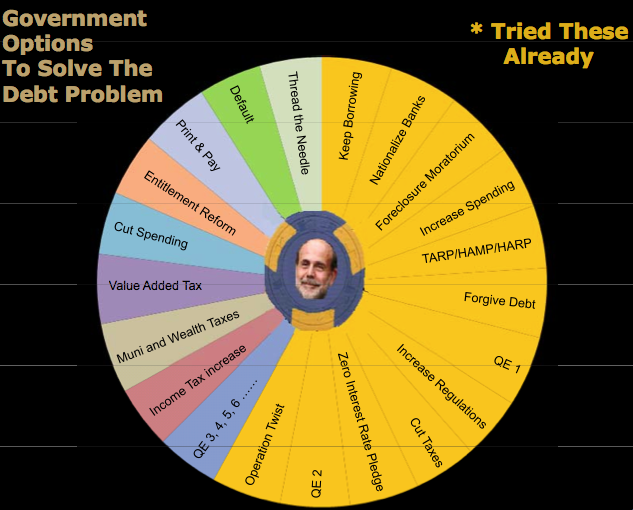

Gundlach loves to trot out his Bernanke Wheel of Fortune slide, it is the same one he brought last fall (complete with game show sound effect) only this time, more of the gambits have already been attempted.

“The options to solve the debt problem have been exhausted one by one – TARP, HAMP, HARP, QE1, QE2, Cut Taxes, Zero Interest Rate Pledge, Operation Twist…”

He relates a funny story about how he was doing CNBC and the producers were hocking him over and over again to “give us something we can tweet!” in terms of QE3. The crowd doesn’t get how funny this is, but the reporters and bloggers at my table knowingly snickered, we know how obsessed with Twitter the mainstream media has become.

As far as Operation Twist, Jeffrey says “Make no mistake, this IS QE3.” We’ll see if they extend it past June 30th when it’s set to expire.

On Bernanke’s strategy, he is unconvinced that we’re going to simply “print and pay” as the gold bugs expect us to unless the crisis gets much worse. Instead, Bernanke seems to favor a strategy of moderate inflation, which he can continue to pursue until about 5% CPI, at which point a rate hike is a given.

“The big7 question is what happens when stimulus ends.”

Tax Rates in the Post-Reagan Revolution Period

When Dick Cheney pronounced that “Deficits don’t matter” it was “the defining moment when our fate was sealed.” And now, it’s become obvious that federal tax receipts as a percentage of GDP must go up, there’s no way around it – especially on the top earners, who’ve enjoyed quite a ride since 1960.

The tax rate paid by top earners (1%) has fallen by half (71% into the mid-30’s %) since 1960. But the middle class (40% of the country) have seen an increase over the same time frame from 25% to 28%.

“I am for the Buffett Rule, I think it’s offensive that Mitt Romney paid 13% in taxes, that’s his Achilles heel this election.”

Gundlach sounded like he felt Obama would win this fall without coming out and saying it.

Stocks

Jeff likes to point out how the Shanghai Composite is still a great leading indicator for stocks although you can plainly see the divergence of late. He also sees Emerging Markets as an excellent tell.

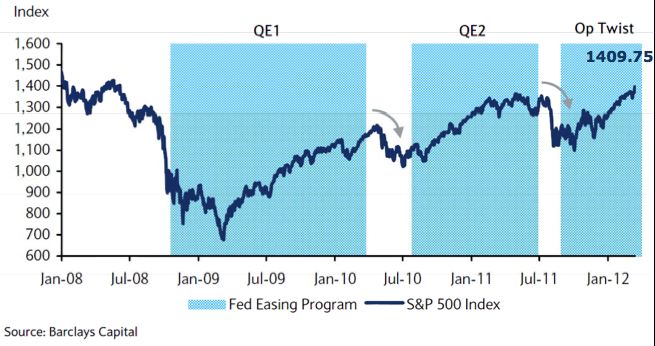

Much discussion ensues about the effect of QE programs on the stock market (where they’ve had more visible impact than anywhere else), I know you’ve seen a version of this chart before (every strategist has one in his or her slide deck this spring, it’s the cool thing to do), here’s Jeffrey’s (via Barclays):

He remarks (as I have several times) that the stock market this year looks exactly like last year and like 2010. The losers of the prior year have been the big winners in the first quarter, “very typical action in banks, emerging markets, etc.” He notes that 2012, like 2011, saw European stocks off to the races – but now, just like last spring, they are back to being negative on the year.

Nothing but Scorn for Apple Bulls

I’m not going to say that Jeffrey is a strict, dyed-in-the-wool mean reversionist but his comments on Apple were pretty sharp, almost unnecessarily so. Or maybe my reaction is exactly what he’s talking about.

He’s got a great anecdote about a Uruguayan illegal immigrant, recovering drug addict prostitute (I think I got that right) who is overheard complaining that she got stopped out of Apple the other day, but that that the next time she’s buys back in, she will go in with no stop loss. His delivery is flawlessly deadpan, the crowd cracks up. Ritholtz chortles and tries to fit it into a Tweet.

Jeffrey’s take is that for Apple to continue to grow earnings at this pace, they will literally have to take over the world. He emphasizes the fact that earnings growth does not equal stock price growth (yes, Apple can keep getting more profitable but that doesn’t mean the stock price will). The law of large numbers is immutable is the message.

His go-to comparison for Apple stock is Google stock last decade, the enthusiasm and expectations were very similar. And then he throws a chart of Google heading into 2007 compared with Apple circa now and there is an audible gasp in the dining room. They are nearly identical and Google hasn’t made a shred of forward progress since…

Here’s Google (white) versus Apple (red):

Another money quote: “If I were one of these crazy hedge fund guys, with the slick haircuts and fancy shoes and racing stripe shirts, the trade I’d put on is 10-times-leveraged natural gas long versus 10-times short Apple.” I don’t think he’s joking.

“The Land of Confusion”

This is his nickname for the Federal Reserve. As a bond manager, it’s his job to parse the statements coming out of the various Fed people and it’s become impossible (a point I’ve been ma=king here on TRB as well).

But Jeffrey does believe Bernanke when he says that the Fed will stay at zero Fed Funds Rates through 2014. This despite tha fact that “11 out of the 17 Federal reserve economist predict that he will not.” It’s bizarre to hear Bernanke say he’s staying and the rest of the organization say he’s not.

But Jeffrey notes that the only thing saving us right now is that the Fed can hold down rates. The Fed can’t raise rates because for every 1% rise it means an additional $150 billion in debt service cost (interest payments to US bondholders). “Why on earth would the Fed ever want to do that?” he mentions that this concept of holding down debt service costs is exactly what Japan has been doing – they are now trapped, they can never raise rates again without committing suicide.

And he makes it very clear that the days of raising rates preemptively to counter potential inflation are over. “THE FED WILL NOT RAISE RATES PREEMPTIVELY. EVER.” See? he notes that there’s not been any real inflation since 1985 as the Fed has historically acted preemptively but that was then and this is now.

He also notes that the labor participation rate will continue to force the Fed to keep rates down for longer than anyone thought possible.

When asked about what the Fed should be doing later on during the Q&A, Jeffrey says that the right thing to do is the hardest – let the debt clear and have a depression. You could hear a salad fork drop when he says this.

But of course, we’ll never do this, he says. So in the absence of letting the everything reboot, at the very least the Fed should “stop with the manipulation of markets.”

Housing and Mortgages

The main event, Jeffrey sees the housing market at having made progress at working through its issues but it is not quite there.

He goes through “a lightening round of housing charts” for us

On inventories: The most progress has been made on inventory, we have gone from 11 months of housing supply to only 6 months of supply so “inventory is not a big problem anymore.”

On new home sales and home prices: “Nothing going on.”

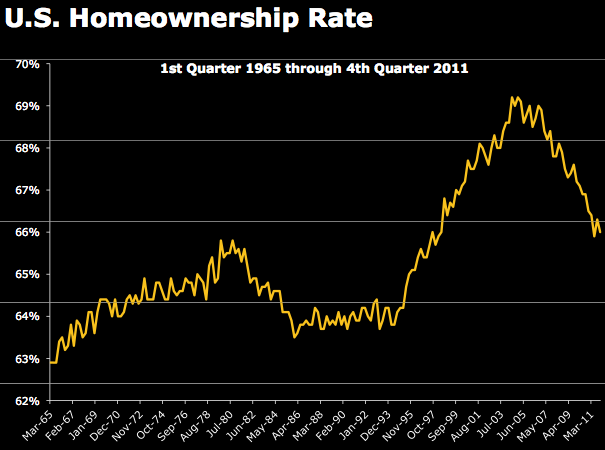

Jeffrey sees the single biggest headwind as the fact that the home ownership rate is still too high given the economic realities of the middle class. The home ownership rate peaked out above 70% and is still clinging to 67% – way higher than trend. And the thing is that most things don’t simply revert to trend but end up crashing through trend so there is work to do here:

As far as mortgages, there is a rollover or a double dip beginning to form in terms of default rates in the charts Jeffrey shows us. He says that the “loss severity” for subprime residential mortgage backed securities (RMBS) is now trending higher again after having stabilized. This is not a good sign. Also, Alt-A and Subprime are being treated the same in terms of default/liquidation and the rate of these loans being liquidated is now running in the 8-9% range (versus prime mortgages at only 4%).

And the worse news is that, despite every idiotic and costly program we’ve embarked on to “help keep people in their homes,” the activity in subprime mortgage refinancing is virtually nil, “dead as a doornail,” says Gundlach.

“So what’s the trade?”

So where is all of this going? What is a bond manager to do? Jeffrey downplays several other types of bonds (TIPS – no reason to buyat all) and then stands by the “very successful” trade he’s had on since at least last year. He continues to believe that non-agency mortgage bonds are the single best place to be.

(Josh’s note: This is a relatively small market, and Gundlach’s Total Return Bond is still not at the size where he’ll be unable to maneuver in non-agency mbs. In my discussions with the fund company, I’ve come to learn that $50 billion is the level at which they may consider closing the fund to new assets so that Gundlach and his team can continue to do what they do. It’s kind of funny to see Pimco now getting more involved in the mortgage bond market for their Total Return after being spanked by DoubleLine last year. I wonder what that will mean for the market itself, two warring Bond Kings fighting for supremacy – and securities.)

Anyway, in Gundlach’s view, the bull case for mortgage bonds of good quality is that “defaults will improve and prices have to stabilize” over time. He views this market just like the corporate junk bond market in 2002, bonds were depressed and no one wanted them, then defaults leveled out and they took off on a torrid run.

After this, the Q&A begins. He is asked all kinds of questions about natural gas and gold and politics and the election. Finally someopne asks him a hanging curveball of a question: “Let’s say someone is a conservative investor, where can they get some decent yield without taking on a lot of risk?” The question came from Monsieur Ritholtz and it was essentially meant as an invitation for Jeffrey to bash it out of the park…

Without missing a beat, Jeffrey answers “DBLTX.” This is the ticker symbol of his fund, and the crowd goes wild.

***

So those are my notes and again, I hope you’ve found this review helpful. Below I’ve embedded the entire slide presentation (mostly charts) if you’d like to download it for yourselves. Thanks for reading, I’ll be your eyes and ears for the next one. – JB

In the interest of full disclosure, my clients and personal accounts currently have an allocation toward DoubleLine Total Return’s institutional share class. My commentary above is meant for informational purposes and is not an endorsement of any particular product or strategy. Before investing in anything, people should do their own homework and decide whether it makes sense for them based on their own personal financial situation.

Slides Here:

Getting There – 4-26-12 DoubleLine

erythromycin gonorrhea

erythromycin gonorrhea

erythromycin prices

erythromycin prices

clindamycin hcl

clindamycin hcl

clindamycin interactions

clindamycin interactions

celebrex dosing guidelines

celebrex dosing guidelines