From the mailbag:

“Yo JB, just finished Backstage Wall Street – dude you just stomp all over the analysts, CRUSHING THEIR BONES, I love it! but why did you give Henry Blodget a pass in the chapter about Ranking for Banking? It seems to me like he was the worst of them all and you let him off the hook totally.”

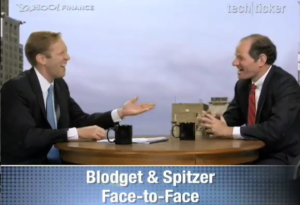

I won’t print the rest, you get the gist. I’ve gotten a few questions about why I give Henry Blodget a pass in Chapter 17 of Backstage Wall Street. If you haven’t yet read it, it’s the part of the book in which I launch missiles at Wall Street research, using the dotcom era as one example of its blatant suckitude. So I’ll tell you why he got a pass from me in the book…

First, I know the guy personally and I like him. Sorry, but it’s true.

Second, I’m not the supreme arbiter of right from wrong – I certainly didn’t spend my own early days in the business as an angel saving lives and granting wishes.

Also, Blodget was far from “the worst of them all”. That particular honor would belong to the grifter Jack Grubman, a Smith Barney analyst who would sit in on investment banking meetings with telecom companies and literally sell them a “Strong Buy” rating in exchange for selecting his firm as lead underwriter. Imagine a drug company directing doctors in their patient diagnoses and you have an inkling of how disgusting this all was.

I take the position in my book that Henry Blodget was essentially scapegoated and made an example of. Why Henry, you ask? Here are the primary reasons:

a) He represented Merrill Lynch, a symbol of the relationship between Wall Street brokers and Main Street clients in a way that Goldman Sachs never was. It was the nation’s biggest retail-facing brokerage at the time. Remember that, for example, Anthony Noto at Goldman was parading around with a “Strong Buy” on his employer’s banking client eToys at 30 bucks a share, too – but when it went bankrupt a month later nobody paid any attention. Mary Meeker’s also still flitting about unscathed to this day, cranking out the occasional 900-page research report on mobile web browsing or whatever.

b) Blodget ranked very highly on the Punchability Scale – he was oh-so punchable. Here we had a red-headed, young and ambitious guy making a ton of dough as a “rockstar analyst” in a gilded era. In addition, he was good-looking, well-spoken and came off as smarter than everyone else. On the Punchability Scale, he fell somewhere between “teenage girls who drive white BMWs” and “people who pay for a pack of gum with a credit card while you’re on line behind them at CVS.” The average upper-middle class to high net worth investor had lost at least six figures when the Nasdaq collapsed from 5000 to 1200 and everybody wanted somebody to punch. Blodget fit the bill and so the press hound dogs latched onto him in particular and never let go.

c) He was the the one who grew a conscience in the middle of it all. Never a good thing while the robbery is in progress.

d) He not only grew the conscience – but it compelled him to begin sending really stupid emails. Now back then, email was fairly new and in Henry’s defense, no one really knew to what extent they could be harvested and applied by prosecutors. Eliot Spitzer, the prosecutor who would make his name going after Henry and the rest of Wall Street, would come to define how devastating emails could be in a courtroom. Prior to the Global Settlement, no one had a clue.

Lastly, Henry’s done his penance already. In addition (and in an ironic twist), he is now the largest and most voluminous distributor and democratizer of Wall Street research on planet earth. His staff excerpts and passes along roughly 500 to 1000 Wall Street research reports every week on the Business Insider and its archipelago of sister and brother websites. The economists and strategists at every major firm need only to choose thousand island dressing over vinaigrette one day at lunchtime and Henry’s troops are all over it. The beneficiaries of this are his site’s reader who would otherwise not have access to this stuff. And so in addition to paying his fine and accepting his industry bar, he continues to enlighten and delight the investing public in this way – an ongoing bit of incidental community service one must factor in.

The bottom line – Henry’s a good guy, was overly blamed for a scam that involved tens of thousands of people and has more than paid his debt, so to speak, in the ensuing decade. So he gets a pass from me even as the entire Wall Street sell-side analyst complex is fed crotch-first into a buzzsaw.

Blodget’s okay by me.

Buy the goddamn book already (here).

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] There you will find 82766 more Info to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Here you can find 48893 more Information to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] There you can find 11857 additional Info to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2012/03/25/why-blodget-gets-a-pass/ […]