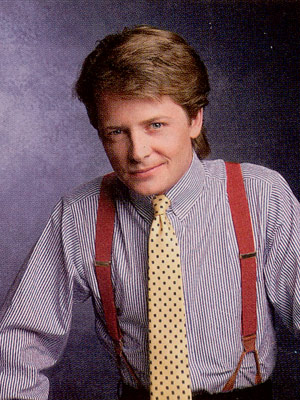

In the final episode of Family Ties, which aired in the spring of 1989, Alex P. Keaton (played by Michael J. Fox) was en route to his dream job at a major Wall Street investment firm after graduating college. He was 23 years old and had spent the entire Reagan decade preparing for his yuppie ascendance. Let’s take a look at Alex’s career in finance over the ensuing two decades…

1990 – 1993: Alex makes his bones as a junior investment banker at Lazard Freres & Co in New York. His team takes advantage of the Savings and Loan crisis in which 787 deposit institutions failed costing almost $100 billion to mop up by snagging real estate all over the country at pennies on the dollar. Alex is in his mid-20’s and still rocking the suspenders/white collar-on-blue shirt look.

1993-1996: An explosion of more than 500 Initial Public Offerings finds Alex riding high as an underwriter at Merrill Lynch. He takes a myriad of deals public including Boston Chicken, Snapple Iced Tea and Callaway Golf to name a few.

1998: Alex is now operating out of Silicon Valley as a research analyst/investment banker for Thomas Weisel. The deal flow is fast and furious and Alex is in a position to both bring web companies public and then ‘rate” them on the sell side. It’s a win-win for both the bankers and the companies…not so much for the retail investors who buy in the secondary.

2000-2002: Alex is fined by the SEC and accepts a two-year suspension after settling charges of manipulation. He manages to avoid the coming $1 billion Global Settlement between Elliot Spitzer and Wall Street by bowing out early. He will spend this time writing his first book (Keaton on the Money, Simon & Schuster) and doing some “consulting work”.

2003: With public markets back action, Alex reemerges as a hedge fund manager with an emphasis on credit opportunities and real estate. His firm is called Zeus Mountain LP, he is 38 years old and is featured in a 40-Under-40 spread in Fortune Magazine (The New Young Guns Changing the Financial Paradigm, October 2003) He is making non-traditional loans for new housing development on both coasts as the Fed leaves rates at 1% for an “extended period”. He is also working closely with firms like Goldman Sachs and Deutsche bank on the construction of new innovative mortgage bonds to help meet the new century’s demand for “home ownership for everyone no matter what.”

2004-2007: The Zeus Mountain empire grows to include real estate development. Alex is building casinos on the Vegas Strip with cheap loans financed by the perpetual Yen carry trade. He is also on the cover of Trader Monthly, posing in front of his Cessna Citation jet with his arm around Zeus Mountain’s Chief Investment Officer, Skippy. A subsidiary, Keaton Equity, becomes one of the leading sources of no-documentation “forgivable” mortgages, he is hailed as a hero and honored by Barney Frank at a gala event called ” A House for Everyone with a Heartbeat”.

2008: Keaton real estate holdings begin to crumble as the global credit crisis takes hold. He is almost bankrupt but manages to secure a loan with the help of his sister Mallory, a government official who convinces the banking authorities that Zeus Mountain is a systemic financial institution Realizing he is too buried to ever reach his high watermark level, Keaton closes Zeus Mountain in October and opens a new fund in November called Poseidon River Partners in the same space. His principle a ctivities consist of buying back mortgage-backed securities being puked up by the creditors of his old fund. Business is good.

2009: Alex Keaton is named to a senior economic post in the Obama White House. he brings back the suspenders look and casually blows the hair up off his forehead before addressing the White House Press Corp. America falls in love with him…until they find out that he hasn’t paid taxes in 12 years through an elaborate Turbo Tax algo he paid Russian programmers to construct. Keaton is dismissed from his post with a stern warning and $12 million in severance/pension.

2010-2011: Alex P Keaton is now the controlling shareholder in a privately-held high frequency trading outfit clandestinely located in the swamplands of New Jersey, with thick pipes ported directly into the New York Stock Exchange. Keaton’s HFT firm is known as 12KDF6 corp, in contrast with his previous endeavors, this one he’d prefer for no one to hear about ever. From the first day of trading in January 2010 through September of that year, 12KDF6 corp doesn’t record a single day of trading losses. When a camera crew shows up to ask how it’s done, Keaton pretends they have the wrong address.

Where in the world of finance will Alex P Keaton find himself next? Stay tuned!

phenq benefits

[…]Here is a superb Blog You may Discover Intriguing that we Encourage You[…]

full version pc games download

[…]always a massive fan of linking to bloggers that I enjoy but do not get quite a bit of link adore from[…]

app download for windows 10

[…]below you will uncover the link to some web-sites that we feel you must visit[…]

vpn ایفون

Just beneath, are a good deal of entirely not associated internet websites to ours, nonetheless, they could be certainly actually worth likely in excess of.

app download for windows 8

[…]the time to study or check out the subject material or websites we’ve linked to beneath the[…]

types of cantilever beam

[…]very handful of internet websites that take place to become comprehensive beneath, from our point of view are undoubtedly nicely really worth checking out[…]

Biz Carlton

[…]Sites of interest we’ve a link to[…]

seo service

[…]check below, are some absolutely unrelated websites to ours, on the other hand, they may be most trustworthy sources that we use[…]

Managed Service Provider Michigan

[…]one of our guests not long ago advised the following website[…]

free phone cases

[…]The facts talked about within the post are a few of the top obtainable […]

cell phone

[…]Every when in a even though we decide on blogs that we read. Listed beneath are the most up-to-date websites that we choose […]

مه پاش

we arrived across a amazing site that you just could perhaps delight in. Take a seem in case you want

human resources

[…]always a massive fan of linking to bloggers that I love but do not get lots of link like from[…]

etf vs mutual fund

[…]Here is a great Weblog You may Uncover Exciting that we Encourage You[…]

how to invest in stocks

[…]here are some links to web-sites that we link to for the reason that we consider they may be really worth visiting[…]