One of the things I try to do in the course of my equity research is to get a sense of not only what is working but try to figure out the underlying trends that explain why it’s working. While pure technicians dismiss this kind of pursuit with a “who cares, everything you need to know is in the charts” – I wholeheartedly disagree.

For starters, institutional investors all talk to each other and a compelling narrative is infectious, especially in the hedge fund community. Goldman Sachs and Merrill Lynch both keep “Hedge Fund Hotel” lists – the stocks that are most widely owned by the 2-and-20 set. It’s not an accident that certain themes and theses are echoed across so many professional portfolios – I promise you it was the story that made that buying happen, the data was only part of the narrative. Also, billions of dollars don’t move in or out of an industry group based on stochastics and fib fans; the guys running the big money still need the cave paintings and the storytelling – even if they’re using technicals for their entry points.

Secondly, it is only by grasping what is working now (and why) that you can formulate an opinion as to whether that performance will continue into the future. Charts are great for a variety of things but they are backward-looking in nature and only provide clues as to future performance, not a logical and well-reasoned roadmap. With stocks, the question is not only about why something is happening but in what inning is this trend, and what might be the next beneficiary? As an example, Warren Buffett didn’t “play” the rally in commodities or emerging market stocks although he clearly recognized why they were “working” – so he saw that all the Asian demand for commodities (especially Powder River Basin coal) would mean a massive secular growth story for Burlington Northern Railroad and he bought that instead. The whole train set.

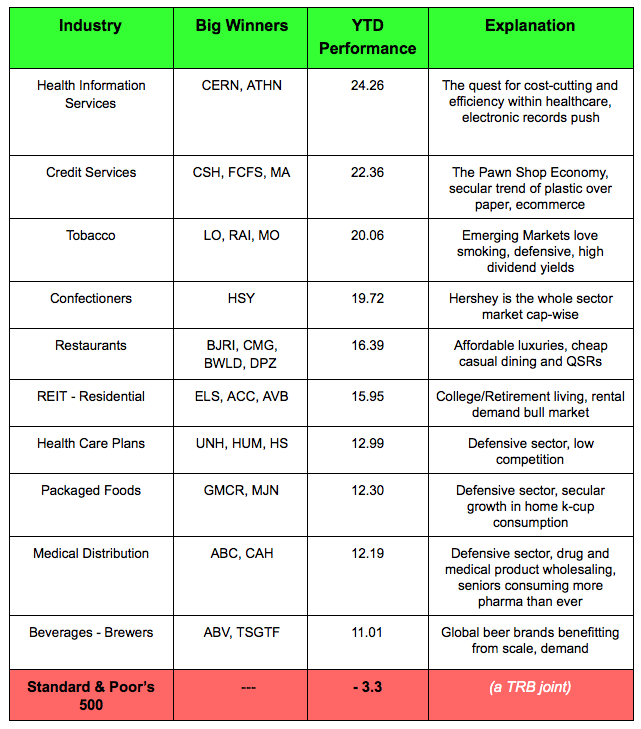

Anyway, let’s have a look at which industry groups have led the market for the first three quarters of this year as food for thought; Which trends are poised to continue, which might lead to new areas of investment and which have simply run their course? Here are the top ten performing industry groups year-to-date along with some of the big winners and a quick-n-dirty rationale. Make this a starting point for your own work.

all performance figures from Morningstar database

Tags: $ATHN $GMCR $MJN $BJRI $CMG $UNH

… [Trackback]

[…] There you can find 91419 more Information on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]

… [Trackback]

[…] There you can find 21958 more Info to that Topic: thereformedbroker.com/2011/09/18/whats-working-in-2011-and-why/ […]